The investor group comprising Arkhouse Management and Brigade Capital Management raised their bid to acquire the department store operator Macy’s (NYSE:M). This follows Macy’s rejection of their initial $5.8 billion offer, citing a “lack of compelling value” and raising doubts about Arkhouse and Brigade’s ability to finance the proposed deal.

Furthermore, the investor consortium has indicated its willingness to raise the bid even more, subject to the customary due diligence.

The Revised Offer

Arkhouse and Brigade Capital announced they have put forward an increased all-cash offer to acquire Macy’s at $24 per share. This revised bid represents a 33.3% premium over the closing price on March 1, 2024. Furthermore, this offer is 14.3% higher than its previous offer of $21 per share.

Additionally, in response to financing apprehensions raised by Macy’s, Arkhouse and Brigade have elaborated on their financing arrangements. The group disclosed Fortress Investment Group and One Investment Management US as its equity capital partners for the proposed transaction.

While the retailer’s stance on the proposal is awaited, let’s look at the Street’s forecast for Macy’s stock.

What is the Forecast for Macy’s Stock?

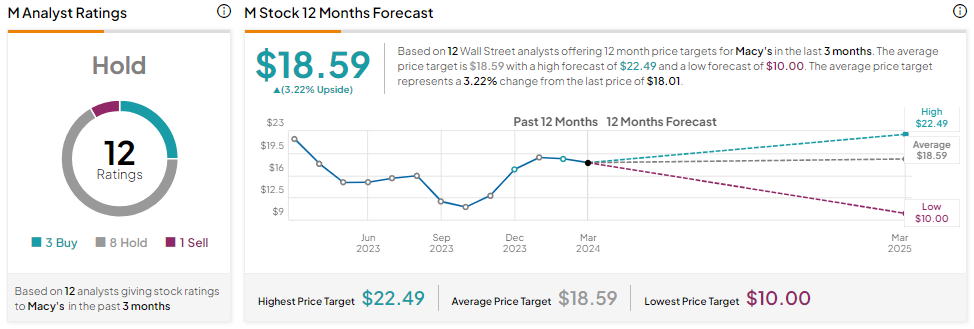

Macy’s stock fell over 10% year-to-date. Further, it has declined by more than 13% in one year. The underperformance reflects continued pressure on its top line due to macro headwinds. Nonetheless, the company is taking steps to accelerate sales growth and drive productivity. However, analysts remain sidelined.

With three Buy, eight Hold, and one Sell recommendations, Macy’s stock has a Hold consensus rating. Analysts’ average price target of $18.59 implies 3.22% upside potential from current levels.