Shares of money transfer company, MoneyGram International, Inc. (MGI) spiked as much as 8% in intraday trading on July 16, closing up 2.9% at $10.27 on rumors of a potential acquisition by Private Equity firm Advent.

According to the Financial Times, the company is said to be in early talks with Advent over a potential acquisition, although no formal bid has yet been made. (See MoneyGram International stock charts on TipRanks)

Furthermore, on July 15, MoneyGram released its June cross-border transaction results for its direct-to-consumer digital business. The company’s MoneyGram Online (MGO) business grew 44% year-over-year, driven by continued momentum for its mobile app and high customer retention rates.

Additionally, MGI said that during the second quarter, the total digital transactions made directly to customers’ accounts, cards, and mobile wallets hit an all-time high growth rate of 77%, compared to the prior-year period.

Alex Holmes, Chairman and CEO said, “MoneyGram’s large, loyal customer base, unique competitive advantages, and innovation roadmap will ensure MoneyGram continues to capture share and strengthen its position as the leader for progressive innovation in the industry.”

Also, on July 14, the company announced the pricing of its private offering of 5.375% senior secured notes due 2026 totaling $415 million. The offering is expected to close on July 21, subject to closing conditions.

The company expects to use the proceeds from the offering along with borrowings under its contemplated new secured credit facility towards closing the debt under its existing senior secured credit facilities.

MGI is scheduled to report its second-quarter results on July 29. The Earnings Whisper numbers for Q2 earnings and revenue are expected to be $(0.01) per share and $321.08 million, respectively.

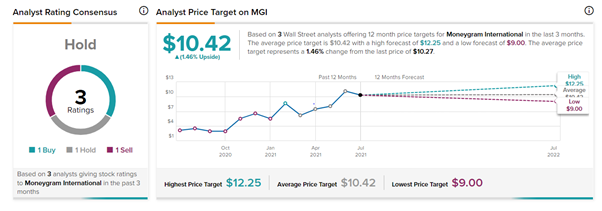

Recently Barclays analyst Ramsey El Assal reiterated a Sell rating on the stock but lifted the price target to $9 (from $7), implying 12.4% downside potential.

Assal stated the company’s shift in focus towards digital transactions and expected debt refinancing as a basis for raising its price target.

Overall, the stock has a Hold consensus rating based on 1 Buy, 1 Hold, and 1 Sell. The average MoneyGram International price target of $10.42 implies 1.5% upside potential to current levels. Shares have gained a whopping 231.3% over the past year.

Related News:

Corsair’s Elgato Launches Facecam; Shares Pop

fuboTV to Offer Sportsbook Service in Pennsylvania; Shares Jump

Oatly Accused of Overstating Revenue by Activist Short-Seller Firm