Winnebago Industries (NYSE: WGO) reported stronger-than-expected fiscal Q2 results, topping both earnings and revenue estimates driven by robust consumer demand and improved pricing.

Despite the beat, shares of the leading manufacturer of outdoor lifestyle products and motorhomes declined 11.78% to close near its 52-week low at $55.04.

Q2 Beat

Q2 adjusted earnings of $3.14 per share grew 42.1% year-over-year and significantly beat analysts’ expectations of $2.94 per share. The company reported earnings of $2.21 per share for the prior-year period.

Furthermore, revenues jumped 39% year-over-year to $1.2 billion and exceeded consensus estimates of $1.1 billion. The increase in revenues reflected a 29 % surge in organic growth. Retail market share gains of 1% also aided top-line growth.

However, aided by operating leverage, better pricing despite cost input inflation and supply constraints, gross profit margin was in-line with the prior year at 18.6%.

CEO Comments

Looking ahead, Winnebago Industries CEO, Michael Happe, commented, “We are confident that Winnebago Industries has continued headroom for sustained market share gains and profitable growth across our portfolio, leading to enhanced value creation for our end consumers, dealers, employees and shareholders.”

Wall Street’s Take

Following the results, CFRA downgraded Winnebago Industries from Buy to Hold and also decreased the price target to $55 (1% downside potential) from $90.

According to TipRanks’ analyst rating consensus, Winnebago is a Moderate Buy, based on two Buys and one Hold ratings. The average Winnebago Industries price target is $80, implying 45.35% upside potential.

Bloggers Weigh In

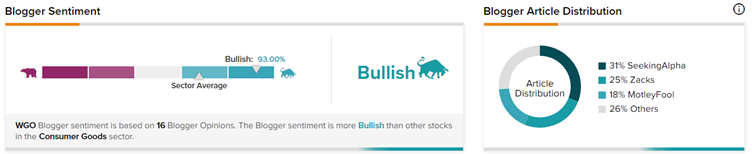

TipRanks data shows that financial blogger opinions are 93% Bullish on WGO stock, compared to a sector average of 68%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights. Read full Disclaimer & Disclosure

Related News:

On Holding Delivers Robust Q4 Sales & Outlook; Shares Gain 14%

Pinduoduo Smashes EPS Estimates; Shares Gain 6% Pre-Market

Williams-Sonoma Shares Gain 8.2% on EPS Beat & 10% Dividend Hike