These are the 3 Best Cryptocurrency Stocks to buy in April 2024, as per Wall Street analysts. The crucial Bitcoin (BTC-USD) halving event is soon approaching, with the expected date sometime on April 19 or April 20, 2024. The halving event essentially halves the rewards that miners earn on mining Bitcoin. The event takes place every four years and is modeled to reduce the supply of bitcoin in the system and tame inflation. Another important aspect of this event is that the halving event occurs everytime when 21 million Bitcoins are mined.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After this year’s halving event, Bitcoin miners’ rewards would be cut from 6.25 Bitcoins (effective May 11, 2020) to 3.125 Bitcoins. Considering this important event, let’s look at 3 Bitcoin miners that have won analysts’ favor and carry high share price appreciation potential.

#1 Riot Platforms (NASDAQ:RIOT)

Riot Platforms is a Bitcoin mining and digital infrastructure company. It has Bitcoin mining operations and data center operations in central Texas. Additionally, the company has electrical switchgear engineering and fabrication operations in Denver, Colorado.

In March 2024, Riot produced 425 bitcoins, up 2% month-over-month, but down 39% compared to March 2023. As of March end, the company held 8,490 BTC, up 20% year-over-year. Also, Riot’s hash rate grew 18% year-over-year to 12.4 EH/s (exahash per second).

Riot aims to reach a self-mining hash rate capacity of 31 EH/s by the end of 2024, with the addition of new miners and the operation of a new facility at Corsicana. The company’s existing Bitcoin mining facility at Rockdale has a total power capacity of 700 MW and is believed to be North America’s largest single facility, as measured by developed capacity.

What is RIOT’s Stock Prediction?

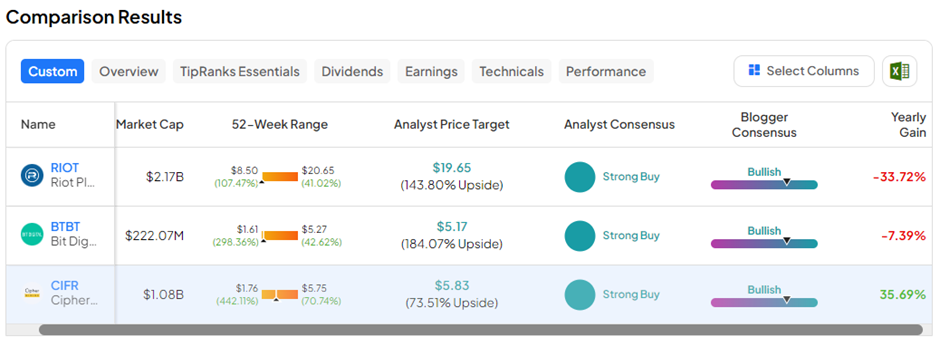

On TipRanks, the average Riot Platforms stock prediction of $19.65 implies a humongous 143.8% upside potential from current levels. Meanwhile, RIOT shares have lost 37.7% in the past year. Also, RIOT stock commands a Strong Buy consensus rating based on ten unanimous Buys.

#2 Bit Digital (NASDAQ:BTBT)

New York City-based Bit Digital is a sustainable platform for digital assets and artificial intelligence (AI) infrastructure. BTBT has bitcoin mining operations in the U.S., Canada, and Iceland. Moreover, the company’s Bit Digital AI offers infrastructure services for AI applications.

Last month, BTBT produced 136.4 BTC, up 6% from February 2024. The company’s active hash rate as of month end was 2.76 EH/s. BTBT held 956.6 BTC and 16,032 Ethereum (ETH-USD) as of March 31, 2024.

Bit Digital has strategic global partnerships with institutional-quality specialist hosting providers. These partnerships help it remain low capital-intensive and create more shareholder value.

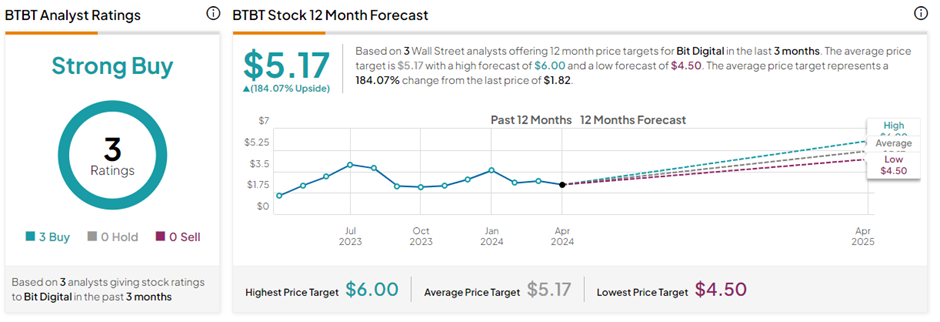

Is BTBT Stock a Good Buy?

With three unanimous Buy ratings on TipRanks, BTBT stock has a Strong Buy consensus rating. The average Bit Digital price target of $5.17 implies a massive 184.1% upside potential from current levels. Meanwhile, BTBT shares have lost 10.3% in the past year.

#3 Cipher Mining (NASDAQ:CIFR)

Cipher Mining is an industrial-scale Bitcoin mining company that aims to expand and strengthen the Bitcoin network’s critical infrastructure in the U.S. It owns and operates four data centers across the U.S.

In March 2024, Cipher mined 316 BTC, with a month-end hash rate of 7.6 EH/s. The company is on track to exceed a hash rate of 9.3 EH/s by the end of Q3 FY24. As of March end, Cipher held 1,741 BTC in its treasury. Notably, by the end of Fiscal 2025, Cipher targets a hash rate of 25 EH/s.

IS CIFR a Buy or Sell?

With three unanimous Buy ratings, CIFR stock has a Strong Buy consensus rating on TipRanks. The average Cipher Mining price target of $5.83 implies 73.5% upside potential from current levels. In the past year, CIFR stock has gained 24.9%.

Ending Thoughts

The crypto industry is set to witness one of the important events soon and everyone is talking about the impact on miners. Even so, the launch of the Spot Bitcoin ETFs has created a sort of breather for the miners, with huge inflows already registered in the ETFs. Experts are predicting that this year’s halving event will not have as much impact as in the previous years due to the spot ETFs. The aforementioned three crypto stocks are highly favored by analysts and also boast solid share price appreciation potential in the next twelve months.