The social media platform Snap (SNAP) has been a disappointing stock this year, down almost 20% year-to-date, reflecting ongoing monetization challenges and weak signals of sustainable recovery. However, Q3 results were well received, with shares jumping double digits—not necessarily due to concrete improvements in monetization, but largely because of the high-profile partnership with Perplexity AI, which could become an additional revenue opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s important to note that SNAP is a stock that reacts strongly to the quality of its ad platform signal. Each earnings call shifts the market’s conviction about whether the ad stack is improving, and when that belief changes, the stock tends to move sharply. The issue this time is that the positive reaction is still driven by narrative.

We have yet to see sufficient improvement in monetization to warrant a more constructive stance, in my view. Given this balance, I continue to recommend holding SNAP, as I do not believe a bullish outlook is justified at this stage.

Snap’s Monetization Progress Is Real, But Still Not Clean

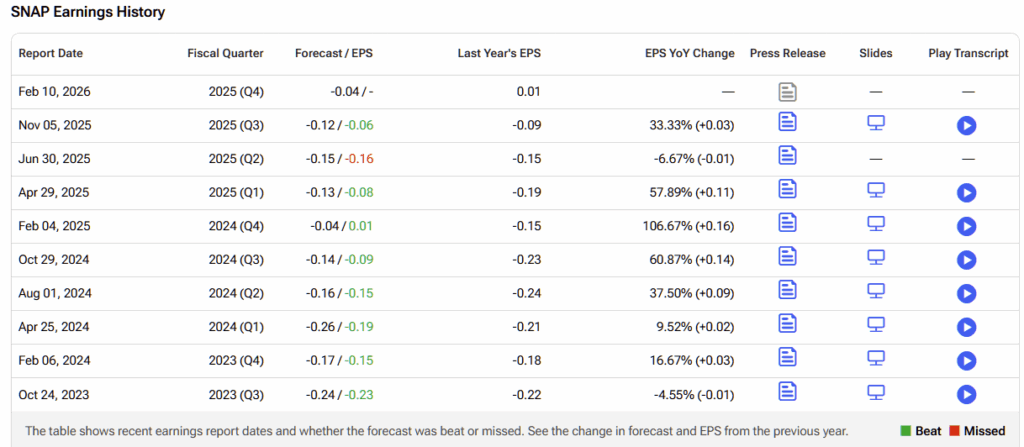

Snap posted a solid all-around beat in the third quarter, delivering normalized EPS of $0.10 vs. $0.05 expected and revenue of $1.51 billion, roughly 1% above consensus. However, beyond a minor fluctuation in the numbers, the primary driver for where SNAP trades going forward essentially comes down to three key factors: ad revenue efficiency, user engagement quality, and ad platform recovery.

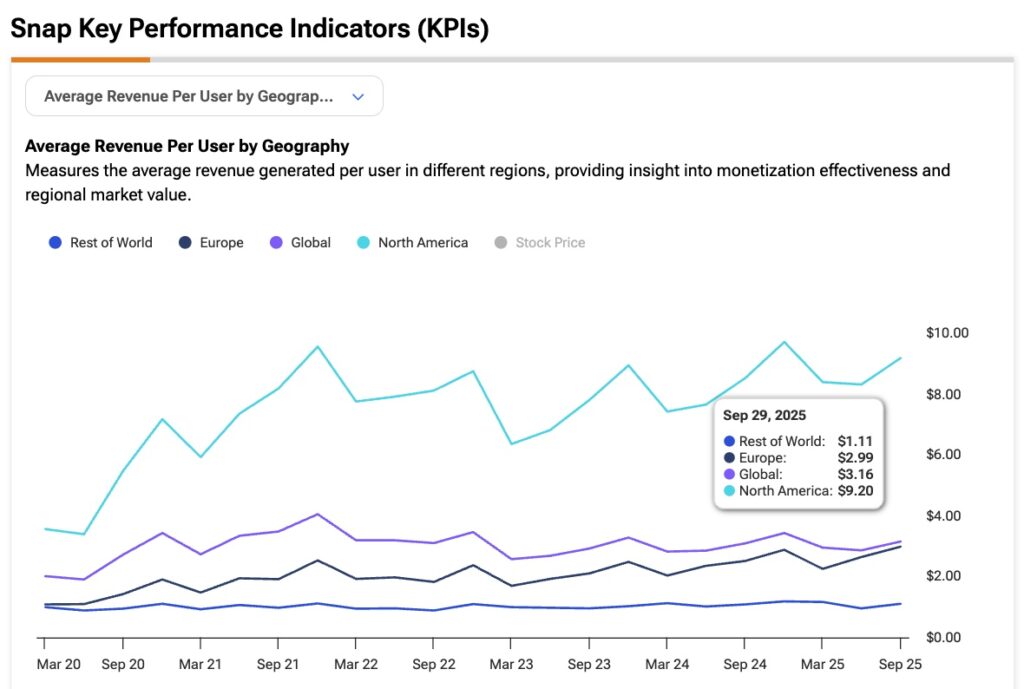

Considering that Snap ultimately lives and dies by how well it can monetize attention, the key metric to watch is ARPU (average revenue per user), especially in the U.S., where performance advertisers actually spend at scale.

