Small-cap stocks often fly under the radar, but some are now drawing attention from Wall Street. Analysts have identified three such companies with strong fundamentals and growth potential, each offering solid upside from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s dive into the details. Click on any ticker to explore each stock further and decide if it deserves a spot in your portfolio.

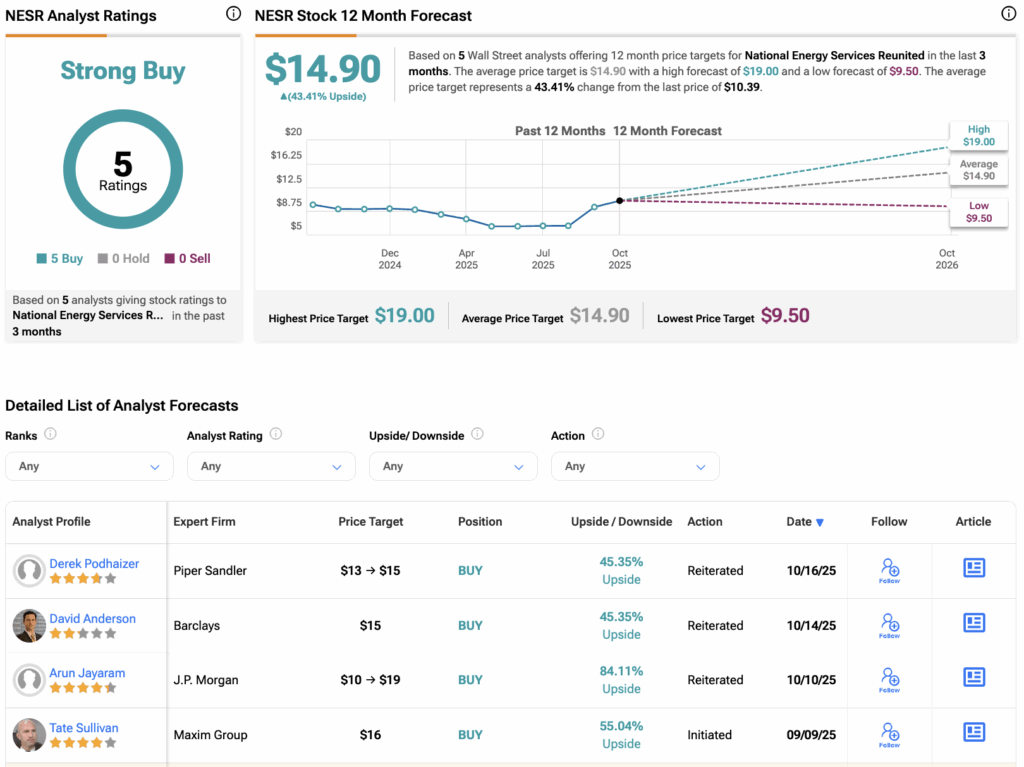

National Energy Services Reunited (NESR)

National Energy Services Reunited is a global oilfield services company providing integrated energy solutions to the Middle East, North Africa, and Asia. Year-to-date, NESR stock has gained over 15%.

Yesterday, four-star-rated analyst Derek Podhaizer at Piper Sandler reiterated his Buy rating on NESR stock, predicting around 45% upside. Overall, all five analysts currently covering NESR stock have issued Buy recommendations. Meanwhile, the average NESR stock price target of $14.90 suggests over 43% upside from current levels.

