Global cargo shipping company ZIM Integrated Shipping Services Ltd. (ZIM) delivered blowout second-quarter results with revenue and earnings both recording significant year-over-year growth. Shares popped 2.7% on the news, closing at $46.73 on August 18.

The company reported stellar quarterly earnings of $7.38 per share, significantly higher than analysts’ estimates of $5.22 per share and much higher than earnings of $0.23 per share reported in the prior-year period.

To add to that, revenue climbed a whopping 200% to $2.38 billion compared to the prior-year period and outpaced the Street’s estimate of $1.77 billion. The outstanding revenue growth is attributed to higher freight rates coupled with increased carried volumes.

Second-quarter carried volume grew 44% year-over-year to 921 K-TEUs, and the average freight rate per TEU also increased 119% to $2,341 compared to the prior-year quarter.

Additionally, ZIM reported its highest ever recorded adjusted EBITDA of $1.34 billion, showing outstanding growth of 820% over the prior-year period. (See ZIM Integrated Shipping Services stock charts on TipRanks)

Commenting on the company’s stellar results, Eli Glickman, President & CEO of the company, said, “Driving our success, we have further leveraged digitalization initiatives and have drawn on our global-niche strategy to launch new lines to address profitable, underserved route.”

Glickman added, “Our outlook for the remainder of 2021 and into 2022 is very positive and we are excited about our strategy to further enhance our position as an innovative digital leader of seaborne transportation and logistics services.”

Based on its superior second-quarter performance, ZIM raised its full-year 2021 guidance and now expects adjusted EBITDA and adjusted EBIT to be in the range of $4.8 – $5.2 billion and $4.0 – $4.4 billion, respectively.

In May 2021, ZIM announced a special cash dividend of $2.00 per share, payable on September 15 to shareholders of record on August 25, 2021. The company also plans to pay out 30% – 50% of its annual 2021 net income as dividends in 2022, subject to the Board’s approval.

Impressed by the company’s outstanding results, Jefferies analyst Randy Giveans lifted the price target on the stock to $70 (49.8% upside potential) from $60 while maintaining a Buy rating.

Giveans notes that ZIM reported much higher EPS than his estimates owing to the higher average freight rates and carried volumes. Moreover, he also increased his second-half 2021 and FY2022 EPS estimates based on the company’s guidance.

For the remainder of 2021 and into 2022, the analyst expects container freight and charter rates to remain “very robust”, which bodes well for ZIM.

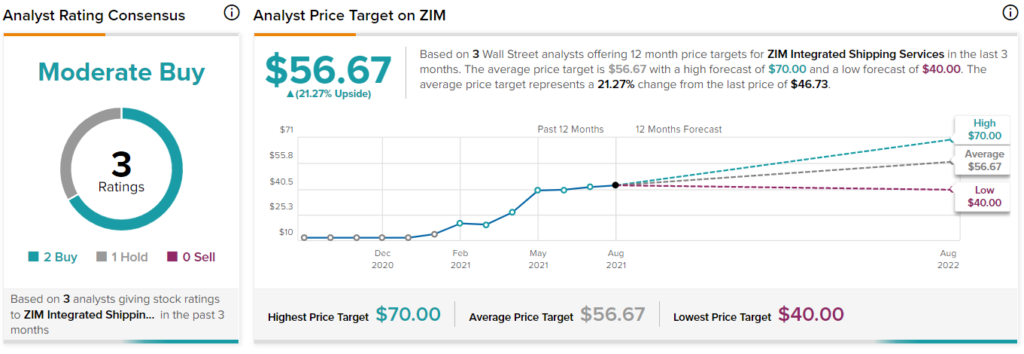

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys and 1 Hold. The average ZIM Integrated Shipping Services price target of $56.67 implies 21.3% upside potential to current levels. Shares have exploded 306.4% over the past year.

Related News:

Lowe’s Raises Guidance on Robust Q2 Results; Shares Jump 10%

Victoria’s Secret Shares Sink 8.6% After-Hours Despite Strong Q2 Results

Walmart Exceeds Q2 Expectations, Lifts Guidance