Small-cap stocks often fly under the radar, but some are now drawing attention from Wall Street. Analysts have identified three such companies with strong fundamentals and growth potential, each offering more than 100% upside from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s dive into the details. Click on any ticker to explore each stock further and decide if it deserves a spot in your portfolio.

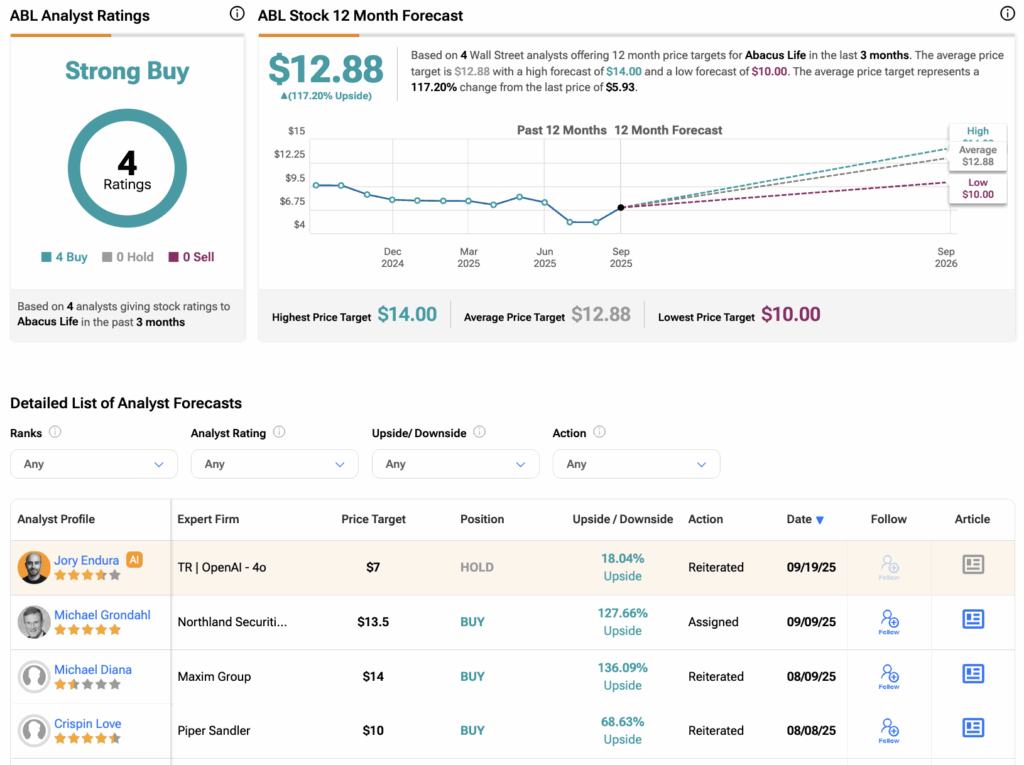

Abacus Life (ABL)

Abacus Life is an asset manager specializing in life settlements, acquiring life insurance policies to provide investors with uncorrelated, insurance-linked returns. Year-to-date, ABL stock has declined by 24.4%.

Overall, all four analysts currently covering ABL stock have issued Buy recommendations. Meanwhile, the Abacus Life’s stock price target of $12.88 suggests over 117% upside from current levels.

