Shares of diversified technology behemoth 3M (NYSE:MMM) have surged by nearly 5% in the pre-market session today after its third-quarter results exceeded estimates. EPS of $2.68 comfortably outpaced expectations by $0.34. Although revenue declined by 3.6% year-over-year to $8.3 billion, the figure still cruised past estimates by $280 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A focus on operational performance, risk reduction, and lowering uncertainty helped the company deliver strong operational execution during the quarter. Impressively, operating cash flow rose by 25% compared to the previous year, reaching $1.9 billion.

Looking ahead to the full Fiscal year 2023, 3M now expects adjusted EPS to fall in the range of $8.95 to $9.15, compared to the prior outlook of $8.60 to $9.10. Owing to lower organic sales, adjusted sales growth for the year is expected at -5% versus prior expectations in the range of -5% to -1%. Nonetheless, the company anticipates adjusted operating cash flow to hover between $6.5 billion and $6.9 billion, a significant increase over prior expectations of $5.9 billion to $6.3 billion.

What Is the Future of 3M Stock?

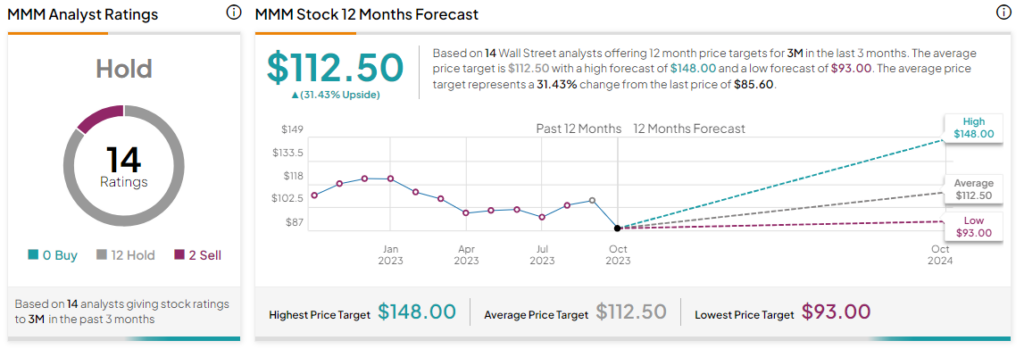

Overall, the Street has a Hold consensus rating on 3M. The average MMM price target of $112.50 implies a 31.4% potential upside. That’s after a nearly 23.5% slide in the share price over the past year.

Read full Disclosure