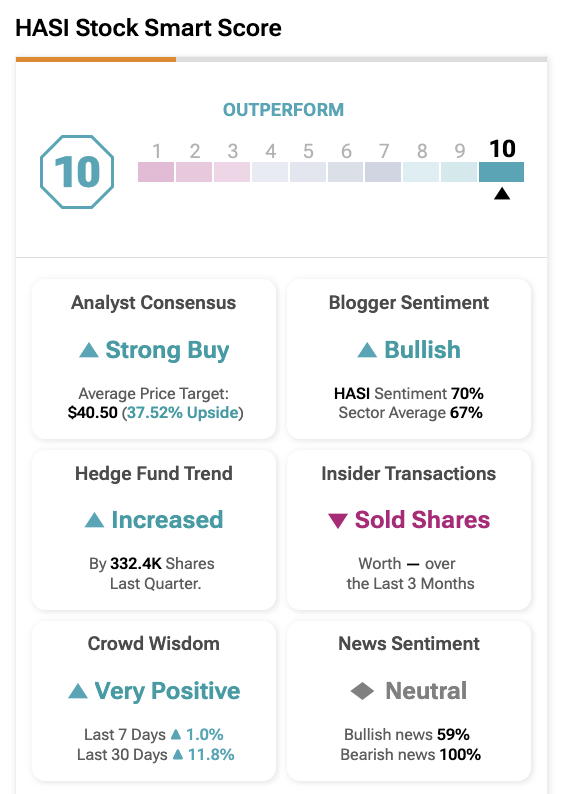

Amid global market volatility, TipRanks offers valuable tools to guide investors. One of the most powerful is the Smart Score, which assigns a ranking of one to ten to stocks and highlights their potential to outperform the broader market. Using this tool, we have identified three standout stocks: HASI (HASI), TTM Technologies (TTMI), and California Resources Corp (CRC). Each of these has earned a top Smart Score and a Strong Buy rating from Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The TipRanks’ Smart Score rates the stocks on a scale from 1 to 10, with 10 being the highest. The score is based on eight key market factors, including Wall Street analyst ratings, insider transactions, financial blogger opinions, and more. Additionally, the Top Smart Score Stocks list offers a comprehensive selection of stocks rated a perfect 10, along with advanced filtering options.

Let’s dive into the details.

Is HASI Stock a Good Buy?

HASI invests in sustainable infrastructure assets supporting the shift to clean energy.

Year-to-date, HASI stock has gained over 9%. Looking ahead, Wall Street analysts remain bullish on its upside potential. Of the 10 analysts covering the stock, nine rate it a Buy, while one has a Hold rating. The HASI’s average stock price target of $40.50 suggests a potential upside of almost 38% from current levels.

What Is the Stock Price Prediction for TTM Technologies?

TTM Technologies is a global manufacturer of printed circuit boards and radio-frequency components used in electronics, aerospace, and defense. Year-to-date, TTMI stock has gained over 130%.

Wall Street analysts are optimistic about TTMI stock in the long run, with all four analysts assigning a Buy rating. According to TipRanks, the stock has an average price target of $55.25, suggesting a 3.75% downside from current levels.

Is CRC a Good Stock to Buy?

California Resources is an independent oil and natural gas producer focused on exploration and production in California. So far in 2025, CRC stock has gained over 8%.

CRC stock holds a Strong Buy rating from nine Wall Street analysts, with eight Buys and one Hold. According to TipRanks, CRC’s average price target of $64.89 suggests a 15.5% upside from current levels.