Despite reporting better-than-expected fourth-quarter results and giving upbeat guidance, shares of ZoomInfo Technologies Inc. (ZI) plunged 12.6% during the extended trading session on February 15.

ZoomInfo is a cloud-based technology platform, providing data on organizations and professionals to sales and marketing teams.

ZI stock gained 6.2% to close at $58.78 on February 15, as the market anticipated robust results from the tech company, and rightly so. Driven by strong customer acquisition and retention, the company’s Q4 results beat both earnings and revenue estimates.

ZI’s annual net revenue retention rate advanced to 116% compared to FY20, and the company ended the quarter with 1,452 customers generating more than $100,000 in annual contract revenue.

Better-Than-Expected Results

ZoomInfo’s Q4 revenue rose 59% year-over-year to $222.3 million and surpassed Street estimates of $207.69 million.

ZI reported quarterly adjusted earnings of $0.18 per share, outpacing analyst estimates of $0.13 per share and 50% higher than the prior-year quarter figure.

Similarly, full-year fiscal 2021 revenue leaped 57% to $747.2 million and adjusted earnings stood at $0.57 per share, growing 67.6% compared to FY20.

CEO Comments

Happy with the company’s performance, ZoomInfo Founder and CEO, Henry Schuck, said, “In 2021 we delivered a leading combination of growth and profitability, significantly expanded our platform, added more new customers than ever before, and drove record customer retention… 2021 was a transformative year for ZoomInfo, and we continue to execute our vision to deliver a comprehensive revenue operating system that reimagines how businesses go-to-market.”

Upbeat Outlook

Based on the current business momentum and client retention, ZoomInfo guided Q1FY22 revenue to fall between $226 million and $228 million, higher than the consensus estimate of $215.6 million. Further, adjusted earnings are projected to be between $0.14 per share and $0.15 per share, in-line with the consensus estimate of $0.15 per share.

Moreover, FY22 revenue and adjusted earnings are projected to be between $1.01 billion and $1.02 billion and $0.71-$0.73 per share respectively. The consensus estimates for the same are pegged at $982.2 million and $0.68 per share, respectively.

Analysts’ Take

Responding to ZoomInfo’s quarterly results, JMP Securities analyst Patrick Walravens reiterated a Hold rating on the stock.

The Wall Street community has awarded a Strong Buy consensus rating to the ZI stock with 5 Buys and 1 Hold. The average ZoomInfo price target of $72.60 implies 23.5% upside potential to current levels.

Blogger Opinions

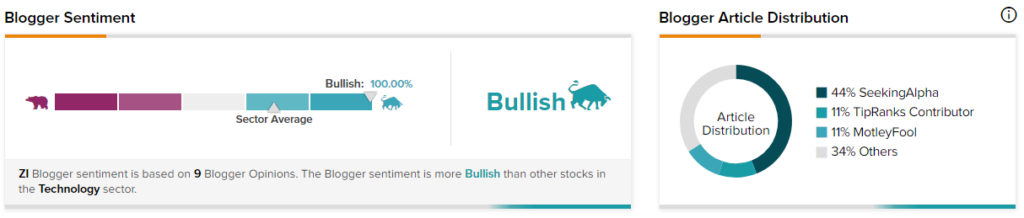

TipRanks data shows that financial blogger opinions are 100% Bullish on ZI, compared to a sector average of 69%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Intel Nearing $6B Deal to Buy Israel’s Tower Semiconductor – Report

Novavax Shares Plunge 11% Despite Positive Vaccine Update

Ford Continues to Idle Production Amid Chip Shortage – Report