Banks could emerge as the optimal portfolio diversifier this year, particularly considering the stock, bond, and housing markets all took a long, deep, worrisome breath exactly one year ago. Silicon Valley Bank (SVB), once an enviable success story, had suddenly collapsed, leaving angst and worry over whether other banks would follow. Cautiously, the entire stock market pushed lower as fear spread that global financial markets could soon implode.

Now, twelve months later, the markets are breathing much more confidently. We’ve identified the poisonous ingredients baked into that super-regional bank. While only a small percentage of financial institutions faced serious problems, most financial stocks took a sizeable tumble. Other market sectors quickly rebounded and amassed above-average returns, yet banking stocks are still struggling.

Investing in an Undervalued Sector

Successful investing fundamentally involves aligning probabilities in your favor. When a sector falls out of favor, like banking did a year ago, seeking out undervalued opportunities while others overlook the industry enhances your return potential when the sector attracts renewed investor interest. The market conditions following the rapid Fed tightening and an inverted yield curve last year caused turmoil in bank assets. This situation is unlikely to repeat as the FOMC has signaled no intentions to raise Fed Funds rates. However, concurrently, the Federal Reserve’s quantitative tightening (QT) continues, exerting upward pressure on longer-dated maturities.

As indicated by the Invesco KBW Bank ETF (NASDAQ:KBWB) chart, bank stocks are still below their pre-collapse highs.

How Banks Make Money

The ongoing upward trend in CPI and other inflation data has gradually pushed the yields on longer-dated US Treasuries higher. Typically, banks generate revenue by borrowing short term and lending long term. With the rise in long-term interest rates, banks can demand higher interest on loans and credit products like mortgages and business loans, while their borrowing costs remain stable. This results in a wider spread between the interest rates they charge and those they pay, leading to increased profitability. Essentially, banks see improved profitability as long-term interest rates climb. The increase in long-term rates usually coincides with a rise in inflation expectations.

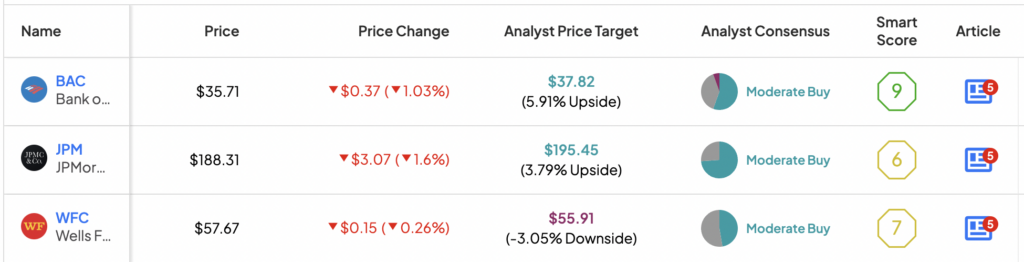

Bulge Bracket Banks

Bulge bracket banks, which are large, globally recognized investment banks that offer a wide range of financial services, including underwriting, M&A advisory, sales and trading, and market making, such as Bank of America (NYSE:BAC), JPMorgan Chase & Co. (NYSE:JPM), and Wells Fargo (NYSE:WFC), possess a diversified mix of earnings and revenue streams that could benefit from rising long-term interest rates. Out of these three major banks, each closely followed by street analysts, only one analyst has issued a Sell rating on one of the banks.

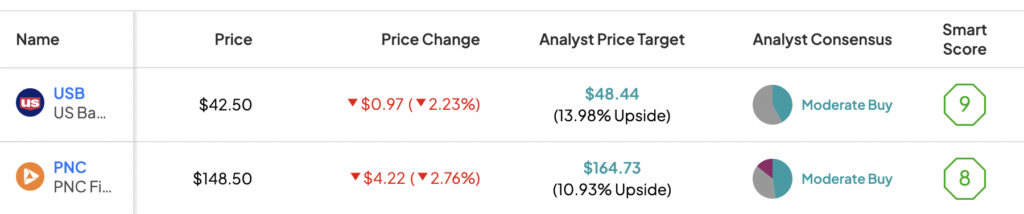

Regional Banks

Large regional banks, such as U.S. Bancorp (NYSE:USB) and PNC Financial Services (NYSE:PNC), benefit from rising long-term interest rates, as they can charge more for loans and credit products. These banks primarily focus on lending to local businesses and consumers, who can be more sensitive to interest rate changes. While, analysts are somewhat less optimistic on regional banks over the bulge brackets, they still hold a level confidence in this sub-sector.

Key Takeaway

In the year since broader markets held their breath to assess whether the financial sector would have a domino effect, much has changed. While the banking sector didn’t collapse entirely, it notably lagged behind in last year’s market surge. The combination of mounting inflation expectations, quantitative tightening (QT), and the increasing issuance of U.S. Treasuries hints at an upward trajectory for long-term rates.

As long-term interest rates climb, banks stand to see a potential surge in profits, enabling them to raise rates on loans and credit products while maintaining stable funding costs.