WNS (Holdings) reported a year-over-year decline in its 2Q revenues and earnings as COVID-19 pandemic took a toll on its operations and clients volumes. Shares of the business process management services provider closed 3.4% lower. on Thursday.

WNS (WNS) 2Q adjusted earnings per ADS (American Depositary Share) plunged 7.6% to $0.73 year-over-year. The company’s revenues declined 1.6% to $222.6 million year-over-year mainly due to adverse impact from COVID-19 pandemic. Moreover, revenue excluding repair payments fell 2.9% year-on-year.

The company said that the pandemic caused “lower volume requirements from certain clients and service delivery constraints resulting from the transition to a work from home delivery model.” The factors more than offset the benefit of new client additions and the expansion of existing relationships. (See WNS stock analysis on TipRanks)

The company initiated its fiscal 2021 outlook. For the fiscal, WNS projects revenue excluding repair payments between $830 million and $854 million. It forecasts adjusted earnings per ADS in the range of $2.33-$2.48.

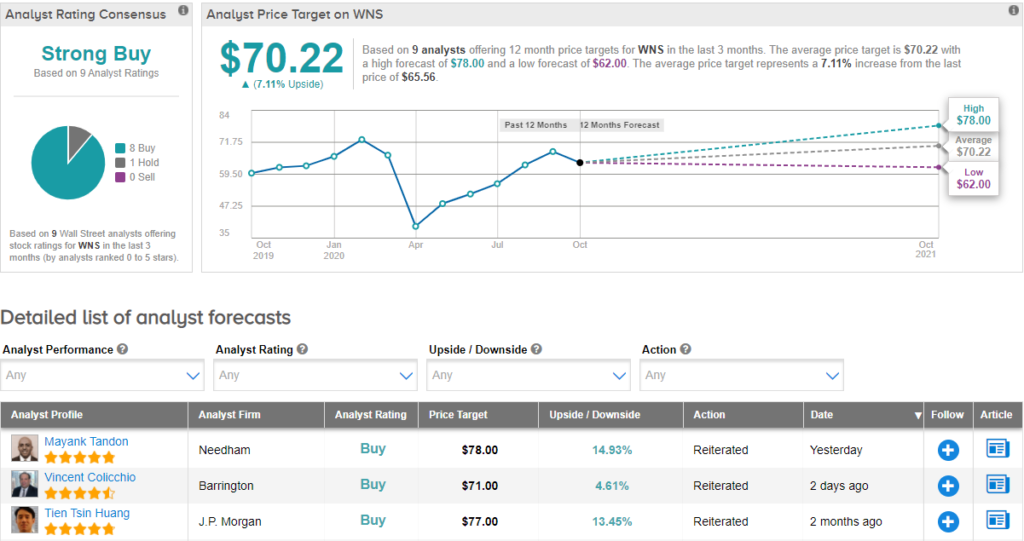

Following its quarterly results, Needham analyst Mayank Tandon raised the stock’s price target to $78 (18.8% upside potential) from $73 and reiterated a Buy rating. In a note to investors, Tandon said, “Looking out LT (long-term), we believe that WNS will be able to sustain industry-leading organic growth and premium margins and view the risk-reward as favorable for GARP investors looking for exposure to the positive secular trends driving growth for BPO/analytics.”

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 8 Buys versus 1 Hold. The average price target of $70.22 implies upside potential of 7.1% at current levels. Shares of the company are marginally down by approximately 1% year-to-date.

Related News:

Hewlett Packard Rises On Better-Than-Expected FY21 EPS Outlook

Tiffany Sees Better-Than-Feared 4Q Profit Aided By Online Sales

Walgreens Tops 4Q Profit; Shares Rise 5%