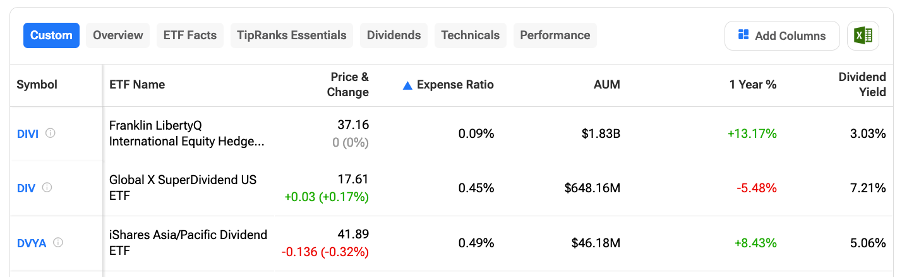

Dividend ETFs remain a favorite among income-seeking investors, but not all are created equal. Using TipRanks’ High Dividend Yield ETFs tool, we have shortlisted three ETFs: Franklin LibertyQ International Equity Hedged ETF (DIVI), iShares Asia/Pacific Dividend ETF (DVYA), and Global X SuperDividend US ETF (DIV) that offer a solid balance of good yields and low expense ratios. All three funds have expense ratios under 0.50%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, a dividend ETF (Exchange-Traded Fund) is a fund that holds a basket of dividend-paying stocks and trades on an exchange like a regular stock.

TipRanks Makes Dividend Investing Easier

TipRanks provides a range of tools to help investors find and track dividend opportunities that fit their goals. The Best Dividend Stocks list highlights top dividend-paying companies along with key comparison metrics. Meanwhile, the Dividend Calendar makes it simple to track upcoming payouts, so investors can plan purchases in time to qualify for the next distribution.

For those interested in ETFs, TipRanks also offers powerful comparison features. TipRanks’ ETF Comparison Tool lets investors compare funds across metrics such as AUM (assets under management), expense ratios, technicals, dividend analysis, etc.

Franklin LibertyQ International Equity Hedged ETF (DIVI)

Franklin LibertyQ International Equity Hedged ETF (DIVI) is an attractive option for investors looking for high dividend income from global stocks. It seeks to track the Morningstar Developed Markets ex-North America Dividend Enhanced Select index.

Importantly, DIVI has an expense ratio of 0.09%. Notably, ETFs with low expense ratios cost less to own, helping investors keep more of their returns.

DIVI pays a dividend of $0.185 per share, reflecting a yield of 3.03%. In terms of holdings, the fund has a total of 459 holdings with total assets of $1.83 billion.

Global X SuperDividend US ETF (DIV)

The Global X SuperDividend US ETF is a solid option for investors seeking steady income from high-dividend U.S. stocks. By following the Indxx SuperDividend U.S. Low Volatility Index, DIV provides exposure to a diversified mix of high-yield, U.S.-based equities.

DIV pays a monthly dividend of $0.108 per share, reflecting a yield of 7.21%. Meanwhile, DIV has an expense ratio of 0.45%. In terms of holdings, it has a total of 51 holdings with total assets of $648.16 million.

iShares Asia/Pacific Dividend ETF (DVYA)

The iShares Asia/Pacific Dividend ETF tracks the Dow Jones Asia/Pacific Select Dividend 50 Index, providing exposure to a diverse range of high-yielding stocks across the Asia-Pacific region.

Meanwhile, DVYA pays a quarterly dividend of $0.663 per share, reflecting a 5.06% yield, and carries a low expense ratio of 0.49%. The ETF holds 51 stocks with total assets of $46.18 million, with its top 10 holdings accounting for 41.3% of the portfolio.