Online sales on Black Friday came in at $9.12 billion, driven by strength in categories like electronics, toys, and exercise equipment. While that figure was a record level, as noted by Adobe Analytics, it indicates a muted year-over-year growth of 2.3%. High inflation and weak consumer sentiment are impacting spending. Nonetheless, Adobe Analytics estimates Cyber Monday sales to grow by 5.1% to $11.2 billion.

As per Adobe Analytics, “Cyber Monday will offer the best deals for computers (27%), as well as furniture (11%). Those looking to buy an appliance should consider waiting until Thursday (Dec. 1), when discounts are set to peak at 18% on average.”

Lower Door-Buster Deals Impact Black Friday Sales

Generally, attractive discounts offered by retailers drive robust traffic in physical stores on Black Friday. Per Sensormatic Solutions, in-store consumer traffic increased 2.9% on Black Friday. This year’s in-store traffic was not only impacted by macro challenges but also by a lesser number of the so-called door-buster deals.

During a door-buster sale, certain items are offered at deep discounts for a limited time to boost customer traffic at stores. Several big retailers, including Walmart (WMT), Target (TGT), and Macy’s (M), stopped door-buster deals during the pandemic keeping in mind the safety of customers and staff. Instead, they are running promotional deals for longer duration.

Citing DealNews.com, a Wall Street Journal report noted that Black Friday advertisements using the word “door-buster” were at 50% of the level seen last year. According to Julie Ramhold, a consumer analyst at DealNews.com, “The types of discounts are similar, but retailers aren’t restricting them to a narrow time frame.”

Recently, Target, Macy’s, Nordstrom (JWN), Kohl’s (KSS), GAP (GPS), and Amazon (AMZN) indicated weak holiday sales as consumers are pulling back their discretionary expenses and spending more on essentials.

Meanwhile, Canadian e-commerce company Shopify (NYSE:SHOP) (TSE:SHOP) announced a 17% rise in Black Friday sales to $3.36 billion. The company experienced robust sales in the U.S., U.K., and Canada markets. The top-selling cities for Shopify’s Black Friday business included London, New York, and Los Angeles.

What is the Prediction for Shopify Stock?

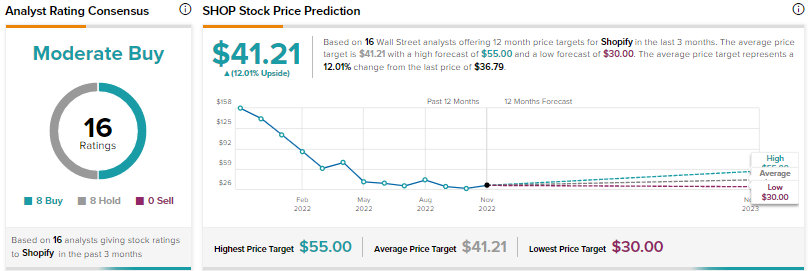

Wall Street’s Moderate Buy rating for Shopify stock is based on eight Buys and eight Holds. The average SHOP stock price target of $41.21 implies 12% upside potential. Shares have declined 73% year-to-date.