Shares of workplace technology solutions provider Xerox (NASDAQ:XRX) are trending lower today after the company agreed to repurchase all the XRX shares owned by activist investor Carl Icahn and his affiliates for $15.84 per share. This pegs the aggregate purchase price for the transaction at $542 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company plans to fund the purchase with a new debt facility. The deal is expected to close no later than September 29, and upon closing, Icahn and related parties will no longer hold any common shares in the company.

Further, Jesse Lynn and Steven Miller (employed by the Icahn parties) and James Nelson, an independent director at Xerox, will resign from the company’s Board. Concurrently, Xerox has appointed Scott Letier as the Chairman of its Board.

Icahn, a longtime Xerox shareholder, commented, “I will continue to be a champion of the company and hope my activism will long be remembered as Xerox continues its positive momentum.”

What Is XRX Stock Target?

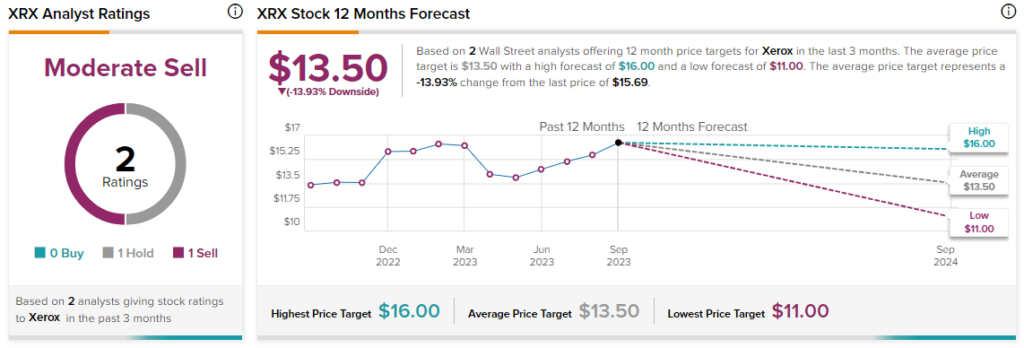

Overall, the Street has a consensus price target of $13.50 on Xerox, alongside a Moderate Sell consensus rating. This implies a 14% potential downside in the stock.

Read full Disclosure