Workday (WDAY) beat earnings and revenue estimates in the fiscal first quarter 2022. The company provides enterprise cloud applications for finance and human resources.

Shares of the software company declined 1.1% in Wednesday’s extended trading session.

The company’s revenues of $1.18 million surpassed the Street’s estimates of $1.16 million and jumped 15.4% from the year-ago period. Subscription revenue increased 17.0% year over year to $1.03 billion.

Earnings came in at $0.87 per share, beating the consensus estimates of $0.73 per share and soared 97.7% year-over-year.

Workday CFO Robynne Sisco said, “We delivered solid first-quarter results driven by strong execution against an improving market backdrop.”

He further said, “As a result, we are raising our fiscal 2022 guidance for subscription revenue to a range of $4.425 to $4.440 billion, growth of 17%. We expect second-quarter subscription revenue of $1.095 billion to $1.097 billion, growth of 18%. We are also raising our fiscal 2022 non-GAAP operating margin guidance to a range of 18% to 19%.” (See Workday stock analysis on TipRanks)

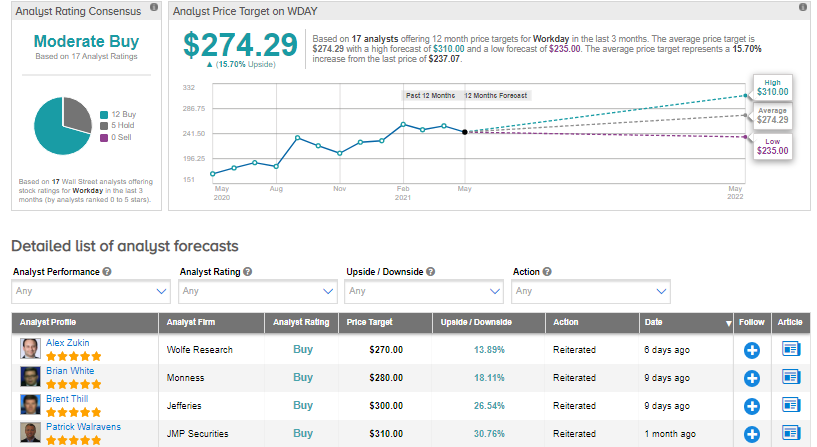

On May 18, Monness analyst Brian White maintained a Buy rating and a price target of $280 (18.1% upside potential).

White commented, “Held hostage by this pandemic, we expect Workday to benefit from the great U.S. reopening and accelerated digital transformation trends, emerging from this crisis a stronger company.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 12 Buys versus 5 Holds. The average analyst price target of $274.29 implies 15.7% upside potential to current levels. Shares have increased 39.1% over the past year.

Related News :

Garmin Expands Digital & Aviation Offerings with AeroData Buyout

Keysight Expands Quantum Solutions With Quantum Benchmark Buyout

AutoZone Beats Analysts’ Expectations in Q3