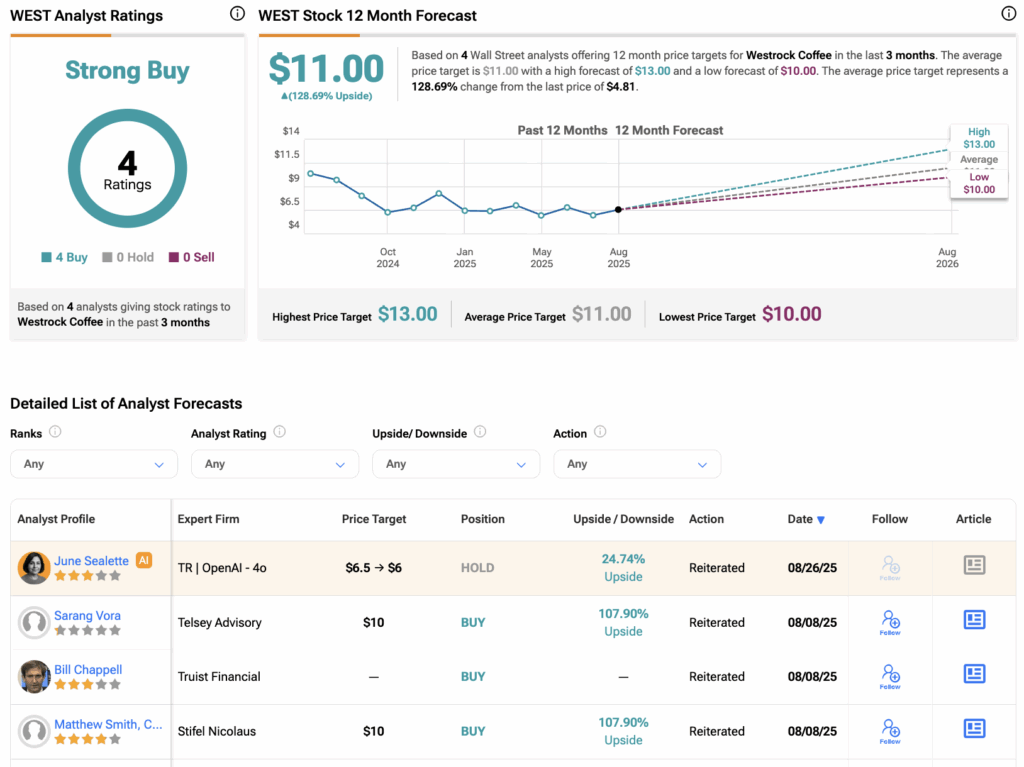

Westrock Coffee (WEST)

Westrock Coffee is a vertically integrated beverage solutions provider specializing in ethically sourced coffee, tea, and extracts. WEST stock has declined by 25% year-to-date in 2025.

Looking ahead, analysts are strongly bullish on WEST stock. On TipRanks, the stock has all Buy recommendations from four analysts. Meanwhile, Westrock Coffee’s average stock price target of $11.0 suggests a potential upside of 128% from current levels.

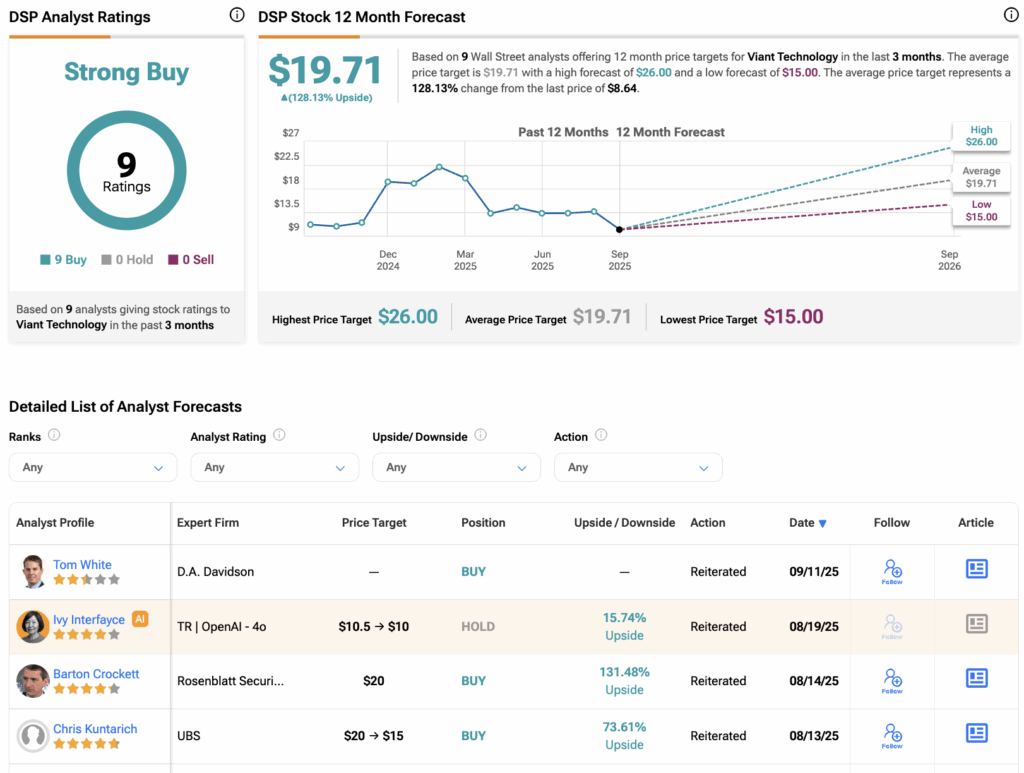

Viant Technology (DSP)

Viant Technology is an ad tech company offering AI-powered programmatic advertising solutions. Year-to-date, DSP stock has declined by 54%.

Overall, DSP stock has received all Buy ratings from the nine analysts covering the stock. Meanwhile, Viant Technology’s stock price target of $19.71 suggests a potential upside of 128.13% from current levels.