NIO, the Chinese electrical auto manufacturer, has been trending recently after its stock climbed over 70% in a month. That followed impressive second-quarter results that showcased increased revenue of $2.4 billion, in a 98.8% jump year-over-year. In addition, the company has started deliveries of its new sub-brand, Onvo, Model L60, which could increase its revenues even further. However, our writer at Tipranks, James Fox, holds a bearish position on the stock. So why can’t NIO instill much confidence in its investors despite its impressive revenues and growing car deliveries?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a quick look at 3 reasons:

- NIO is still not profitable: Despite impressive Q2 results, as mentioned above, NIO is still not a profitable company, showing an adjusted net loss of $624.1 million in Q2 2024. So, Nio experienced a 98.9% increase year-over-year, but the company is not making any money. It is even burning its cash flows, with an estimated $600 million burned in the last quarter. Also, the net loss down to shareholders was $705.4 million. For now, the road to profitability seems long, and there are a few factors that could undermine its recent momentum, such as growing SG&A (Selling, General, and Admin) expenses, its share-based compensation plan program, China’s slowing economy, and of course, fierce competition from its industry counterparts.

- Fierce competition despite battery technology: Nio has started to deliver its brand-new Onvo L60 Model, a direct rival to Tesla’s Model Y, With the company aiming for 20,000 monthly sales if this model is expected to contribute to NIO’s margins. That’s a hard task, especially considering the model’s relatively low price tag. Moreover, NIO’s market share in China is 2.1%, which is considerably lower than BYD’s (BYD) 35% and Tesla’s (TSLA) 7.8%. Its changeable battery is innovative, and NIO has already built 2,577 battery swap stations in China. However, that won’t be sustainable if its market share lingers at 2.1%.

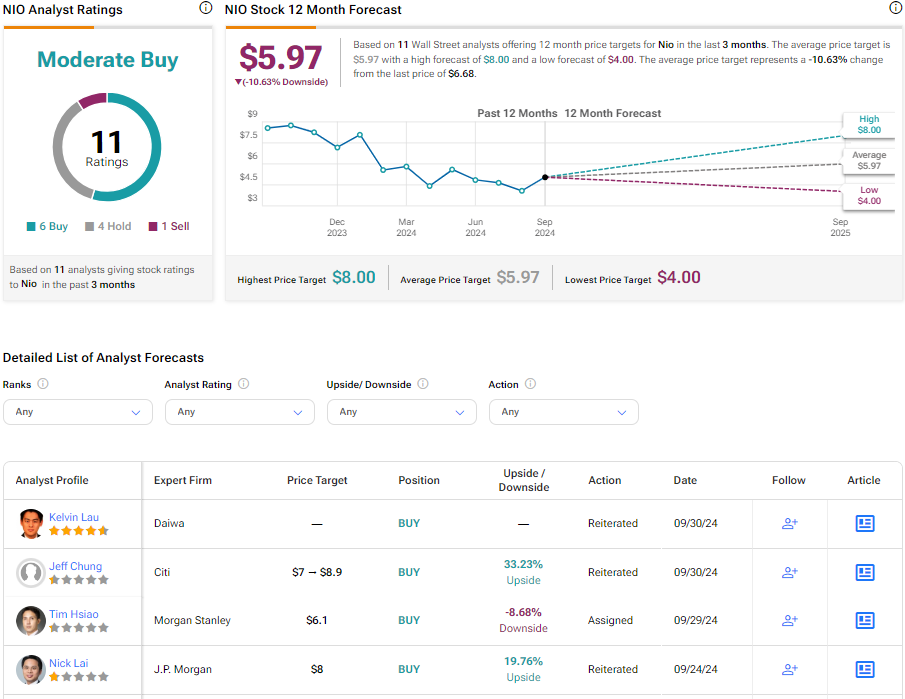

- What Wall Street analysts think: On Wall Street, NIO stock is a Moderate Buy, with 6 Buys, 4 Holds, and 1 Sell. The price target, however, is $5.97, implying a -10.63% downside. This means that after its stock surge in the last month, analysts consider this stock overpriced, signaling a downturn in the near term. Or, they might be wrong, and everything will go as NIO plans, and dedicated investors will celebrate hefty profits.

Takeaway

NIO has presented successful second-quarter results, exceeding estimates in revenue while its car deliveries have increased significantly. On paper, it seems optimistic all around. However, the company is still losing money, its market share is minimal relative to its industry rivals, and it will take time if ever, to become profitable.