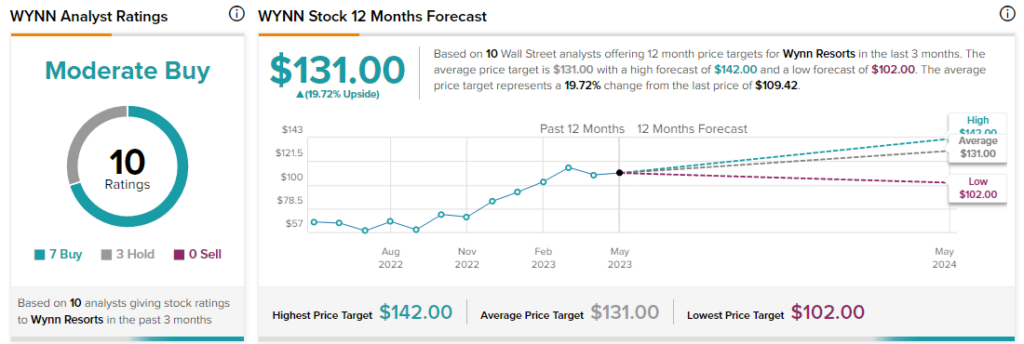

Shares of Wynn Resorts (NASDAQ: WYNN) rallied in morning trading at the time of writing on Wednesday after Barclays’ top-rated analyst Brandt Montour upgraded the stock to a Buy from a Hold. The analyst has a price target of $135 on the stock, implying an upside potential of 23.3% at current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The analyst expects WYNN to generate 2019 EBITDA levels at a faster clip than forecast. Montour commented, “We increasingly believe WYNN will be able to hold onto recent property performance in Las Vegas in spite of macro conditions worsening, or at least hold in better than we think current investor expectations assume, based on a certain level of scarcity value for WYNN’s high-end product that should keep it relatively insulated.”

Even with the more than 25% rally in WYNN stock year-to-date, Montour is of the opinion that the stock can extend this run.

Besides Montour, other analysts, however, remain cautiously optimistic about WYNN stock with a Moderate Buy consensus rating based on seven Buys and three Holds.