These are the 5 Best Technology Stocks to buy in April 2024, as per Wall Street analysts. Tech stocks carry high growth potential and are often disruptors in products or technological advancements. Technology companies include hardware and equipment makers, Software-as-a-Service (SaaS) providers, artificial intelligence (AI)-based solution providers, semiconductor makers, and several other sub-segments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To help investors benefit from the huge opportunities in the sector, we have sorted five tech stocks from different fields. These stocks have won analysts’ bullish reviews and could offer high share price appreciation potential in the next twelve months. Let’s delve right into them

#1 Braze Inc. (NASDAQ:BRZE)

New York-based Braze operates a customer engagement platform that is used by businesses for multichannel marketing. To date, Braze claims to have helped over 2,000 global brands reach their consumers effectively, with more than 2.2 trillion messages sent in 2023 from 12 global offices. In the past year, BRZE stock has gained 27.5%.

In Fiscal 2024 (January 31, 2024), Braze’s revenue grew 32.7% annually to $471.8 million, with a majority contribution from Subscription revenue. Meanwhile, the adjusted loss per share narrowed significantly to $0.25 from $0.64 in the prior year.

For FY25, Braze projects revenue in the range of $570 to $575 million and an adjusted loss per share between $0.08 and $0.12. The company’s performance is expected to improve with new customer additions, upsells, and renewals.

Is Braze a Good Stock to Buy?

With 16 Buys and one Hold rating, BRZE stock has a Strong Buy consensus rating on TipRanks. The average Braze price target of $67.67 implies 60.6% upside potential from current levels.

#2 Five9, Inc. (NASDAQ:FIVN)

California-based Five9 operates cloud software for contact centers across North America, Europe, South America, and the Asia Pacific (APAC) region. The company provides end-to-end digital engagement, analytics, workforce optimization, and AI and automation to increase agent productivity and deliver tangible business results.

In FY23, total revenue rose 17% annually to reach $910.49 million, backed by solid subscription revenue growth. Also, adjusted earnings per share (EPS) increased 36.7% to $2.05.

Based on continued business momentum, Five9 expects FY24 revenue to be between $1.053 and $1.057 billion and adjusted EPS in the range of $2.14 to $2.18.

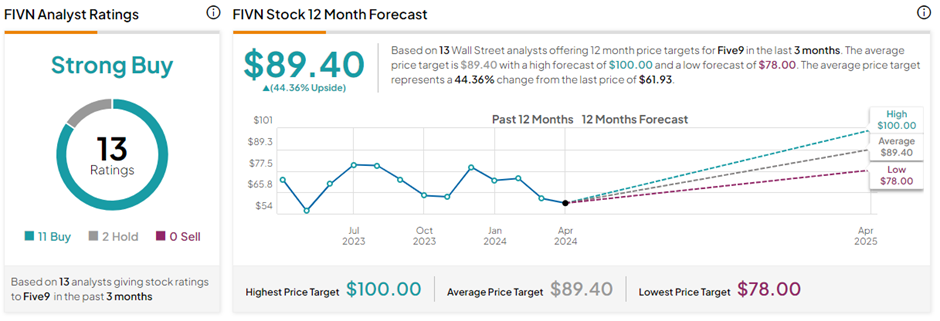

Is Five9 Stock a Buy?

On TipRanks, FIVN stock commands a Strong Buy consensus rating based on 11 Buys versus two Hold ratings. The average Five9 price target of $89.40 implies 44.4% upside potential from current levels. Meanwhile, FIVN stock has lost 12.9% in the past year.

#3 Zscaler, Inc. (NADSAQ:ZS)

Zscaler is a cloud-based software security solutions provider. The company offers a wide range of services, including internet security, web security, vulnerability management, firewalls, antivirus, and control over user activity in mobile, cloud computing, and Internet of Things (IoT) environments. To date, ZS boasts over 7,500 clients, with more than 320 billion daily transactions secured.

In Q2 FY24, Zscaler’s revenue jumped 35% year-over-year to $525 million, while adjusted EPS more than doubled to $0.76 per share. The demand for Zscaler’s services is increasing as more customers switch from traditional firewall-based security to the Zscaler Zero Trust Exchange platform.

For FY24, ZS projects revenue in the range of $2.118 to $2.122 billion and adjusted EPS of $2.73 to $2.77. In the past year, ZS stock has zoomed 73.6%.

