The ridesharing industry has taken its share of lumps over the years, first from COVID-19, then from internal labor troubles from drivers. But Uber (NASDAQ:UBER), pretty much the leader in the ridesharing sector, gained modestly in Wednesday afternoon’s trading thanks to a new set of features designed to pull in more interested travelers.

None of these improvements are, by themselves, particularly innovative. Or even particularly big. But combined together, they might be enough to move some needles, and that’s worth considering. One of the developments is Uber Shuttle, a service that basically creates tiny bus lines to specific destinations that users can reserve seats on. Events like sports matches, concerts, and others can all be used in conjunction with Uber Shuttle.

Further, Uber Caregiver allows caregivers to install those they care for into their profiles, letting them call rides for their elderly or similar people in their lives. Finally, a new connection with Costco (NASDAQ:COST) will let Uber Eats users not only order products from Costco for delivery but also do so at a 15% to 20% discount.

International Expansion

This news comes shortly after an earlier move in which Uber picked up foodpanda in Taiwan, dropping $950 million on the acquisition. foodpanda was getting out of the Taiwanese market to begin with, which opened up an opportunity for Uber to step in. Since foodpanda held a 52% market share in Taiwan, and Uber Eats held 48%, this effectively makes Uber the only game in town for Taiwanese food delivery. Whether or not that will stand, and for how long, remains to be seen.

Is Uber a Buy or Sell Right Now?

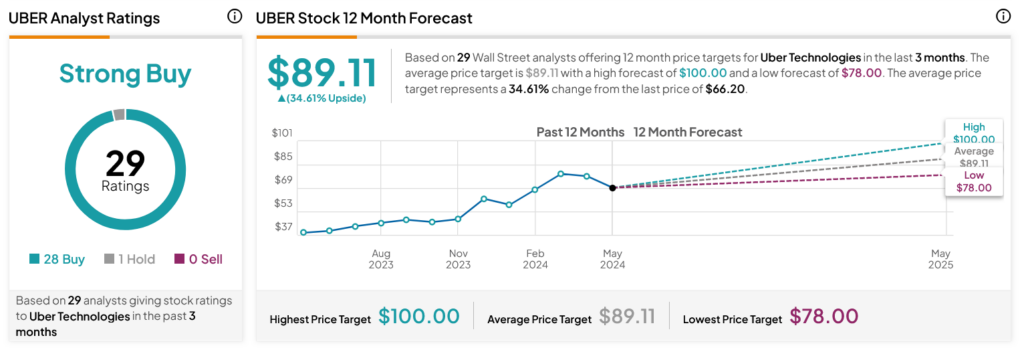

Turning to Wall Street, analysts have a Strong Buy consensus rating on UBER stock based on 28 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 76.82% rally in its share price over the past year, the average UBER price target of $89.11 per share implies 34.61% upside potential.