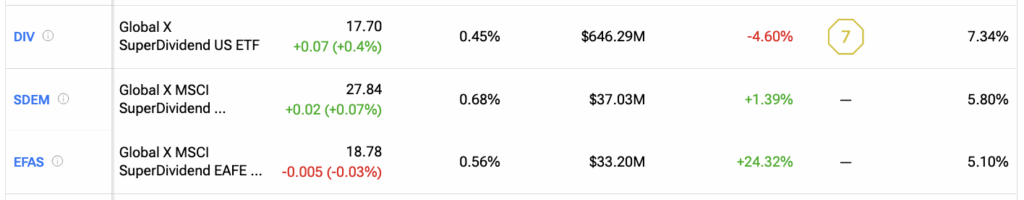

Dividend ETFs remain a favorite among income-seeking investors, but not all are created equal. Using TipRanks’ High Dividend Yield ETFs tool, we have shortlisted three ETFs: Global X SuperDividend US ETF (DIV), Global X MSCI SuperDividend Emerging Markets ETF (SDEM), and Global X MSCI SuperDividend EAFE ETF (EFAS) that offer high dividend yields of over 5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

TipRanks Makes Dividend Investing Easier

TipRanks provides a range of tools to help investors find and track dividend opportunities that fit their goals. The Best Dividend Stocks list highlights top dividend-paying companies along with key comparison metrics. Meanwhile, the Dividend Calendar makes it simple to track upcoming payouts, so investors can plan purchases in time to qualify for the next distribution.

For those interested in ETFs, TipRanks also offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc.

Global X SuperDividend US ETF (DIV)

The Global X SuperDividend US ETF is a solid option for investors seeking steady income from high-dividend U.S. stocks. By following the Indxx SuperDividend U.S. Low Volatility Index, DIV provides exposure to a diversified mix of high-yield, U.S.-based equities.

DIV pays a monthly dividend of $0.108 per share, reflecting a yield of 7.34%. Meanwhile, DIV has an expense ratio of 0.45%. In terms of holdings, it has a total of 51 holdings with total assets of $646.29 million.

Global X MSCI SuperDividend EAFE ETF (EFAS)

The Global X MSCI SuperDividend EAFE ETF focuses on delivering strong dividends by investing in international equities across developed markets outside North America. It seeks to track the MSCI EAFE Top 50 Dividend Index, which selects companies based on their high dividend yields.

EFAS pays a regular monthly dividend of $0.072 per share, reflecting a yield of 5.1%. Importantly, EFAS has an expense ratio of 0.56%. In terms of holdings, EFAS has a total of 50 holdings with total assets of $33.20 million.

Global X MSCI SuperDividend Emerging Markets ETF (SDEM)

The Global X MSCI SuperDividend Emerging Markets ETF is an exchange-traded fund for investors who want steady income from emerging-market stocks. SDEM holds a wide mix of high-dividend firms across industries in places like Asia, Latin America, and Eastern Europe.

SDEM currently pays a monthly dividend of $0.13 per share, leading to a 5.8% yield, while maintaining an expense ratio of 0.68%. Notably, the ETF holds 52 stocks with $37.03 million in AUM.