Ride-sharing app Uber Technologies (NYSE:UBER) generated a solid earnings performance recently. However, a small speedbump in the form of lower-than-anticipated projected gross bookings hampered the investment narrative. In turn, options activity has turned somewhat bearish on the enterprise. Nevertheless, the pessimism overlooks how Uber aligns with shifting travel sentiment. As a result, I am bullish on UBER stock.

Uber Delivers Strong Results with a Caveat

On paper, UBER stock should be flying high, as TipRanks contributor David Moadel recently argued. For the company’s first quarter of Fiscal 2024, the ride-sharing specialist posted a 21% year-over-year increase in reported trips to 2.6 billion. That comes out to approximately 28 million rides per day on average during the three months ended March 31, 2024.

Further, gross bookings came out to $37.7 billion, up 20% year-over-year. And this print contributed to revenue growing 15% against the year-ago quarter to $10.1 billion. This figure came in roughly in line with analysts’ expectations.

In addition, Moadel noted that “Uber reported quarterly income from operations of $172 million, up $434 million versus the year-earlier quarter. Thus, using that metric, it could be concluded that Uber swung from a loss to positive income. It’s not the most important metric, but it’s worth considering.”

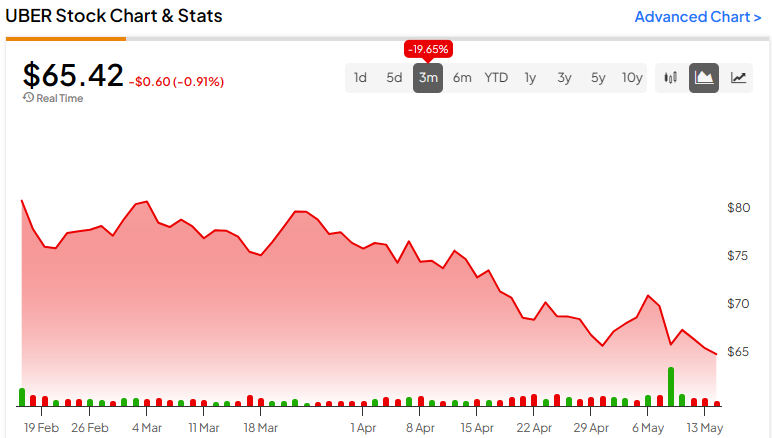

Finally, Moadel mentioned the big one: Uber’s adjusted EBITDA of $1.4 billion represented a dramatic increase of 82% over Q1-2023’s result. However, the market wasn’t impressed, which dropped UBER stock 11% in the trailing month.

A major concern was that management guided Q2 gross bookings to land between $38.75 billion and $40.25 billion. However, the consensus forecast called for this metric to hit $40.04 billion. Combined with a Q1 adjusted net loss of 32 cents compared to the expected 22-cent loss, investors quickly exited.

Subsequently, UBER stock became the subject of unusual options activity with bearish sentiment. Last Friday, a trader acquired 60 contracts of a far out-the-money (OTM) UBER Jun 14 ’24 52.00 Put. Previously, open interest of this put was zero and arguably for good reason. Assuming that shares will fall more than 22% by the June 14 expiration date is a bold move.

Based on the fundamentals, it could be an imprudent one.

Travel Prioritization Boosts the Bullish Narrative for Uber Technologies

During the COVID-19 crisis, the urge to escape mandated quarantine-like conditions was understandable. More significantly, this pent-up demand fueled a social phenomenon called revenge travel. Essentially, people were eager to escape the doom cycle of the virus and start living again.

Now, if market research from Deloitte is to be believed, the acute emotions driving revenge travel have largely faded. However, in its place is a new trend of travel prioritization. Households are socking away their funds to save for vacations and other experiences. Deloitte’s research is backed up by other studies that indicate that within household discretionary budgets, travel-related expenditures take priority.

Obviously, that’s huge for UBER stock because of its underlying ride-sharing app. However, it’s bigger than investors may realize. Yes, Uber is a much larger enterprise than Lyft (NASDAQ:LYFT), and there are risks tied to its size. In particular, the gargantuan overhead makes it more difficult to achieve consistent profitability.

That said, Uber is a godsend for those who want to travel internationally. Without naming names, taxi driver scams represent one of the common pain points for tourists. However, with the Uber app, such concerns can be significantly mitigated. With the transaction occurring inside the app, it’s difficult for scammers to pull one over their victims’ heads. Uber “sees” what its drivers are doing.

Moreover, an inherent capitalistic incentive rewards good behavior. Those with poor reviews can lose access to part of or even all of the Uber platform. And that goes for the riders or users of other Uber services. Therefore, even with a massive language barrier, the invisible hand of capitalism helps direct transactions to positive outcomes.

That’s the beauty of the business model. And it’s not something that’s reflected in the price of UBER stock, though eventually it may if travel prioritization rises.

Not Just Travel Centered

While the organic facilitation of positive experiences may be a key potential catalyst for UBER stock, it’s not the only one. Uber CEO Dara Khosrowshahi mentioned that the impact of remote work imposed a negative effect on the company’s financials.

“With the pandemic, I think a lot of people who are kind of commuting to work, etc., stopped commuting,” Khosrowshahi stated during the Q1 earnings call. “We have lost some of our most frequent customers.”

That’s not great news for UBER stock, but the story gets better. The head executive noted that the ride-sharing firm is starting to see a recovery in this metric. More people are being asked to return to the office, and that’s good for business.

Is Uber Technologies Stock a Buy, According to Analysts?

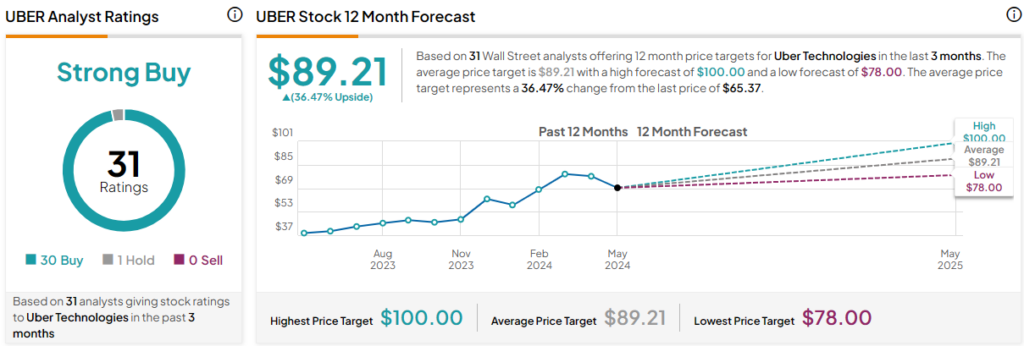

Turning to Wall Street, UBER stock has a Strong Buy consensus rating based on 30 Buys, one Hold, and zero Sell ratings. The average UBER stock price target is $89.21, implying 36.5% upside potential.

The Takeaway: Facilitating Worry-Free Mobility Should Boost UBER Stock

While Uber Technologies posted strong numbers overall in its Q1 earnings report, certain metrics failed to impress the Street. That led to some traders placing bearish bets against UBER stock. Still, this reaction misses the forest for the trees. With the underlying company facilitating worry-free mobility at home and abroad, it’s a powerful partner for the emerging travel prioritization trend.