Quick service restaurant operator Yum! Brands, Inc. (YUM) has reported lower than expected second-quarter numbers. Its exit from Russia impacted metrics and store counts. Revenue ticked upwards by 2.5% year-over-year to $1.64 billion, but missed the cut by $10 million. Earnings per share (EPS) at $1.05 fell short of expectations by $0.04.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

The company clocked 4% unit growth and a 1% same-store sales increase during this period.

Yum’s CEO David Gibbs commented, “Our global business continues to perform well, led by industry-leading results at Taco Bell U.S., including same-store sales growth and in-line margins year-over-year.”

He further added, “We are pleased with the continued growth of our digital business with digital sales of nearly $6 billion, fuelled by the adoption of our global platforms and capabilities.”

Yum is in the process of exiting Russia completely and has already transferred Pizza Hut Russia to a local entity. It is in advanced talks to transfer KFC Russia restaurants to a local entity as well. Adjusting for Russia, the company saw 4% higher sales in the KFC division and 5% higher sales worldwide. Furthermore, Taco Bell saw a 10% increase.

Yum also added 781 gross units during the quarter. The decrease of 1,165 Russian units meant a decline in the unit count by 702 and net new unit additions of 463 during this period.

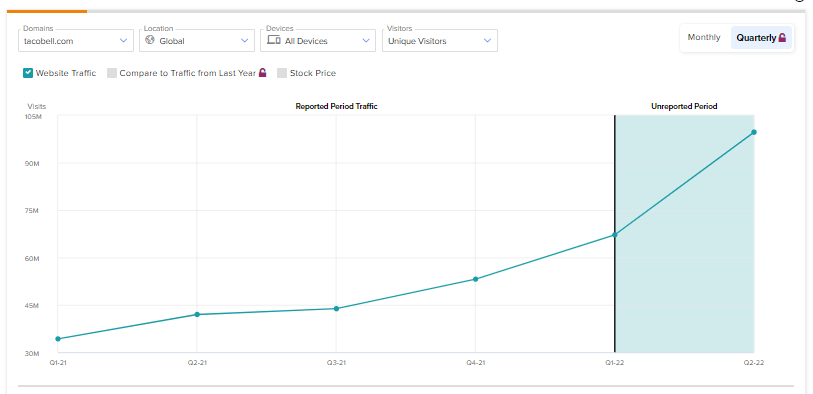

Website Traffic

Notably, results from Yum’s focus on online presence are also reflected in the findings of our website traffic tool. Data shows that total website traffic to Yum globally and across devices has been steadily ticking upwards for some time now. During Q2, these visits jumped nearly 48.4% to around 99.7 million. In the year-ago period, total visits were around 42 million and had clocked a 22.6% growth.

Learn how Website Traffic can help you research your favourite stocks.

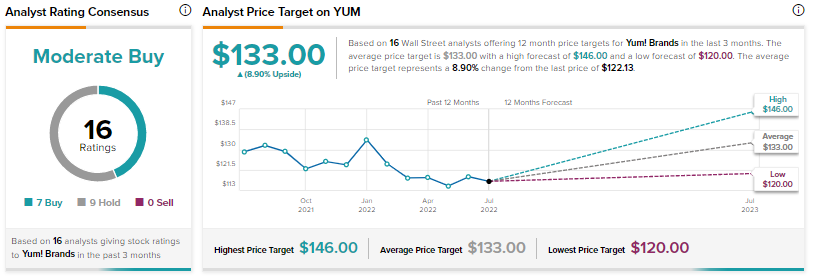

Analysts’ Take on YUM

The Street, in the meantime, is cautiously optimistic about the stock with a Moderate Buy consensus rating alongside an average price target of $133. This implies an 8.9% potential upside.

Closing Note

While the exit from Russia may impact the company in the short term, it remains on a growth trajectory. Additionally, it’s India sales which contribute only 1% to the total topline at present, doubled during the period. This indicates Yum can continue to expand revenue internationally as well.

Read full Disclosure