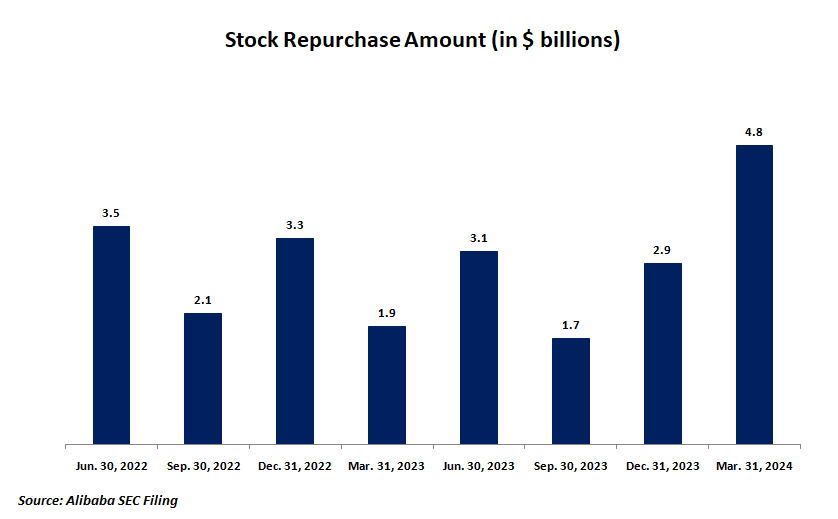

Chinese e-commerce and cloud computing company Alibaba (NYSE:BABA) is on a stock buyback spree. It repurchased 524 million shares (equivalent to 65 million American Depository Shares, or ADSs) for a total of $4.8 billion during the quarter ended March 31, 2024.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This comes after Alibaba’s management increased its existing share buyback program by $25 billion through the end of March 2027. During the Q3 conference call, Alibaba’s leadership emphasized that the decision to increase the share repurchase program underscores management’s confidence in the company’s fundamentals and ability to generate substantial cash flow.

Notably, Alibaba repurchased shares worth $12.5 billion for the Fiscal Year ended March 31, 2024. This is higher than the $10.8 billion worth of shares it repurchased in the prior year.

What Does the Future Hold for Alibaba?

Alibaba stock has underperformed the broader market and is down about 25% in one year. Its Cloud segment’s growth has moderated amid intense competition and macro headwinds in the domestic market. This has weighed on its share price. The company’s announcement of price cuts to drive growth is expected to increase competition and pressure margins.

Despite challenges, Wall Street analysts are bullish about BABA stock. Alibaba stock sports a Strong Buy consensus rating based on 15 Buys and three Holds. The analysts’ average price target on BABA stock of $104.66 per share implies a 43.61% upside potential.