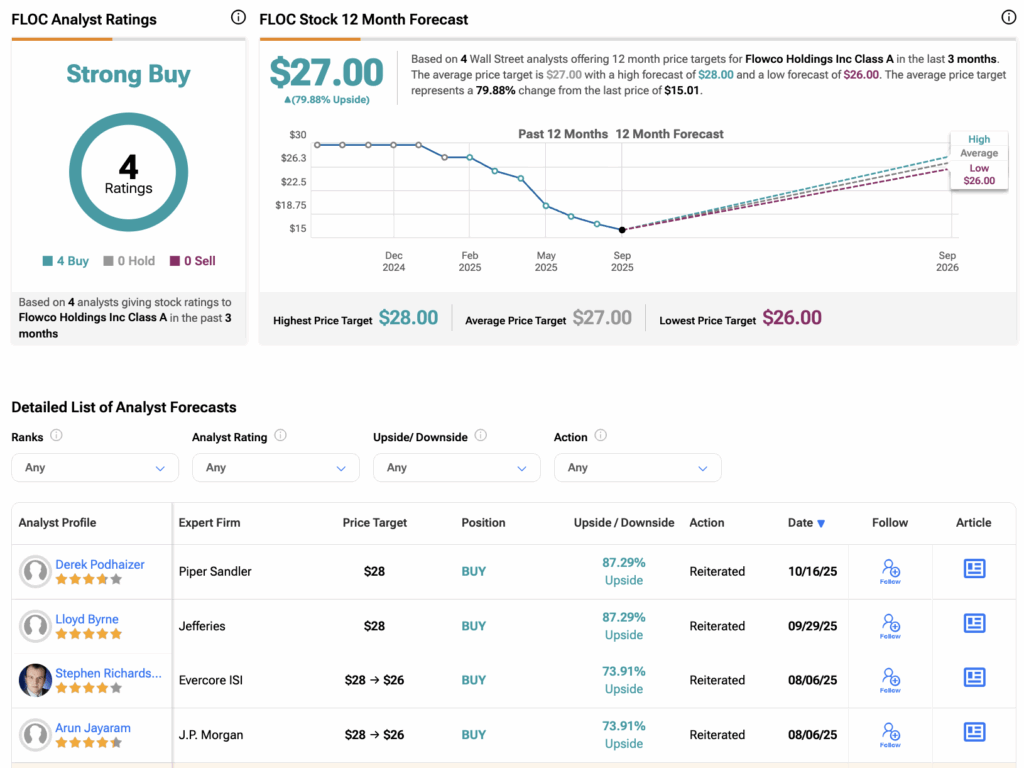

Flowco Holdings Inc Class A (FLOC)

Flowco Holdings is a diversified energy and infrastructure company focused on delivering innovative solutions in fluid management and industrial systems. It serves clients across the oil, gas, and renewable energy sectors. FLOC stock has declined by 50% year-to-date.

Yesterday, Podhaizer also reiterated his Buy rating on FLOC, predicting over 85% upside. Overall, analysts are strongly bullish on FLOC stock. On TipRanks, the stock has all Buy recommendations from four analysts. Meanwhile, Flowco’s average stock price target of $27 suggests a potential upside of 80% from current levels.

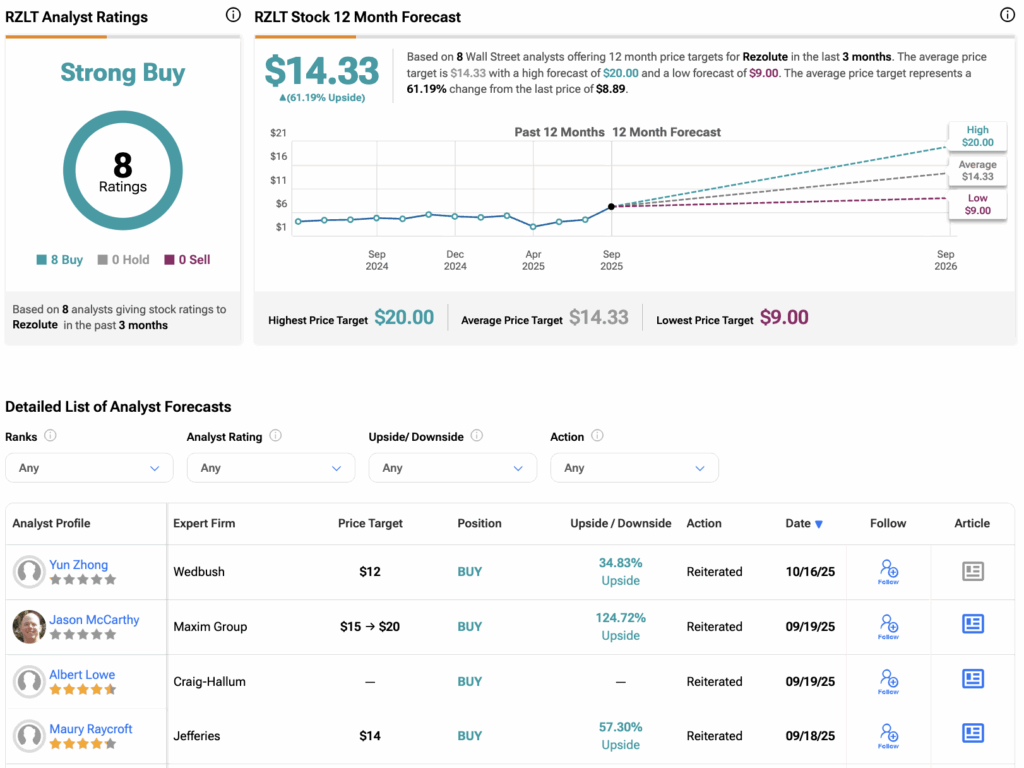

Rezolute (RZLT)

Rezolute is a biopharmaceutical company developing innovative therapies for rare and metabolic diseases. Its pipeline focuses on addressing unmet medical needs with novel treatment approaches. Year-to-date, RZLT stock has gained 80%.

Today, Wedbush’s analyst Yun Zhong reiterated his Buy rating on RZLT. Overall, RZLT stock has received all Buy ratings from the eight analysts covering the stock. The average Rezolute stock price target of $14.33 suggests a potential upside of 61% from current levels.