After market close today, cloud-based security solutions provider Zscaler (NASDAQ: ZS) released its Fiscal Q4-2022 and full-year earnings results. Both earnings per share (EPS) and revenue beat expectations. The company also gave solid guidance for the next quarter and the remainder of its Fiscal 2023. As a result, ZS stock is rallying in the after-hours trading session.

Zscaler’s Q4 revenue of $318.1 million grew 61% on a year-over-year basis, beating the consensus estimate of $305.42 million. The company’s earnings per share came in at $0.25, beating the $0.20 estimate, and its Q2 non-GAAP net income was $36.4 million, better than the $20.3 million loss in the same quarter last year. However, on a GAAP basis, the company lost $97.7 million, more than the $81 million it lost in the same quarter last year.

Next, Zscaler’s Q4 cash flow from operations came in at $103.1 million, representing a 32% margin, and its free cash flow was $74.8 million. In the same quarter last year, its operating cash flow margin was only 23%, and cash flow was $44.7 million, while free cash flow was $27.7 million.

Regarding its full-year results, revenue reached $1.09 billion, growing 62% year-over-year, while non-GAAP net income grew $25.6 million year-over-year, reaching $101.3 million.

The company ended the quarter with $1.73 billion in cash, cash equivalents, and short-term investments.

Zscaler Provides Fiscal Q1-2023 and Full-Year Guidance

Investors may have also been pleased with Zscaler’s guidance, which signals solid growth ahead. For Fiscal Q1 2023, ZS is projecting revenue of $339 million to $341 million, implying 47.5% year-over-year growth at the midpoint. Non-GAAP EPS is forecast to be $0.26.

Meanwhile, for Fiscal 2023, revenue is expected to be between $1.49 billion and $1.5 billion, representing a 37% growth rate, and non-GAAP EPS is forecast to range from $1.16 and $1.18.

Is ZS Stock a Good Buy?

Turning to Wall Street, Zscaler stock earns a Strong Buy consensus rating based on 13 Buys and one Hold assigned in the past three months. The average ZS stock price prediction of $212.15 implies 37.5% upside potential from the last closing price.

Top TipRanks Investors are Positive on ZS Stock

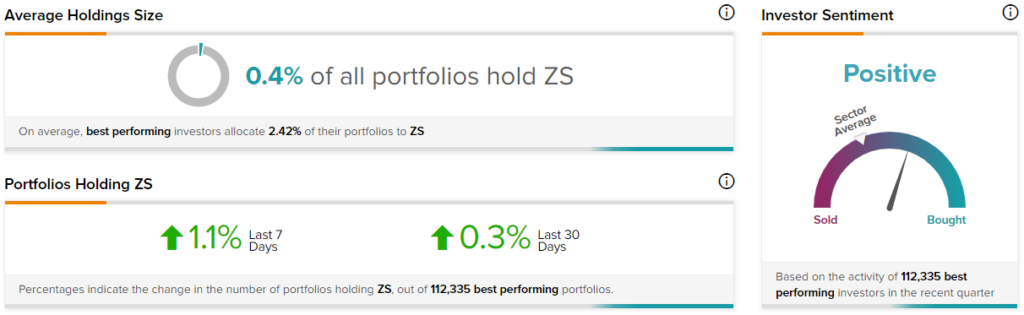

TipRanks currently tracks 561,678 investor portfolios that use the Smart Portfolio tool. The top investors, which amount to 112,335 portfolios, appear positive on Zscaler.

In the past 30 days, the number of top-performing TipRanks portfolios holding ZS stock increased by just 0.3%, leading to 0.4% of portfolios holding the stock. Similarly, in the past seven days, this number increased by 1.1%. Zscaler’s slightly positive investor sentiment is above the sector average, as shown in the image below:

Conclusion: Zscaler’s Solid Results Impressed Investors

Zscaler’s results beat both revenue and earnings estimates, and the company’s guidance was solid as well. This caused the stock to rally in the after-hours trading session. Besides this, analysts have a Strong Buy consensus rating on Zscaler, making it worth considering.