Financial technology (fintech) stocks have the potential to deliver outsized gains to shareholders this year and beyond. Generally, fintech companies digitize legacy products and solutions, allowing them to attract and expand their user base at an accelerated pace. Two blue-chip fintech companies that have already delivered stellar returns to investors in the past decade are Visa (NYSE:V) and Mastercard (NYSE:MA).

I remain bullish on the two companies due to their wide economic moats, strong financials, robust business models, and reasonable valuations. Let’s dive deeper.

An Overview of Visa and Mastercard

Visa and Mastercard are payment processing companies. This means that they charge a fee or commission charged on every payment processed on their network. According to a report from Statista, the two companies account for roughly 63% of transactions globally.

Both companies benefited from rising credit and debit card transactions globally as individuals and businesses moved away from cash-based payments. Additional rapidly expanding markets, such as e-commerce, acted as massive tailwinds for the two fintech giants in the last two decades.

Moreover, unlike banks, Mastercard and Visa don’t lend money to borrowers, making them immune to credit risk and less cyclical than banking companies.

Valued at $447 billion, Mastercard stock went public in May 2006 and has since returned over 10,500% to shareholders. Comparatively, Visa commands a market cap of $586 billion and has surged 1,675% since its IPO in 2008.

The Bull Case for Mastercard Stock

A key reason for Mastercard’s stellar performance can be attributed to its revenue and earnings growth. In the last 10 years, the company has increased its revenue by 11.7% annually, while earnings have expanded by 16.6% each year. An asset-light model allows Mastercard to improve profit margins at a much higher pace compared to revenue.

Despite its massive size, Mastercard continues to grow at an enviable clip. In Q4 2023, it increased sales by 13% year-over-year to $6.5 billion, while adjusted net income grew by 20% to $3.1 billion, indicating a margin of over 47%.

A high profit margin allowed Mastercard to report free cash flow of $10.9 billion in 2023. It pays shareholders an annual dividend of $2.64 per share, translating to a forward yield of 0.55%. The company distributed $2.44 billion to shareholders via dividends, indicating a payout ratio of less than 25%.

So, Mastercard has enough flexibility to reinvest in organic growth, strengthen its balance sheet, target accretive acquisitions, and enhance shareholder wealth via dividends and buybacks. Mastercard first paid shareholders a quarterly dividend in late 2006. In the last 17 and a half years, these payouts have risen by 27% annually, which is exceptional.

The Bull Case for Visa Stock

In the last 10 years, Visa increased its sales by 10.7% annually. It only reported a top-line decline in 2020 when the global economy was wrestling with the dreaded COVID-19 pandemic, resulting in lockdowns.

Visa is a fintech giant, as it has partnered with 14,500 institutions, processing $15 trillion in total transactions in the last four quarters. It currently powers 4.3 billion cards, allowing it to increase sales by 9% year-over-year in Fiscal Q1 2024 (ended in December). Similar to Mastercard, Visa enjoys high profit margins. It ended Fiscal Q1 with an operating margin of over 64%.

Visa pays shareholders an annualized dividend of $2.08 per share. In Fiscal 2023, it reported free cash flow of $19.7 billion, an increase of 10% year-over-year. A widening base of earnings has meant that Visa’s quarterly dividends have risen by 24% annually in the last 15 years.

Are Mastercard and Visa Undervalued?

Mastercard is forecast to increase its earnings per share to $14.39 in 2024 and $16.78 in 2025. So, it currently trades at 33x forward earnings, which might seem steep since the median earnings multiple is much lower at 10.3x. However, the company is forecast to grow earnings by 17.4% in 2024 and by 16.6% in 2025 and commands a premium valuation.

Visa, on the other hand, is forecast to increase adjusted earnings by 13% to $9.92 per share in Fiscal 2024 and by 12.5% to $11.16 per share in Fiscal 2025. Visa stock is priced at 28.6x forward earnings, which is reasonable.

What Is the Target Price for Mastercard Stock?

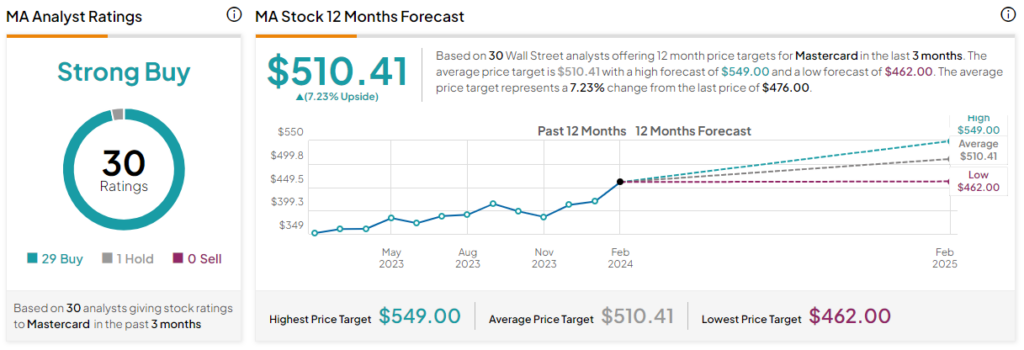

Out of the 30 analysts tracking Mastercard, there are 29 Buys and one Hold, indicating a Strong Buy consensus rating. The average Mastercard stock price target is $510.41, indicating upside potential of 6.6% from current levels.

What Is the Target Price for Visa Stock?

Out of the 24 analysts tracking Visa, 23 recommend Buying, one recommends Holding, and none recommend Selling, indicating a Strong Buy consensus rating. The average Visa stock price target is $303.74, indicating upside potential of 7.4% from current levels.

The Takeaway

The growth story for Visa and Mastercard is far from over, given that a significant portion of transactions still require cash payments in emerging economies. Both companies are positioned to grow revenue and earnings higher in the next 10 years, allowing shareholders to benefit from outsized gains in this period.