It doesn’t always get as much attention as its Asian peers like China and Japan, but the South Korean market looks like a promising investment opportunity, and the inexpensive Franklin FTSE South Korea ETF (NYSEARCA:FLKR) is an attractive way to play it. I’m bullish on FLKR based on the modest valuations of South Korean stocks, ongoing corporate governance reform efforts aimed at boosting valuations, and the fund’s ultra-low expense ratio, diversified portfolio, and decent dividend yield.

What Is the FLKR ETF’s Strategy?

According to fund sponsor Franklin Templeton, FLKR “provides access to the South Korean stock market, allowing investors to precisely gain exposure to South Korea at a low cost.” The fund invests in an index of large-cap and mid-cap South Korean equities.

South Korea doesn’t always get as much attention as its larger neighbors like China and Japan, but it is an economic powerhouse in its own right. It is the fourth-largest developed economy in Asia and the world’s 13th-largest economy. The country is a force to be reckoned with when it comes to semiconductors and electronics, with prominent companies in these fields, like Samsung Electronics (OTC:SSNLF) and SK Hynix, calling South Korea home. Meanwhile, it is also an industrial powerhouse that is home to global automotive giants Kia (OTC:KIMTF) and Hyundai (OTC:HYMLF).

FLKR’s Holdings

FLKR owns 161 stocks, and its top 10 holdings account for just under half of the fund’s assets. You can check out an overview of FLKR’s top 10 holdings from TipRanks’ holdings tool below.

One thing investors should be aware of is that because Samsung is South Korea’s largest company by market cap (not to mention one of the largest companies in the world by this measure), it has a massive weighting of over 20% within the fund (when you add in the preferred shares, which are also included within the top 10 holdings). This gives investors a lot of exposure to this one company.

Beyond Samsung, U.S. investors will likely be familiar with some of the fund’s other prominent holdings like aforementioned automakers Hyundai and Kia, as well as electronics mainstay LG Electronics.

These holdings are collectively attractive based on their cheap valuations, especially when compared to U.S. stocks. FLKR’s holdings trade for an average price-to-earnings multiple of just 12.9. For reference, the S&P 500 trades for a considerably higher 22.6 times earnings.

Additionally, these holdings also trade at a very slight discount to book value, adding to the case that they are cheaply valued.

South Korea: “Value Up”?

Stocks that trade at low price-to-earnings multiples or below book value are attractive to value investors. That’s because they offer inherent downside protection and room for upside from valuation multiple expansion. However, they also typically need a catalyst to realize this potential upside.

For these inexpensively valued South Korean stocks, the catalyst could come in the form of the South Korean government’s “value up” initiative.

Reminiscent of the Japanese government’s reforms to its stock market in order to unlock value after a long period of stagnation, South Korea’s government is aiming to make similar changes.

As was the case in Japan, corporate governance issues that are perceived by international investors as being unfavorable are part of the reason for this undervaluation. For example, in a February 2024 whitepaper, Morgan Stanley (NYSE:MS) went over the reforms. The investment bank wrote, “Korean equities are hurt by perceptions of misallocation of capital, convoluted cross-holding structures, and misaligned actions against minority shareholders.”

In response to this, South Korea’s government unveiled the “value up” program in February 2024. A new “Value Up” index will be established during the third quarter, complete with ETFs from leading South Korean asset managers.

Companies trading at below book value will be encouraged to take measures to increase shareholder value, which could theoretically include returning capital to shareholders via dividends and share buybacks. Further, metrics like price-to-book, price-to-earnings ratio, and return on equity will be published as part of the program.

While it’s unclear if these reforms will come to fruition and how effective they will be, it’s worth noting that Japan’s reforms have given a meaningful jolt to its own stock market. For example, following the implementation of reforms in Japan, the Nikkei broke through its previous high for the first time in more than three decades, and the iShares MSCI Japan ETF (NYSEARCA:EWJ) is up 12.7% over the past six months. If nothing else, it’s a nice potential catalyst for a cheap market.

Rock-Bottom Expense Ratio

FLKR’s rock-bottom expense ratio of just 0.09% is extremely compelling. International ETFs typically charge considerably more than their U.S. counterparts, so to be able to invest in a broad South Korea ETF for the same price it costs to invest in the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) is a big deal.

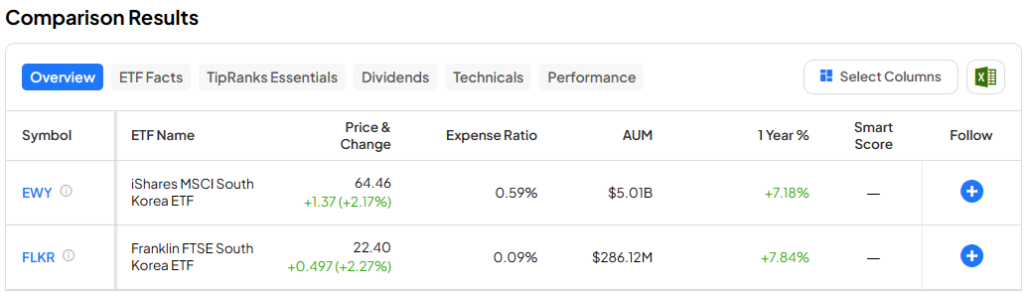

FLKR’s expense ratio is considerably cheaper than those of South Korea-focused competitors like the passively-managed iShares MSCI South Korea ETF (NYSEARCA:EWY). EWY is much larger than FLKR (which has just $280.7 million in assets under management), with $5 billion in assets under management, and features a much higher expense ratio of 0.59%.

This 0.09% expense ratio means that an investor putting $10,000 into FLKR will pay just $9 in fees annually. Assuming that FLKR maintains this expense ratio and returns 5% per annum going forward, the investor allocating $10,000 into it will pay just a meager $116 in fees over the course of a decade. Assuming the same parameters, an investor putting $10,000 into the larger EWY would pay a significantly higher $738 in fees over the same 10-year time frame.

Below, you’ll find a comparison of FLKR and EWY using TipRanks’ ETF Comparison Tool, which allows investors to compare ETFs based on a variety of customizable factors.

Does FLKR Pay a Dividend?

In addition to this favorable expense ratio, FLKR also enhances its appeal with a decent dividend payout. The fund currently yields 2.4%, and while this isn’t necessarily an eye-popping yield, it is considerably more than that of the S&P 500 (SPX), which currently yields just a paltry 1.4%.

Many of Franklin Templeton’s international ETFs are underrated, judging by their lower levels of assets under management (AUM), but by overlooking them, investors are missing out on some super cost-effective ways to invest in international markets.

The Takeaway

South Korean stocks are cheap based on both price-to-earnings and price-to-book ratios, and they could benefit from governmental reforms aimed at unlocking shareholder value and reducing these discounts. I’m bullish on South Korean stocks based on their attractive valuations and this potential catalyst, and I’m bullish on FLKR as an effective way to invest in them based on its ultra-low expense ratio, diversified portfolio, and solid dividend yield.