Gambling giant 888 Holdings (GB:888) posted its third-quarter update today with total revenue down by 7% to £449 million – due to the introduction of safer gambling regulations which hit average spending per player.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Online revenues declined by 13%, mainly affected by strict gambling regulations enforced in the UK for better player safety.

This also led to a reduction in average spending per player by 14%.

The company, which owns brands like 888poker, William Hill, and Mr. Green, saw a decline in online gamers after a peak in lockdown.

Itai Pazner, chief executive of 888 Holdings, said, “We are changing the mix of our business to a lower-spending, more recreational player base that gives us confidence in the long-term potential for our UK business.”

Online revenues were also affected after the company lost its gambling licence in the Netherlands in 2021 after the country legalised online gambling.

Despite the challenging environment, the company anticipates that fourth-quarter revenues will exceed those of this quarter and remain at levels comparable to the fourth quarter of 2021.

The company has already seen some progress in its cost-saving initiatives, which will help it deliver improved EBITDA margins in the third and fourth quarters of 2022.

The shares were trading down by around 6% during the day, but later on, recovered to a gain of 1.22%.

Is 888 Holdings a buy?

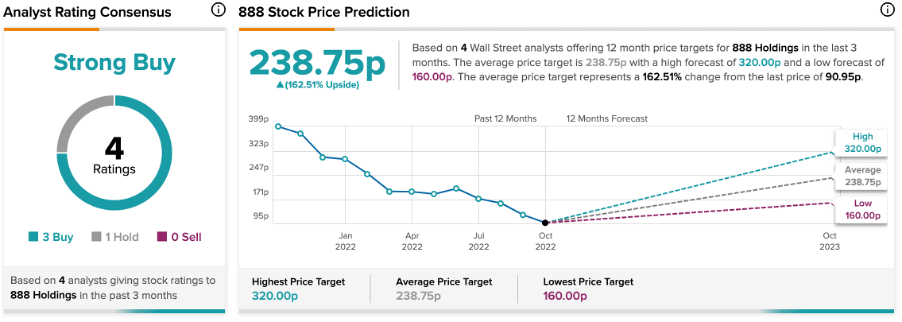

According to TipRanks’ analyst consensus, 888 Holdings stock has a Strong Buy rating, based on three Buy and one Hold recommendation.

The 888 target price is 238.7p, with an upside potential of 162.5%.

Conclusion

The current operating environment remains challenging for the company and could lead to more pressure on revenues.

The company is betting big on its leading portfolio of brands to grow its market share and revenues simultaneously.