Symbotic, Intuitive Surgical, and Thermo Fisher Scientific are the 3 Best non-Nvidia (NASDAQ:NVDA) artificial intelligence (AI) stocks to buy in May 2024, according to analysts. The AI realm encompasses a wide variety of industries, including the robotics industry, which is garnering a lot of traction these days and presents lucrative investment opportunities.

The advent of generative AI has led to greater inclusion of robotics automation, mainly in the science, defense, automotive, and technological domains. As per Benchmark International, the global robotics market is expected to reach $169.8 billion between 2024 and 2032, growing at a CAGR (compound annual growth rate) of 15.1%.

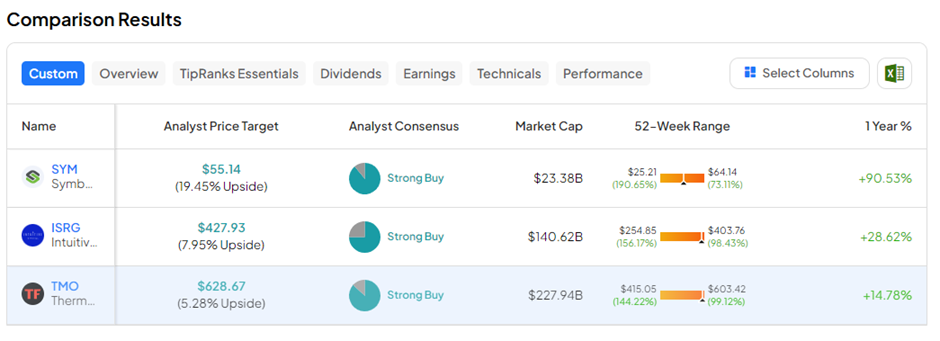

We used the TipRanks Stock Screener tool to discover these three AI stocks with a Strong Buy consensus rating and reasonable upside potential in the next twelve months. Let’s learn more about these robotics AI stocks.

#1 Symbotic Inc. (NASDAQ:SYM)

Symbotic claims to be the backbone of commerce with its AI-powered robotic technology platform. Its fleet of fully autonomous robots and AI-powered software enables companies to run their warehouses with increased efficiency, speed, and flexibility. Symbotic’s robots facilitate automated storage and sorting systems, right from organizing pallets from suppliers to reassembling them for shipping to retail stores.

In Q2 FY24, Symbotic posted a loss of $0.07 per share compared to the loss of $0.10 per share in the prior-year quarter. Revenue surged 59% year-over-year to $424.30 million, backed by significant advances in both software and hardware that benefited customers.

For Q3 FY24, Symbotic forecasts revenue in the range of $450 million to $470 million, representing a year-over-year jump of 47.5% at the midpoint of the guidance range. The company is consistently growing its revenue by attracting greater number of customers.

Is Symbotic a Good Stock?

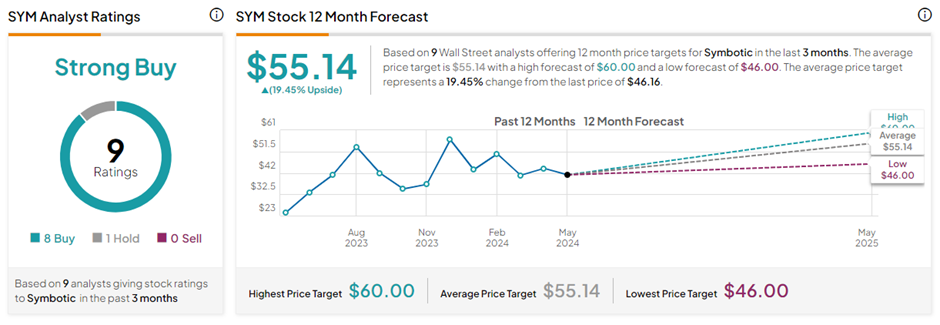

With eight Buys and one Hold rating, SYM stock commands a Strong Buy consensus rating on TipRanks. The average Symbotic price target of $55.14 implies 19.5% upside potential from current levels. in the past year, SYM shares have gained 64%.

#2 Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is one of the forerunners in robotic-assisted surgery with its da Vinci surgical system, known for its minimally invasive care technologies. In Q1 FY24, Intuitive Surgical beat consensus estimates on both the top and bottom lines, driven by accelerated adoption and deployment of its da Vinci surgical systems in healthcare set ups. The company installed 313 da Vinci surgical systems in Q1, leading to an installed base of 8,887 systems globally, up 14% year-over-year.

Importantly, ISRG’s instruments and accessories sales jumped 18% year-over-year to $1.16 billion in Q1, mainly due to a 16% increase in da Vinci procedure volume and a 90% increase in Ion procedure (Intuitive’s brand new lung biopsy platform) volumes, as well as improved pricing. The company even launched its latest version, the da Vinci 5 system, which is expected to ramp up sales. In Q1, ISRG installed eight of these latest machines.

What is the Future of ISRG Stock?

On TipRanks, the average Intuitive Surgical price target of $427.93 implies 7.9% upside potential from current levels. This is above the 19.8% share price gain already witnessed so far in 2024. Also, ISRG stock has a Strong Buy consensus rating based on 12 Buys and four Hold ratings.

#3 Thermo Fisher Scientific, Inc. (NYSE:TMO)

Thermo Fisher Scientific operates in the field of life sciences research, solving complex analytical challenges, increasing productivity in laboratories, improving patient health through diagnostics, and manufacturing life-changing therapies, all through the support of its AI-based robotic technology. Interestingly, TMO hiked its quarterly dividend by 11% to $0.39 per share, reflecting a yield of 0.24%. The company repurchased $3 billion worth of stock during the first quarter.

In Q1 FY24, TMO posted better-than-expected adjusted earnings of $5.11 per share, up 2% year-over-year. Revenue fell 3% to $10.35 billion but beat the consensus. Furthermore, TMO raised its full-year Fiscal 2024 guidance and now expects revenue in the range of $42.3 to $43.3 billion and adjusted EPS to be between $21.14 and $22.02 per share.

Is TMO Stock a Good Buy?

With 13 Buys versus two Hold ratings, TMO stock has a Strong Buy consensus rating on TipRanks. The average Thermo Fisher Scientific price target of $628.67 implies 5.3% upside potential from current levels. TMO shares have gained 14.5% in the past year.

Ending Thoughts

The aforementioned three AI stocks have solid potential to grow revenues from the advancement of AI in their robotics technologies. Wall Street analysts are highly optimistic about these stocks. Investors can consider these AI stocks to boost their portfolio returns after thorough research.