Chinese electric vehicle (EV) manufacturer XPeng (XPEV) recently reported its Q2-2022 earnings results. The company beat revenue expectations but missed earnings per share (EPS) expectations and gave guidance that didn’t excite investors. As a result, XPEV shares are down in today’s trading session. Other Chinese EV stocks, such as NIO (NIO) and Li Auto (LI), are also slightly down today.

XPeng Beats on Revenue, Misses EPS Forecasts

XPEV’s revenue nearly doubled year-over-year and beat expectations by $10 million, coming in at $1.11 billion. Year-over-year vehicle deliveries grew in line with revenue (98% growth), with deliveries for the quarter totaling 34,422. Also, XPeng’s July Sales report revealed that the company outsold both NIO and Li Auto. However, the bad thing is that its non-GAAP EPS came in at -$0.43, missing the -$0.32 consensus.

XPeng’s losses are also much higher than last year’s losses of $0.11 per share. In addition, its vehicle profit margins dropped to 9.1% from 11% in the same period last year.

The market is most likely mainly disappointed by XPeng’s outlook. The company expects to deliver 29,000 to 31,000 vehicles in Q3. While this represents double-digit year-over-year growth, it suggests a sequential decline compared to Q2. Revenue expectations of $1 billion to $1.1 billion also suggest the same.

Is XPEV a Good Stock to Buy?

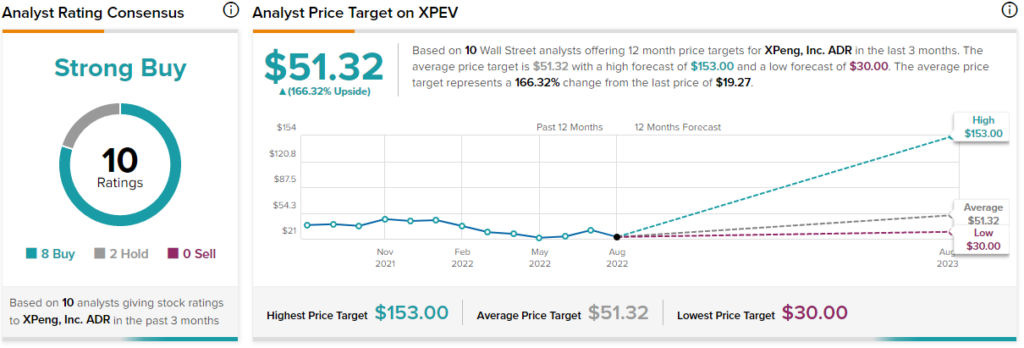

Turning to Wall Street, XPEV stock earns a Strong Buy consensus rating based on eight Buys and two Hold ratings assigned in the past three months. The average XPeng price prediction of $51.32 implies 166.3% upside potential. Analyst price targets range from a high of $153 to a low of $30.

Top TipRanks Investors are Highly Bullish on XPEV Stock

TipRanks currently tracks 557,277 investor portfolios that use the Smart Portfolio tool. The top investors, which amount to 111,455 portfolios, appear highly bullish on XPEV stock.

In the past 30 days, the number of top-performing TipRanks portfolios holding XPEV stock increased by 4.5%, leading to 0.8% of portfolios holding the stock. However, in the past seven days, this number decreased by 0.3%. XPeng has very positive investor sentiment, above the sector average, as shown in the image below:

Conclusion: XPEV’s Earnings and Forward Guidance Disappoint Investors

While XPeng saw very high year-over-year revenue growth of about 98%, the company missed expectations regarding earnings. Also, its forward guidance has left a sour taste in investors’ mouths, as vehicle deliveries and revenues are expected to decline sequentially. Slowing growth or sequential declines are hardly ever taken positively by growth-stock investors, which is likely why the stock is down today.

Nonetheless, analysts and top investors on TipRanks are very bullish on the stock, making it worth considering.