Last week, Mill Road Capital III, L.P., a Director of Superior Industries International (NYSE: SUP), bought SUP shares worth $943,000. Going by an SEC filing, the Director lapped up 188,600 shares of this manufacturer of bulk material processing and handling equipment at $5 per share on July 15. This attracted investors’ attention and SUP stock rose 5.8% to $4.20 on July 19 from the closing price of $3.97 on July 14.

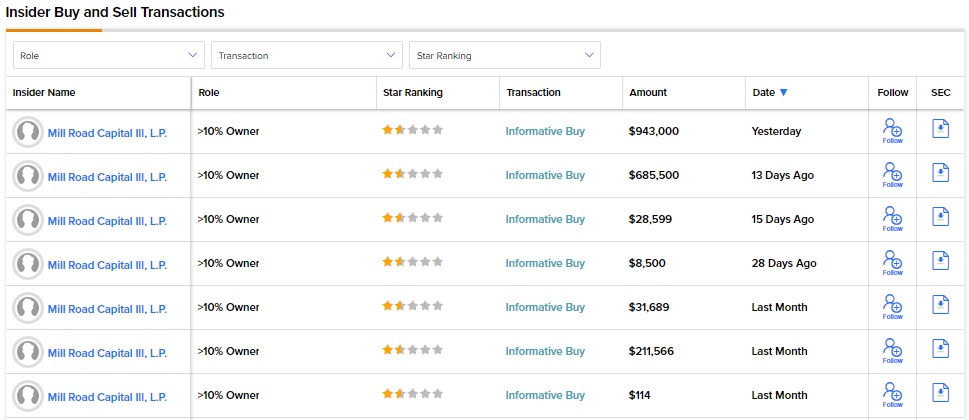

According to TipRanks, which also provides a comprehensive list of daily insider transactions, Mill Road Capital has lapped up SUP shares worth $1.88 million in the last two months.

A pictorial representation of these transactions is provided below:

Insider Confidence Signal is Positive on SUP

TipRanks’ Insider Trading Activity tool shows that insiders are currently Positive about SUP, as corporate insiders have bought SUP shares worth $5.4 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts of either a Very Positive or Positive insider confidence signal.

Street Is Optimistic on SUP Stock

Overall, the Street is optimistic about the stock and has a Moderate Buy consensus rating based on one Buy. Superior Industries International’s average price forecast of $12.50 signals that the stock may surge nearly 197.6% from current levels.

Superior Industries International scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

TipRanks data shows that hedge funds are Very Positive about the company, as they have bought $2 million worth of SUP stock in the last three months.

Key Takeaway for SUP’s Investors

As of now, corporate insiders are seen taking advantage of the company’s weak stock price, which has fallen 9.5% so far this year. The recent insider activities signal that this could be the right time to gain exposure to the stock as it has upside potential of over 197%.

Read full Disclosure