As part of a strategic move, 3M (MMM) disclosed that it has agreed to sell the rights to some of its assets to Selic Corp PCL. It is selling its rights to the Neoplast and Neobun brands as well as its affiliated assets in Thailand and other Southeast Asian countries. This agreement includes the manufacturing assets of its Ladlumkaew facility in Thailand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a part of 3M’s Skin Health & Wellness business, Neoplast and Neobun products, which include sports and medical tapes, bandages, and related products, are mainly sold in Thailand and Southeast Asia.

Based in Minnesota, 3M Company manufactures and sells industrial, safety, and consumer products worldwide. It operates through various business segments, including, Safety and Industrial, Transportation and Electronics, Health Care, and Consumer.

At the Ladlumkaew facility, Selic Corp plans on advancing its operations. This includes employing interested site employees. Further, it plans on boosting its production for its medical device business as well as the Neoplast and Neobun brands.

The deal is not expected to have any material impact on earnings and will is expected to close in the fourth quarter of 2022.

Management Weighs In

Megan Selby, President at 3M’s Consumer Health & Safety Division (CHSD) commented, “3M continues to relentlessly prioritize investments that leverage 3M’s technologies in advanced wound care solutions under the Nexcare brand in skin health and wellness for the consumer.”

She added, “We will continue to invest in health and safety for our Asia customers and those around the world.”

Wall Street’s Take

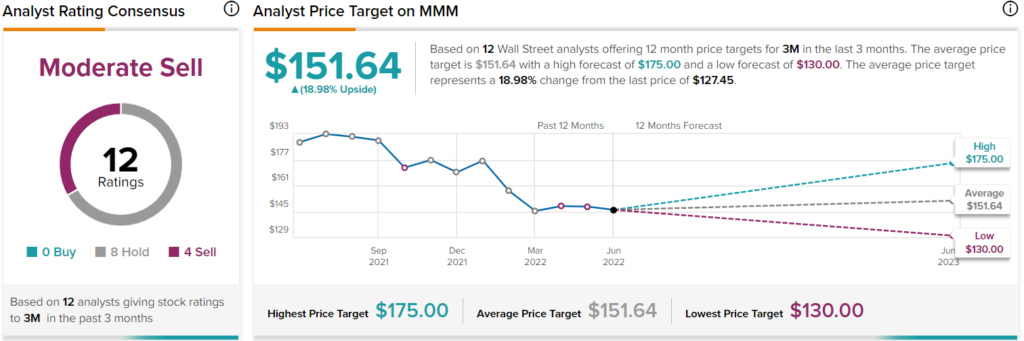

On June 29, Wells Fargo analyst Joe O’Dea decreased the price target on 3M to $140 (8.2% upside potential) from $156 and reiterated a Hold rating.

Overall, the stock has a Moderate Sell consensus rating based on eight Holds and four Sells. The average 3M stock forecast of $151.64 implies 19% upside potential from current levels.

Ending Thoughts

Shares of 3M have lost over a third of their market capitalization over the past year.

The company is working on a turnaround initiative and was planning to shut the Ladlumkaew facility by the end of August 2022. The sale of the Neoplast and Neobun brands may help it prioritize other crucial aspects of its business segments.