ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) shares jumped 6.3% on March 9, after the shipping company delivered a blowout fourth-quarter results and also declared impressive dividends.

Notably, shares of the Israeli international cargo shipping company have gained 268% over the past year and around 525% since its listing on January 29, 2021.

Q4 Outperformance

Notably, adjusted earnings of $14.17 per share more than quadrupled year-over-,year and massively beat analysts’ expectations of $13.20 per share. The company reported earnings of $3.49 per share for the prior-year period.

Furthermore, revenues jumped a whopping 155% year-over-year to $3.47 billion and also exceeded consensus estimates of $3.34 billion. The increase in revenues reflected a surge in the average freight rate per twenty-foot equivalent unit (TEU) to $3,630, implying a year-over-year increase of 139%.

On top of this, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin almost doubled to 68.1% compared to 39% reported for the prior-year quarter.

FY2022 Outlook

Looking ahead into FY2022, the company forecast adjusted EBITDA to range between $7.1 billion and $7.5 billion, while adjusted operating income will range between $5.6 billion to $6.0 billion.

Impressive Dividend Pay-out of 50%

Concurrent with the earnings announcement, the company announced an annual dividend of $17.00 per share, reflecting 50% of Net Income in 2021. The dividend is payable on April 4 to shareholders on record as of March 23.

Since its IPO in January 2021, the company has distributed $2.6 billion or $21.50 per share in dividends, including the special dividend paid in September 2021. The amount distributed represents 30% of the company’s current market cap and is also 50% higher than the IPO market cap.

CEO Comments

Expecting the exceptional momentum of 2021 to carry forward into 2022, ZIM CEO, Eli Glickman, commented, “Notably, we are seizing the opportunity to be at the forefront of carbon intensity reduction among global liners, with 28 eco-friendly LNG dual-fuel container vessels due to be delivered to us between 2023 and 2024, which could account for 40% of our operating capacity.”

He further added, “Complementing our ESG objectives, we continue to invest in digital initiatives and disruptive technologies and further strengthen our commercial prospects to drive long-term profitable growth, while maintaining our disciplined approach to capital allocation to maximize value for all of ZIM’s stakeholders.”

Wall Street’s Take

Following robust Q4 results, Jefferies analyst Randy Giveans increased the price target on ZIM Integrated Shipping Services to $120 (59.7% upside potential) from $100 and reiterated a Buy rating.

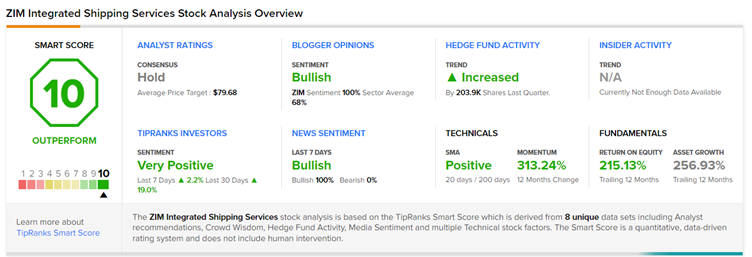

Consensus among analysts is a Hold based on 1 Buy,1 Hold, and 1 Sell. The average ZIM Integrated Shipping Services price target of $79.68 implies 5.68% upside potential to current levels.

TipRanks’ Smart Score

ZIM scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Fathom Digital Q4 Revenues Grow Over 130%

Shares of View, Inc. Drop 24% on Potential Delisting from Nasdaq

EQONEX Shares Soar 15% on Strategic Deal with Bifinity