Shares of Zynga is advancing 3.4% in the pre-market session on Thursday after the mobile gaming company reported record second-quarter revenues. Its top-line results benefited from shelter-in-place directives amid COVID-19 pandemic which drove demand for digital games.

Zynga’s (ZNGA) revenue jumped 47% to $452 million year-over-year mainly due to a 61% increase in online game user-pay revenues. Furthermore, the company expects 3Q sales to grow 29% to $445 million year-over-year.

Zynga’s CEO Frank Gibeau said, “We delivered tremendous results in Q2, achieving our highest quarterly revenue and bookings and generating Zynga’s best quarterly operating cash flow in more than eight years.”

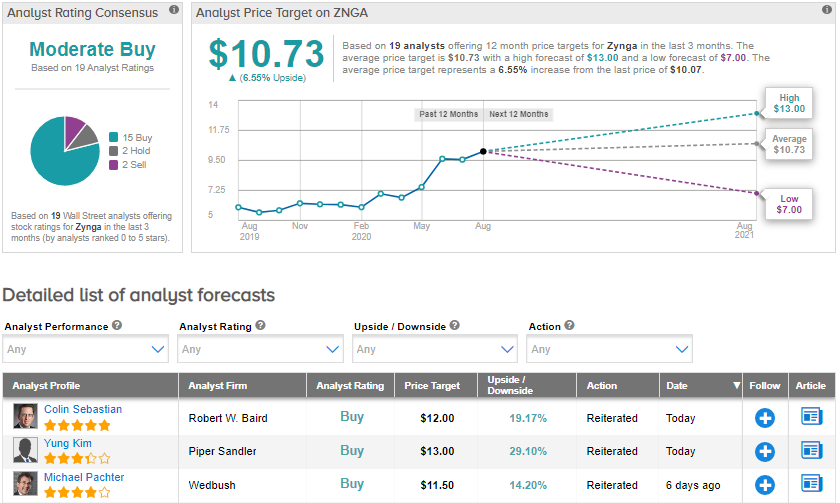

Following the strong results, Robert W. Baird analyst Colin Sebastian raised his price target to $12 (19.2% upside potential) from $10, and maintained a Buy rating on the stock, saying that “Zynga continues to benefit from elevated levels of user engagement, with strong growth evident across the company’s portfolio.”

Like Baird, Piper Sandler analyst Yung Kim raised the price target to $13 (29.1% upside potential) from $11, and reiterated a Buy rating. Kim believes that the momentum is building for Zynga “as it continues to benefit from its strong live services engine in the interim.”

Currently, ZNGA has a Moderate Buy analyst consensus. The average price target of $10.73 implies an upside potential of about 6.6%. (See ZNGA stock analysis on TipRanks).

Related News:

Zimmer Biomet Slips 3.7% On 2Q Profit Decline

Fiverr Pops 18% In Pre-Market On Upbeat 2Q Earnings And Raised Outlook

3D Systems Drops 7% In After-Hours On Wider-Than-Expected 2Q Loss