On that front, global ARPU is moving in the right direction, going from $3.10 in Q3 2024 to $3.16 in Q3 2025, though the trend has been choppy. More importantly, North America ARPU is back to growth at $9.73 (up 8% YoY), even if it hasn’t yet revisited its prior peak of $10.08 in Q4 2024 (a seasonally strong quarter).

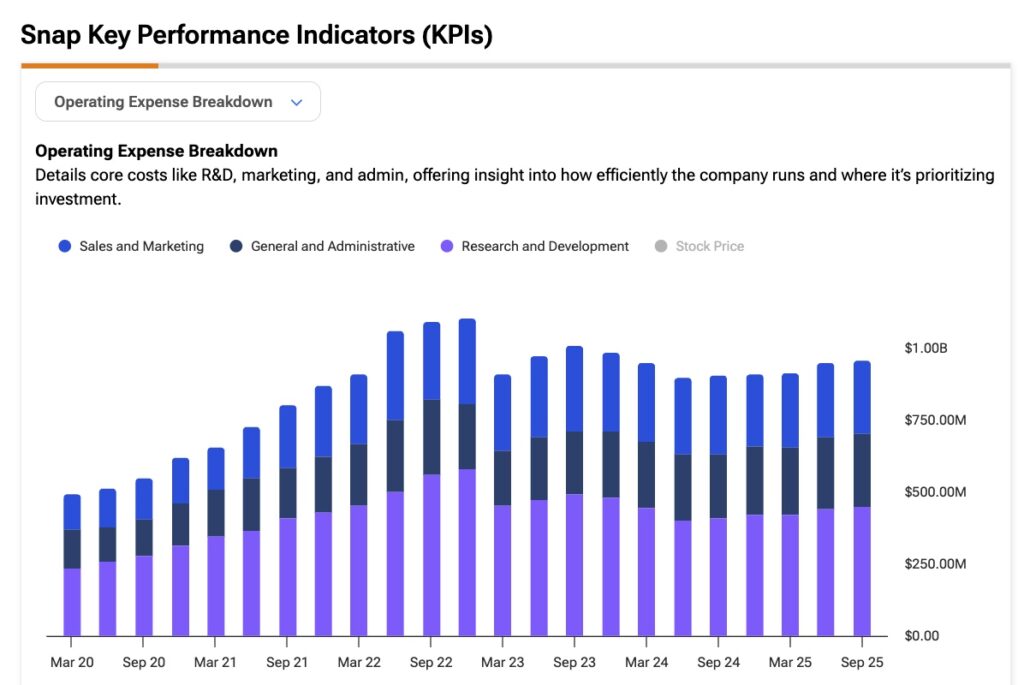

This suggests that the ad stack rebuild—signal plus attribution—is working, but the job is not yet finished. It’s progress, not victory. The issue is cost discipline. In Q3, Snap’s operating expense margin increased to 57% from 56% a year ago, coinciding with the start of ARPU’s improvement. That partially offsets the monetization benefit.

Adjusted OpEx (excluding stock-based compensation expense) also remained elevated at $654 million, basically flat versus Q2. This implies that at least part of the ARPU recovery is being supported by higher spending to attract and retain advertisers, which isn’t ideal for the long-term thesis.

Why Bullish Sentiment Reigned Supreme

Even so, the market reacted very positively to SNAP after Q3, but in my view, this was driven more by a shift in narrative than by the financials themselves—at least for now. The deal with Perplexity AI allows the platform to use Snap’s camera input to enhance multimodal search. In practice, this gives Snap’s camera search box the potential to act more like a search engine.

This was well received because Snap’s model centers on frequent camera use. Users often open the camera with no specific goal in mind—a kind of “search intent without keywords” that could prove highly valuable for AI-driven discovery.

If this works, Snap could monetize the camera layer strategically for the first time, which would be more meaningful than just ARPU recovery. Meta Platforms (META) and Alphabet (GOOGL) don’t have direct access to this layer, and TikTok is still building toward it.

