It wasn’t the best news for 3M (NYSE:MMM), the company that brought us everything from earplugs to Post-it Notes. But it was the earplugs that were a particular problem today, as it turned out its recent settlement efforts were going a bit too well. In fact, the settlement participation rate was on track to clear the thresholds required by the terms of the agreement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The reports noted that the settlement agreement, established back in August 2023, required 3M to pay $6 billion in order to resolve the litigation. Meanwhile, $1 billion of that would be in cash or stock once the settlement reached 98% participation. Now, it’s on track to reach that point, and it plans to pay the $1 billion in cash accordingly. So far, over 250,000 claimants have stepped forward and will release their claims as the settlement requires.

Trouble Under the Hood

A big payout going to the various claimants involved is one thing, but it gets worse from there. In a move that shrieks “bad optics,” reports noted that 3 M’s CEO, Mike Roman, is in line to receive a pension fund valued at $26 million, while at the same time, 3M also froze pensions for its non-union employees. In addition, reports note that 3M is vastly on the decline against the S&P 500 (SPX), even with the dividend factored in, and that its acquisitions haven’t been paying off as hoped. Its margins are also in open decline, which doesn’t help matters, especially as revenues are rising. Even its executive compensation issues are rewarding some of the wrong behaviors, according to some reports.

What Is the Target Price for 3M?

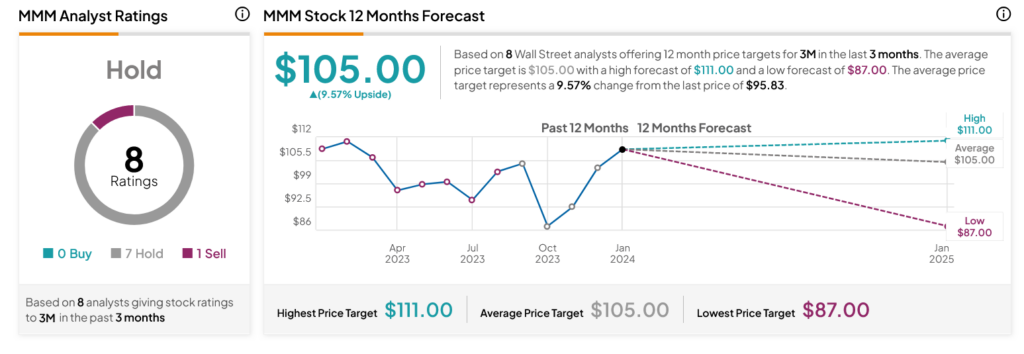

Turning to Wall Street, analysts have a Hold consensus rating on MMM stock based on seven Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 9.71% loss in its share price over the past year, the average MMM price target of $105 per share implies 9.57% upside potential.