Bionano Genomics Inc. (BNGO) is a life sciences instruments firm that specializes in genomic analysis.

The main source of revenue for BNGO is the development and sale of its genome mapping system, Saphyr. Clients can use this platform to detect highly sensitive and specific structural variations, speeding up the discovery of new diagnostics and treatment targets.

Let’s take a look at the company’s financial performance and what has changed in its key risk factors that investors should know. (See Bionano Genomics stock charts on TipRanks)

Bionano Genomics Financial Performance

Bionano reported revenue of $3.9 billion, which increased 226% year-over-year. The increase was attributable to the strong demand for the company’s Saphyr systems.

Total operating expenses increased by 123.8% year-over-year to $17.9 million. The rise was due to higher expenses from the Lineagen acquisition and headcount-related charges.

Bionano’s CFO, Chris Stewart, said, “The second quarter of 2021 was very positive for Bionano…To gain further traction in the cytogenetics market, we are focused on reimbursement in the United States, converting the existing cytogenetics workflow in Europe and increasing our installed base to our target number of 150 Saphyr systems by year-end.”

Following the second-quarter earnings release, Maxim Group analyst Jason McCarthy reiterated a Buy rating on the stock with a price target of $10 (76.4% upside potential).

McCarthy commented, “It is still early days in the Saphyr story, but with a strong balance sheet and a clinical and commercial plan in place, success is starting to be reflected in growing revenue, and we expect this trend to continue as management executes on its commercial strategy.”

Bionano Risk Factors

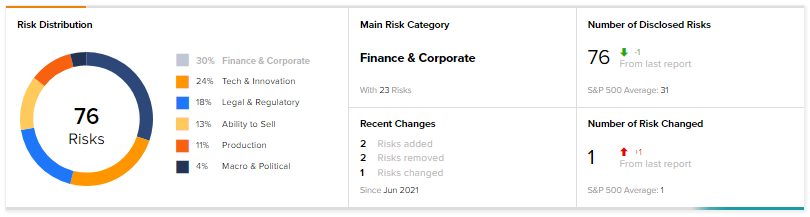

According to the new TipRanks Risk Factors tool, Bionano Genomics’ main risk category is Finance & Corporate, which accounts for 30% of the total 76 risks identified.

Since December, Bionano has added two new risk factors.

Under Tech & Innovation, Bionano emphasizes that the company operates in a very sensitive environment in which it must adhere to a slew of regulations and preserve data security. A breach of the company’s or third-party service providers’ security measures from cyber-attacks could result in major liabilities for the company, negatively impacting its future prospects.

Bionano highlights in the Legal & Regulatory section that if the firm fails to comply with any of the changing laws and regulations, it may face lawsuit charges that could result in fines or penalties. Ultimately, it could damage the company’s brand and have a negative impact on its operations.

The Finance & Corporate risk factor’s sector average is 28.9%, compared to Bionano’s 30.3%.

Wall Street’s Take on BGNO

Bionano stock commands a Strong Buy consensus rating based on 3 unanimous Buy ratings assigned in the last three months.

As for price targets, the average BNGO price target is $11.33, reflecting 12-month upside potential of 99.8% from current levels.

Bottom Line

Bionano’s stock has risen by 800% over the past year, and more gains could be on the way if the company can speed up the global adoption of its Saphyr platform.

However, TipRanks’ SmartScore, which comprises 8 unique data sets, indicates that the stock is likely to perform in line with market averages.

Also, the two new risks that the company has declared could be a cause of concern for the investors.

Related News:

Gauging Viavi Solutions’ Risk Factors Post Q4 Results

Workday Fiscal Q2 2022 Results Beat Estimates; Issues Guidance

Domo Q2 Results Surpass Estimates; Shares Decline 8.4%