Among the famous UK stocks, Lloyds Banking Group PLC (GB:LLOY) offers a generous dividend yield of close to 5%, making it an appealing option for investors seeking passive income. LLOY stock carries a dividend yield of 4.92%, surpassing the industry average of 2.11%.

Given that Lloyds is one of the oldest banks in the UK market, its stock enjoys solid popularity on the FTSE 100 index. In terms of its share price growth, LLOY stock has been performing well lately. After its 2023 results in February, the shares have surged more than 25%. Further, analysts are moderately bullish on the stock.

TipRanks offers a variety of tools to aid users in identifying dividend stocks that match their criteria. For instance, the TipRanks Top Dividend Shares tool for the UK market presents a list of the top dividend-paying companies along with other parameters, simplifying the stock selection process for users.

Let’s take a look at more details.

Lloyds’ Dividends 2023

In its annual results for 2023, Lloyds announced a final dividend of 1.84p per share, taking the total dividend for the year to 2.76p per share. This marked an increase of 15% over the previous year’s payment of 2.4p per share. The final dividend will be paid on May 21 to the shareholders who were registered on or before April 11. The dividend was in line with the bank’s progressive dividend policy.

Additionally, Lloyds announced its plan to buy back shares worth £2 billion in 2024.

Highlights from Lloyds Q1 2024 Update

Last week, Lloyds reported a pre-tax profit of £1.6 billion in Q1 2024, down 23% from the same period a year ago. The bottom line was mainly impacted by reduced net interest income due to lower margins in its mortgage unit and higher operating expenses. Net interest income fell by 12% to £3.13 billion, while operating expenses surged 18% year-over-year. Nonetheless, the bank confirmed its annual guidance for 2024 and also stated the possibility of upward revisions during the year if conditions improve.

RBC Capital analyst Benjamin Toms remains bullish on the bank’s prospects and believes the market will favour Lloyds for its efficient cost management and asset quality compared to its peers. Toms has a Buy rating on the stock and projects an upside of 15% growth rate.

Are Lloyds Shares a Good Buy?

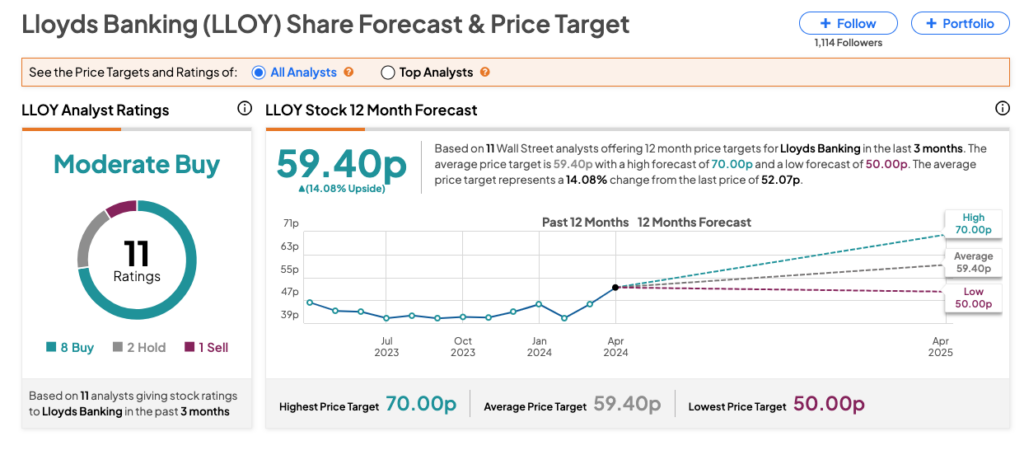

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on 11 recommendations, of which eight are Buy. The Lloyds share price prediction is 59.40p, which shows a positive change of 14% in the share price.