However, this remains a narrative. There isn’t a clear monetization path yet. If Snap can’t convert visual search and generative discovery into ad placements or commerce conversions, the story remains hype rather than generating revenue.

What the Market Still Needs to See

In general, when a platform successfully rebuilds its ad stack, the cycle tends to follow a clear path: better signals lead to higher average revenues per user (ARPU), revenue grows, operating expenses (OpEx) remain stable, and margins expand.

In Snap’s case, both this quarter and prior ones show a different pattern: ARPU increased and revenue improved, but OpEx also rose, leaving margins flat. Because of that, Snap’s multiple hasn’t recovered even with improving ARPU.

Looking at the forward EV/Revenue multiple over the last three years, Snap currently trades around 2.5x—close to the 2.2x lows seen in September and still well below the three-year average of about 3.5x. To move back toward the median, Snap will likely need more consistent ARPU growth (particularly in North America above $10) and flatter OpEx, which would indicate operating margins in the high single-digit range. Even the expectation that this trend is forming could be enough for a re-rating toward ~3.5x EV/Revenue.

Is SNAP a Buy, Hold, or Sell?

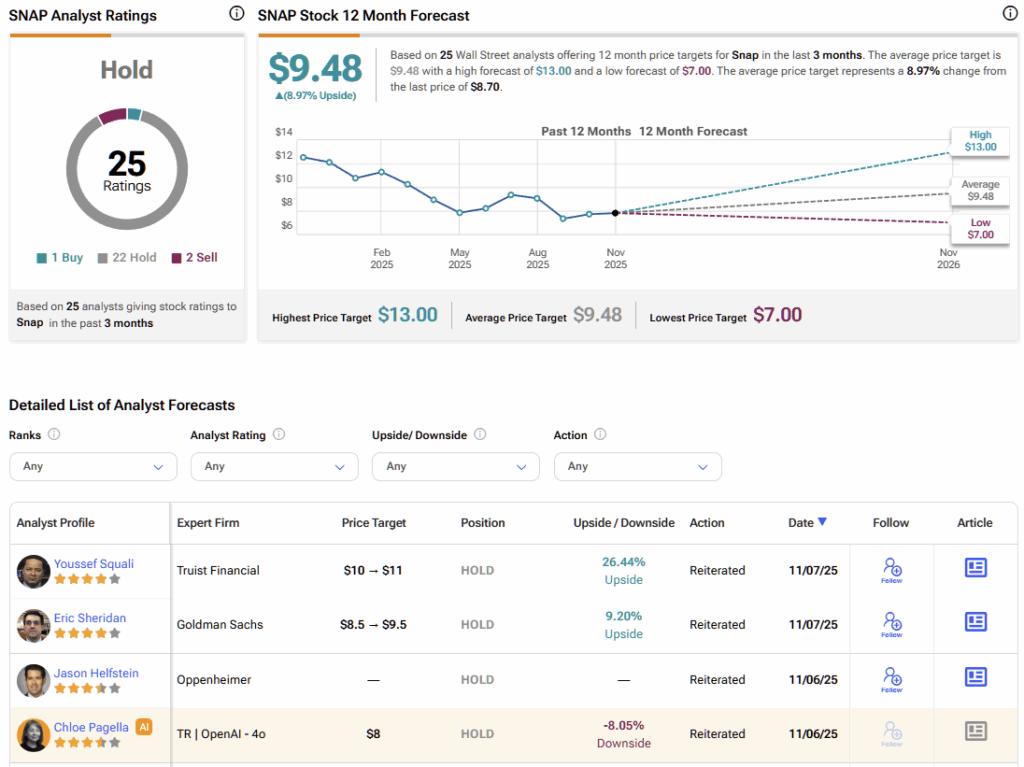

The consensus on Snap still leans toward neutrality. Of the 25 ratings the stock received over the past three months, only one is a Buy and two are Sells. The remaining 22 are Holds. The average price target is $9.48, following several analysts’ upward revisions after the Q3 results. This implies almost 9% upside from the latest share price.

Encouraging Signs Do Not Make SNAP a Buy

There is evident excitement around the Perplexity AI deal, which positions Snap closer to the AI-winner narrative and opens the possibility of a new monetization layer. Although this is still early and speculative, it represents a significant potential shift in the company’s model.

On the more immediate front, Snap did show real progress in monetization, especially in North America, and that deserves recognition. The issue is that operating expenses remain very high, suggesting that part of the monetization improvement is being funded by increased spending. That is a bearish element when thinking about a more sustainable re-rating.

Given this balance between optimism around a possible new monetization path through AI and the still unanswered questions about profitability at the current stage, a Hold rating seems the most reasonable stance for now.