Shares of YETI Holdings (YETI), which produces outdoor products like coolers, are up slightly in today’s trading after investment firm Jefferies suggested that it could be the next private equity target following 3G Capital’s deal to acquire Skechers (SKX). Jefferies analyst Randal J. Konik pointed to YETI’s strong cash flow and well-known brand, which he believes make the company an appealing option for private equity firms looking for significant “asymmetric upside.” Konik compared YETI’s strategic value to Skechers, which attracted 3G due to its innovation and global growth prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, SKX stock is up 25% today after 3G agreed to buy the whole company for $63 per share, a 28% premium from its previous close. Konik noted that today’s uncertain economic environment and market volatility have created favorable conditions for activist campaigns and major takeovers, similar to what is happening with Skechers. As a result, he reiterated his Buy rating on YETI and maintained a $55 price target.

Interestingly, adding to the takeover speculation, YETI has already been under pressure from activist investor Engaged Capital. Indeed, in March, the company reached a “cooperation agreement” with Engaged and agreed to expand its board. This move was aimed at improving shareholder value and addressing investor worries, which could make YETI even more attractive to private equity buyers in the current market climate.

Is Yeti Stock a Good Buy?

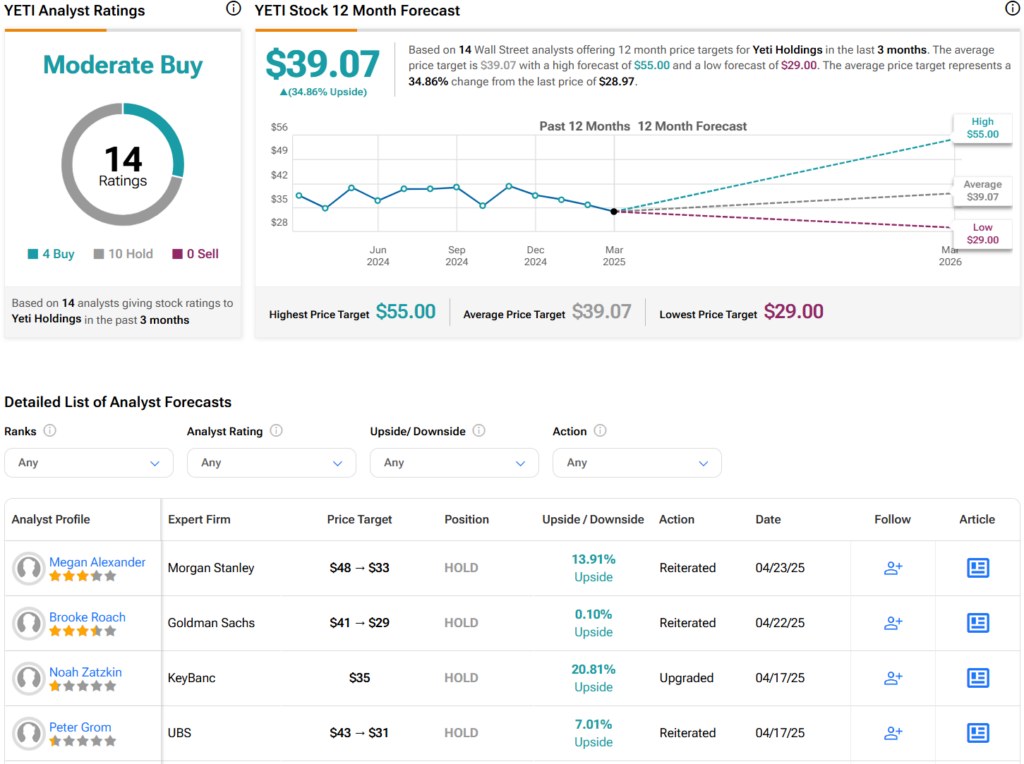

Overall, analysts have a Moderate Buy consensus rating on YETI stock based on four Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average YETI price target of $39.07 per share implies 34.9% upside potential.