These are the 5 Best Travel stocks to buy in April 2024, as per Wall Street analysts. The travel and tourism industry has made a massive comeback after the COVID-19 pandemic. Despite macro pressures, there is still a huge pent-up demand in international travel. As such, travel companies are poised for superior growth and analysts remain bullish on this category. The travel industry has several sub-segments including air carriers, hotels & resorts, online booking portals, casinos and gaming, cruise liners, and hospitality companies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

We have sorted the top five travel stocks from these segments based on analysts’ bullish reviews and high upside potential in the next twelve months. Let’s delve right into them.

#1 Carnival Corp. (NYSE:CCL)

Florida-based Carnival Corp. is witnessing solid demand for its cruise vacations. CCL operates a fleet of nearly 91 cruise ships throughout North America, Europe, Australia, and Asia via world-recognized brands, including Aida, Carnival, and Costa Cruises. In the past year, CCL stock has gained over 57%.

In its most recent results for Q1 FY24, Carnival posted a narrower-than-expected adjusted loss of $0.14 per share, while revenue of $5.41 billion was in line with expectations. CCL also raised its FY24 adjusted earnings guidance to $0.98 per share and guided for a higher adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $5.63 billion.

CCL cited higher ticket prices, a rise in onboard customer spending, and growing occupancy levels as the reasons for its optimistic outlook. However, the cruise liner warned of a roughly $10 million hit to its Fiscal 2024 earnings from the recent collapse of a bridge in Baltimore. Moreover, CCL expects a $130 million cost (through November 2024) related to rerouting due to conflict on the Red Sea.

Is CCL a Good Stock to Buy?

With 14 Buys versus one Hold rating, CCL stock has a Strong Buy consensus rating on TipRanks. The average Carnival Corp price target of $22.75 implies 46.8% upside potential from current levels.

#2 Caesars Entertainment (NASDAQ:CZR)

Caesars Entertainment was formed in July 2020 via the merger of Caesars Entertainment and Eldorado Resorts. Nevada-based Caesars is an American hotel and casino operator with over 50 entertainment destinations. Caesars boasts some of the most prestigious gaming brands and is a leader in gaming and hospitality. Notably, Caesars earns over 50% of its revenues from the Casino segment.

In Fiscal 2023, the company’s net revenue grew 6.6%, backed by solid growth in Caesars Digital revenue. Caesars also reported positive earnings in FY23, a strong reversal from the net loss booked in FY22.

What is the Price Prediction for CZR?

On TipRanks, the average Caesars Entertainment price prediction of $59.09 implies 34.4% upside potential from current levels. Also, CZR stock commands a Strong Buy consensus rating based on ten Buys and three Hold ratings. In the past year, CZR stock has lost 3.3%.

#3 Golden Entertainment, Inc. (NASDAQ:GDEN)

Golden Entertainment is a Nevada-based regional casino and tavern operator. The company owns eight casino resorts and 69 neighborhood pubs and taverns across Nevada. In the past year, GDEN stock has lost 15.2%, That said, with improving financial health, easing of higher labor costs, and deleveraging efforts, Golden Entertainment is expected to bolster its bottom line and boost its share price.

In Fiscal 2023, total revenues declined 6% to $1.05 billion compared to FY22, mainly due to lower gaming revenue. However, net income increased drastically owing to a one-time gain on the sale of non-core businesses.

GDEN even repaid $239 million of total debt in FY23, thanks to the proceeds from the divested businesses. What’s more, the board initiated a recurring quarterly cash dividend of $0.25 per share, reflecting a yield of 0.7%.

What is Golden Entertainment Stock’s Price Target?

The average Golden Entertainment price target of $44.75 implies 24% upside potential from current levels. On TipRanks, GDEN stock commands a Strong Buy consensus rating based on four unanimous Buys.

#4 Wyndham Hotels & Resorts (NYSE:WH)

New Jersey-based Wyndham Hotels & Resorts franchises and operates a portfolio of 24 iconic hotel brands globally. WH boasts to be the world’s largest hotel franchisor, with roughly 9,200 hotels spanning 95 countries. In the past year, WH stock has gained 10.9%.

Notably, WH has exceeded Wall Street expectations for eight consecutive quarters. In FY23, WH posted adjusted earnings of $4.01 per share (up 1.3% annually) on fee-related revenue of $1.38 billion (up 2.2%). Moreover, the board hiked the quarterly dividend to $0.38 per share from $0.35, reflecting an above-average yield of 1.85%.

For FY24, Wyndham forecasts fee-related and other income in the range of $1.43 to $1.46 billion and adjusted earnings between $4.11 and $4.23 per share.

Is Wyndham a Good Stock?

With six unanimous Buy ratings, WH stock has a Strong Buy consensus rating on TipRanks. The average Wyndham Hotels & Resorts price target of $91.83 implies 23.9% upside potential from current levels.

#5 Delta Air Lines (NYSE:DAL)

Delta Air Lines is one of the oldest and among the four largest air carriers in the U.S. with global operations. Delta Airlines flies nearly 200 million travelers to over 280 destinations across six continents, with up to 4,000 daily departures. DAL stock has soared over 39% in the past year, with a healthy travel rebound and expectations of a return to pre-pandemic levels. In FY23, Delta even reinstated a quarterly dividend of $0.10 per share, reflecting a yield of 0.65%.

Delta is set to release its Q1 FY24 results on April 10. The Street expects Delta to post adjusted earnings of $0.36 per share on revenue of $12.51 billion. In Q1 FY23, Delta reported adjusted earnings of $0.25 per share on revenue of $11.84 billion (excluding refinery sales).

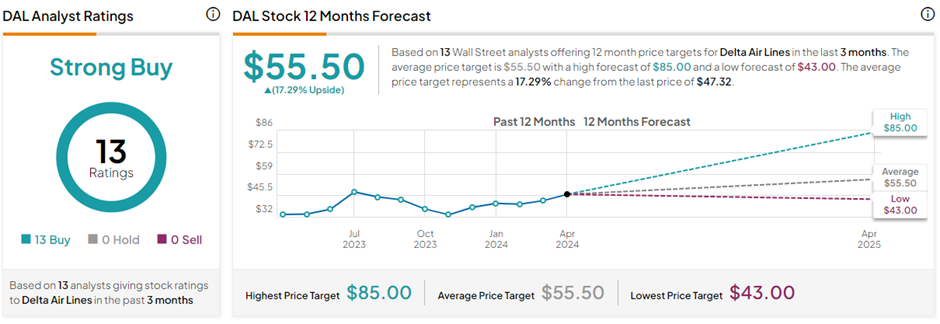

Wall Street remains highly optimistic about Delta’s Q1 performance, with many analysts raising their price targets on DAL stock. Importantly, analysts are encouraged by Delta’s push toward a premium consumer mix, which will enable it to command premium pricing.

What is the Future of DAL Stock?

With 13 unanimous Buy ratings, DAL stock has a Strong Buy consensus rating on TipRanks. The average Delta Air Lines price target of $55.50 implies 17.3% upside potential from current levels.

Ending Thoughts

As per research from Statista, revenue from the Travel and Tourism industry is expected to reach $927.30 billion in 2024, growing at a CAGR (compound annual growth rate) of 3.47%. The full recovery in Asian markets, coupled with higher air travel connectivity, is expected to drive the demand for travel this year. Even analysts are highly bullish about the aforementioned five travel stocks that hold a solid upside potential.