Ulta Beauty stock (NASDAQ:ULTA) dipped more than 5% post-earnings last Friday. As a long-term shareholder in the largest specialty beauty retailer in the U.S., which offers over 25,000 products, I saw the dip as an opportunity to add to my position. While the market’s reaction may suggest that Ulta’s results were underwhelming, I found its Q4 report to be strong. I believe the sell-off was likely driven by profit-taking, especially after the stock’s ~30% rally in the last six months. Thus, I remain bullish on ULTA stock.

Following a Proven Strategy Yields Strong Results

Ulta’s Q4 results were rather strong, with the company following its proven and simple yet highly-effective strategy. Specifically, by gradually expanding its footprint through new store openings, increasing sales in existing locations, and strengthening its loyalty program, Ulta continued to drive profitable growth in a sustainable manner.

As an investor, I really like this business model and overall strategy. It is easy to understand and able to create tremendous shareholder value at scale. Let’s take a deeper look at each of Ulta’s growth channels.

Store Openings and Same-Store Sales Growth

Expanding its market footprint by opening additional stores has been the easiest way for Ulta to increase sales. By handpicking prime locations that are certain to attract significant foot traffic, along with the consumer-staple nature of beauty products, new store openings have historically translated to profitable growth for the company.

The trajectory of Ulta’s store expansion is truly impressive. To put it into perspective, Ulta had 449 stores in 2011. This number surged to 1,074 by the end of 2017 and continued to grow to 1,385 by the end of 2023. In particular, Ulta opened 33 new stores, relocated seven, remodeled 18, and closed three last year. This location optimization strategy ensures that underperforming locations are phased out, enabling a heightened focus on lucrative regions, which in turn leads to consistent same-store sales.

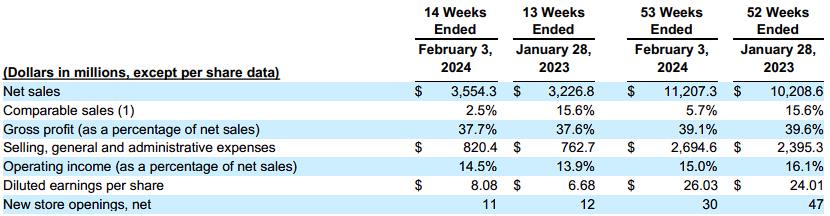

Indeed, same-store sales grew by 2.5% in Q4. This doesn’t really sound like an impressive number, but in context, it suggests continued strength against tough comps. Specifically, this 2.5% growth comes on top of Q4-2022’s same-store sales growth of 15.6%, which, in turn, came on top of Q2-2021’s same-store sales growth of 21.4%. Seeing continued same-store sales growth following two years of large expansion shows both consumer strength and the overall enduring demand for beauty product sales.

Loyalty Program Strengthens Sales

Besides organic growth driving Ulta’s revenues, the brand’s loyalty program – called Ulta Beauty Rewards – has proven to be a powerful driver of sales. By the end of 2023, the program boasted an impressive 43.3 million members, marking an 8% increase from the previous year.

What’s important to note here is the significance of Ultamate Rewards. This is because it lies not only in its ability to attract and retain customers but also in the wealth of data and consumer insights it provides to Ulta. This valuable information gives the company a competitive edge since it can tailor product offerings to each customer’s unique preferences.

The program has shown remarkable success. Back last September, management revealed that about 95% of Ulta’s total sales can be attributed to Ultamate Rewards members. This translates to a great moat for the company in a highly competitive industry, too, as Ultamate Rewards directly encourage members to keep spending at Ulta, reducing the likelihood of them exploring alternatives among competitors.

Overall, the combination of additional store openings, higher same-store sales, and Ultamate Rewards, which drove awareness across online sales channels, led to another quarter of double-digit growth, with fourth-quarter net sales up 10.2% year-over-year to $3.6 billion.

Revenue Growth, Pristine Balance Sheet, Buybacks Drove Records Earnings

As I mentioned earlier, Ulta’s business model can create significant shareholder value at scale. Evidently, the double-digit growth in Q4 revenues, Ulta’s pristine balance sheet, and aggressive buybacks drove record quarter and annual earnings. Specifically, for the quarter, EPS grew by 20.8% to a record of $8.13, while for the full year, EPS grew by 8.4% to $26.03, also a record.

I mentioned that Ulta’s balance sheet also contributed to a strong bottom line result because, unlike many companies out there, whose earnings were negatively affected by higher interest expenses last year as a result of rising rates, Ulta’s debt-free balance sheet came in handy.

Excluding some lease liabilities in the balance, which some financial information may categorize as debt, Ulta’s balance is debt-free. Thus, not only was Ulta not hit with higher interest expenses, but higher rates even benefited its cash position, which produced a net interest income of $17.6 million, up from $4.9 million last year.

Regarding buybacks, Ulta allocated $1.0 billion during the year on that front, reducing its share count by 4.2%. Buybacks have been the sole way management has been returning cash to shareholders, with the company’s share count having declined by nearly 25% since 2015.

Valuation Remains Reasonable, Signals Opportunity

Ulta’s post-earnings stock price decline, combined with growing earnings and management’s optimistic outlook, pushed its valuation to rather attractive levels. I saw this as an opportunity, so I acted quickly and boosted my position in the stock.

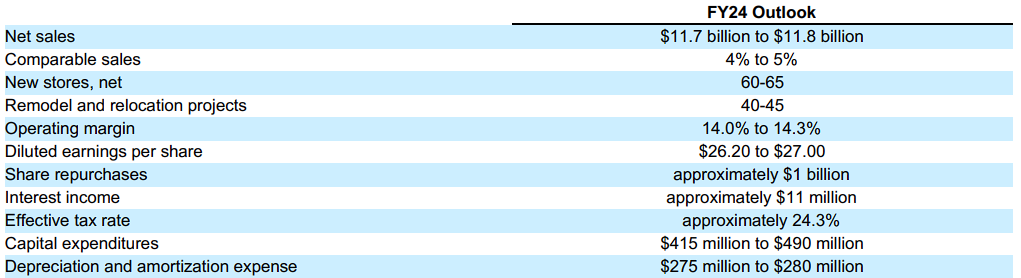

In particular, after a strong FY2023, management expects that comparable sales growth will accelerate in FY2024 and come in between 4% and 5%. Along with further store openings, revenues are expected to rise by about 5% and reach new records.

Accordingly, management expects another year of record EPS, which is expected to land between $26.20 and $27.00. The midpoint of this range implies a forward P/E of about 20. I find this valuation multiple to discount the stock, given its continuous growth potential, resilient business model, and aggressive capital returns.

Is ULTA Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Ulta Beauty features a Moderate Buy consensus rating based on 13 Buys, six Holds, and one Sell assigned in the past three months. At $588.16, the average ULTA stock price target suggests 12.25% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell ULTA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Christopher Horvers from JPMorgan, with an average return of 22.41% per rating and a 79% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I believe that Ulta Beauty’s post-earnings dip presents an opportunity for investors. Contrary to the market’s reaction, the company’s Q4 performance showed relative resilience and a robust growth trajectory.

Further, management’s guidance suggests that growth will persist this year, with same-store sales growth even likely to accelerate relative to Q4’s figure and push earnings to new records. This, coupled with a strong balance sheet and the stock trading at a reasonable valuation, has strengthened my bullish view of Ulta’s stock.