Security might not be the first thing you talk about when the conversation turns to Microsoft (NASDAQ:MSFT), but it remains an essential part of the business.

In fact, at ~10% of sales, security continues to be a significant growth driver, according to Piper Sandler analyst Brent Bracelin.

“With the breadth of security portfolio across six unified families and vendor consolidation adoption drivers with up to 60% cost-savings vs. point solutions, MSFT appears well positioned to sustain growth in security,” the analyst explained. “Microsoft Sentinel alone has quickly scaled revenue to $1B+ since launching in 2019. The expanding scale of Azure, new Copilot offerings, and the 78 trillion security signals that it collects daily (vs. 8 trillion in 2021) could help further broaden security monetization longer-term.”

The “six unified product families” Bracelin mentions cover more than 50 categories and, by 2022, had exceeded $20 billion in revenue. Based on the growth in customers and daily signals, the analyst reckons Microsoft Security has now grown to ~$25 billion.

Bracelin sees Copilot as having the potential to further boost the value of the security suite. Microsoft Copilot for Security was officially released on April 1, with its main applications being incident summarization and impact analysis. With the potential to boost efficiency by 22%, according to a Microsoft study, and a seamless consumption pricing model starting at just $4 per hour, Copilot for Security could become an “important incremental lever to drive broader overall security adoption.”

Security has also become a “top priority” following recent cyberattacks on Microsoft. In response to two recent incidents, the company launched the Secure Future Initiative (SFI). In an internal memo to employees sent earlier this month, CEO Satya Nadella emphasized the importance of “prioritizing security above all else.”

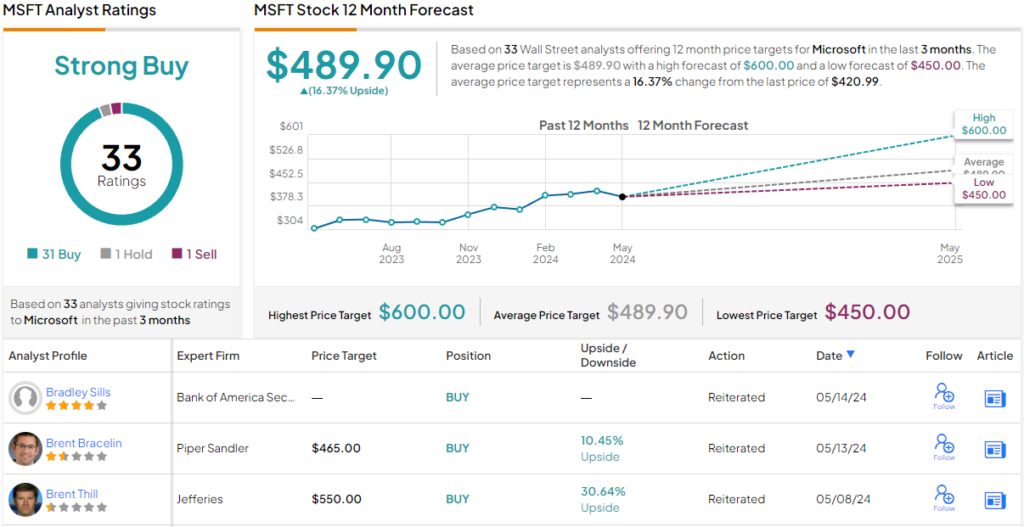

So, what does this all mean for investors? Bracelin rates MSFT shares an Overweight (i.e., Buy), along with a $465 price target. This implies a potential upside of 10% from current levels. (To watch Bracelin’s track record, click here)

Bracelin is just one of many Street analysts taking a positive stance on MSFT. The consensus view, based on a mix of 31 Buys, 1 Hold, and 1 Sell, is that the most valuable company by market cap is still a Strong Buy. The average price target is slightly higher than Bracelin’s; at $489.90, it implies a one-year return of 16%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.