Green Impact Partners and Integra Resources Corp. are the 2 Best Canadian stocks to buy in May 2024, according to analysts. We used the TipRanks Stock Screener tool to scan these two penny stocks that have won a Strong Buy consensus rating from analysts, who see massive upside potential in the next twelve months. In Canada, a penny stock is defined as a company whose shares are trading at less than C$5 per piece.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

There are both merits and demerits of investing in penny stocks. However, a risk-taking investor can consider some exposure to penny stocks as they offer a high potential to generate outsized returns. At the same time, they are hugely volatile and could lack transparency in cases where they trade over the counter (OTC).

Green Impact Partners Inc. (TSE:GIP)

Green Impact Partners acquires, develops, builds, owns, and operates renewable natural gas (RNG) projects with the aim of owning and operating a portfolio of RNG facilities. GIP is focused on developing clean energy and water and solids recycling assets throughout North America.

In Fiscal 2023, GIP’s revenues fell 24.6% year-over-year to $161.16 million owing to the impact of extreme cold weather in January 2023 and wildfires in May 2023. Also, adjusted EBITDA turned negative in FY23 to $(209) million due to higher administration expenses and unrealized gain/loss on foreign exchange. GIP continues to make meaningful progress on its projects and is well set to execute, de-risk, and recycle capital.

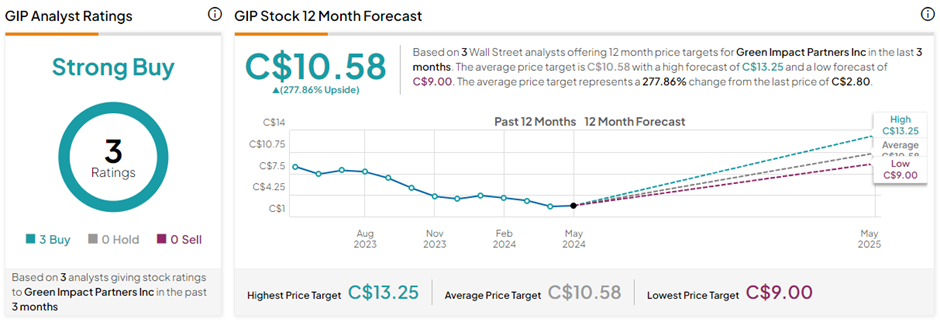

What is the Price Target for GIP Stock?

On TipRanks, the average Green Impact Partners price target of C$10.58 implies a staggering 277.9% upside potential from current levels. GIP stock has a Strong Buy consensus rating, backed by three unanimous Buy ratings. In the past year, GIP shares have lost 65.7%.

Integra Resources Corp. (TSE:ITR)

Integra Resources is considered one of the largest precious metals exploration and development companies in the Great Basin of the Western USA. The company is focused on the exploration of gold and silver at the DeLamar Project and Wildcat and Mountain View Deposits in Nevada.

Integra Resources is a pre-revenue company. In Q1 FY24, ITR reported a net loss of $0.08 per share, narrowing 57.8% compared to the net loss reported in the prior year quarter.

Is Integra Resources a Buy?

With four unanimous Buy views, ITR stock has a Strong Buy consensus rating on TipRanks. The average Integra Resources price target of C$3.28 implies an attractive 215.4% upside potential from current levels. ITR shares have lost 38.1% in the past year.

Ending Thoughts

Penny stock investments are high-risk, high-reward investments. Although these companies are small, they hold great potential for growth in the coming years based on analysts’ views. Investors seeking exposure to such lucrative penny stocks can consider investing in them after thorough research.