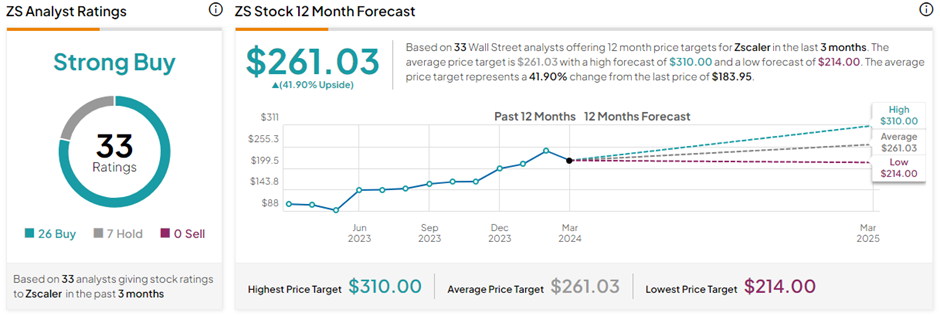

Is Zscaler a Buy, Sell, or Hold?

With 26 Buys and seven Holds, ZS stock commands a Strong Buy consensus rating on TipRanks. The average Zscaler price target of $261.03 implies 41.9% upside potential from current levels.

#4 ACM Research (NASDAQ:ACMR)

California-based ACM Research operates in the highly lucrative semiconductor sector. Its offerings include advanced production tools that support IC (integrated circuit) and compound semiconductor manufacturing, wafer-level packaging, and wafer manufacturing. ACMR’s main manufacturing and research and development hub is based in Shanghai, with a product development base in South Korea, and marketing services based in North America, Europe, and Asia (outside China).

In FY23, ACMR’s revenue grew 43.4% year-over-year to $557.72 million. Also, adjusted EPS nearly doubled to $1.63 compared to FY22. In the past year, ACMR shares have exploded over 166%.

For FY24, ACMR projects revenue in the range of $650 to $725 million, based on continued investments in mature process nodes by existing and new mainland China-based customers. Plus, ACMR expects additional revenue from newly introduced tools and further penetration of products across its existing customers.

Is ACMR a Good Stock to Buy?

With five unanimous Buys, ACMR stock has a Strong Buy consensus rating on TipRanks. The average ACM Research price target of $37.75 implies about 32% upside potential from current levels.

#5 Broadcom (NASDAQ:AVGO)

Broadcom is a technology company offering semiconductor and infrastructure software solutions. In 2023, Broadcom acquired VMWare, an American cloud computing and virtualization technology company. Combined, their products serve many verticals, including cloud, data center, networking, software, broadband, wireless, storage, and industrial markets.

Importantly, AVGO also pays a regular quarterly dividend of $5.25 per share, reflecting an above-average yield of 1.47%.

In Q1 FY24, Broadcom’s revenue jumped 34% year-over-year to $11.96 billion, while adjusted EPS increased 6.4% to $10.99. Excluding VMWare, revenue grew 11% compared to Q1 FY23.

For the full year 2024, Broadcom projects revenue of $50 billion, reflecting a 40% increase compared to the previous year. Broadcom’s revenue is expected to be supported by two drivers – customer adoption of VMWare’s cloud solutions and strong demand for networking products in AI data centers and custom AI accelerators from hyperscalers.

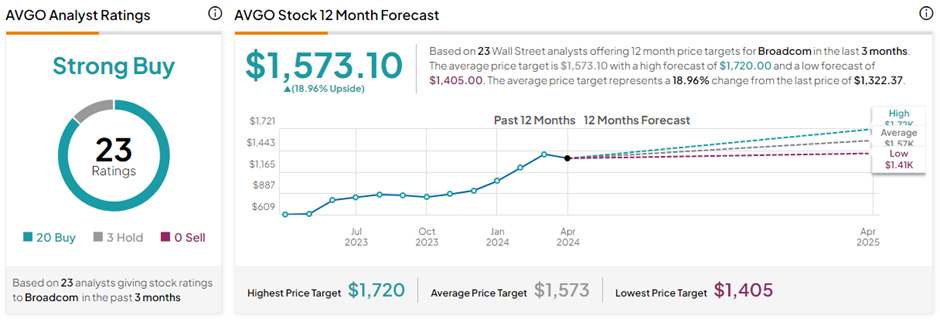

Is AVGO Stock a Buy?

With 20 Buys versus three Hold ratings, AVGO stock has a Strong Buy consensus rating on TipRanks. The average Broadcom price target of $1,573.10 implies nearly 19% upside potential from current levels. AVGO stock has skyrocketed 112.8% in the past year.

Ending Thoughts

Today’s world is driven by accelerated technological advancements in every walk of life. Investors can consider investing in tech companies for solid portfolio returns and diversification. The above five technology stocks have massive potential to grow with their advanced software and solutions. Moreover, analysts have assigned a Strong Buy rating on these stocks and foresee solid upside potential.