The world’s most popular electric vehicle (EV) maker, Tesla, Inc. (TSLA), is being pursued by Indonesia to build an entire “end-to-end” industry in the country. Shares of Tesla closed up 2.4% at $650.28 on June 17.

EV makers are fighting a race to supremacy but are haunted by the ever-increasing input prices of raw materials for both vehicles and batteries. Tesla increased the prices of some of its high-end EVs recently in a bid to overcome rising production costs.

Indonesia’s Proposal

Tesla CEO Elon Musk has noted his intent to directly mine and refine lithium to control costs and to improve the inadequate supply of the metal. With regards to this intent, Indonesia’s President, Joko Widodo, has invited Musk to build an end-to-end industry in Indonesia.

Jokowi had met the billionaire in May and suggested building a fully powered supply base in Indonesia. The Southeast Asian nation is blessed with plentiful natural resources, including tin, copper, nickel, cobalt, and bauxite, a few of which are key components in building EV batteries.

As per a CNBC report, Widodo stated, “We had a lot of discussions, particularly on how Tesla can build their industry from upstream to downstream, end-to-end starting from smelter then build the cathode and precursor industry, build EV batteries, build lithium batteries [and] then the vehicle factory. Everything in Indonesia, because that’s very efficient. That’s what I offered.”

Following this, Musk had delegated a team to Indonesia six weeks ago “to check the potential of nickel, to check environmental aspects, but the car-related team has not come,” the President added.

Jokowi’s Vision

Jokowi has envisioned building “an industrial ecosystem for lithium batteries.” Indonesia is one of the biggest exporters of metals, which shifts the incremental value added to the importing nations.

A while ago, Indonesia had also offered Tesla to build an EV manufacturing plant with an annual capacity of 500,000 cars fueled by renewable resources, because the country does not just want to be an agent for Tesla EVs but also its manufacturing base. The President has also offered rival automaker Ford Motor (NYSE: F) and other EV companies the opportunity to build a manufacturing plant in the archipelago.

Although the discussions with Musk are in a very preliminary stage, building an end-to-end EV manufacturing hub in Indonesia might prove to be highly beneficial for Tesla.

Stock Prediction

Due to the current macroeconomic factors at play, analysts on the Street are cautiously optimistic about the TSLA stock with a Moderate Buy consensus rating based on 16 Buys, eight Holds, and six Sells. The average Tesla price forecast of $917.10 implies 41.1% upside potential from current levels. Meanwhile, TSLA stock has lost 45.8% so far this year.

Risk Analysis

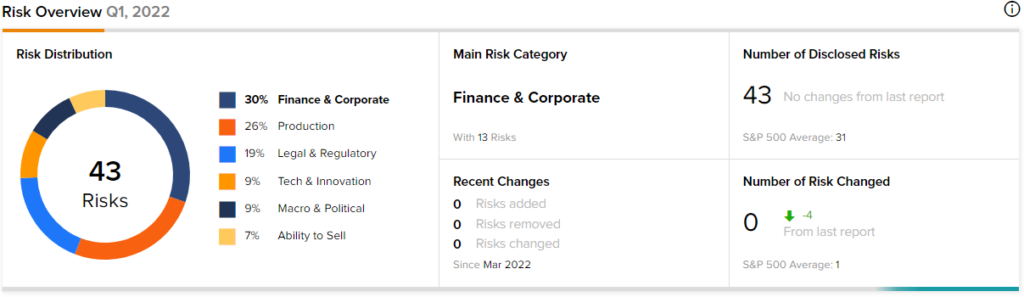

According to the new TipRanks Risk Factors tool, Tesla stock is at risk mainly from two factors: Finance & Corporate and Production, which contribute 30% and 26%, respectively, to the total 43 risks identified for the stock.

Ending Thoughts

As seen above, Production risks remain a persistent overhang on Tesla’s performance. With a limited supply of raw materials and the current inflationary environment, building a fully equipped supply base for manufacturing EVs could be a profitable move.