Creative Media (CMCT) stock surged on Wednesday after the digital media and technology company announced the sale of its lending division. PG FR Holding, LLC, an affiliate of Atlanta-based Peachtree Group, has agreed to buy the company, and Creative Media estimates the deal could be valued at $44 million, which is net of the outstanding balance of debt tied to a 2023 securitization of certain loan receivables.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Creative Media said it expects net cash proceeds of $31 million from the sale of its lending division. This sale will allow the company to advance its main priorities, including “growing its premier multifamily portfolio, strengthening its balance sheet and improving its liquidity.” The company noted it has completed “four refinancings across seven assets, extended the debt maturities on two multifamily assets and fully repaid its recourse credit facility” since it announced these priorities in Q3 2024.

Alongside the sale of Creative Media’s lending division comes changes to its leadership team. Barry Berlin, Executive Vice President, Chief Financial Officer, Treasurer, and Secretary of Creative Media, will resign once the sale is complete. He will then enter into an employment relationship with Peachtree Group or its affiliate. Berlin will be replaced by Brandon Hill as the next CFO and Treasurer of the company.

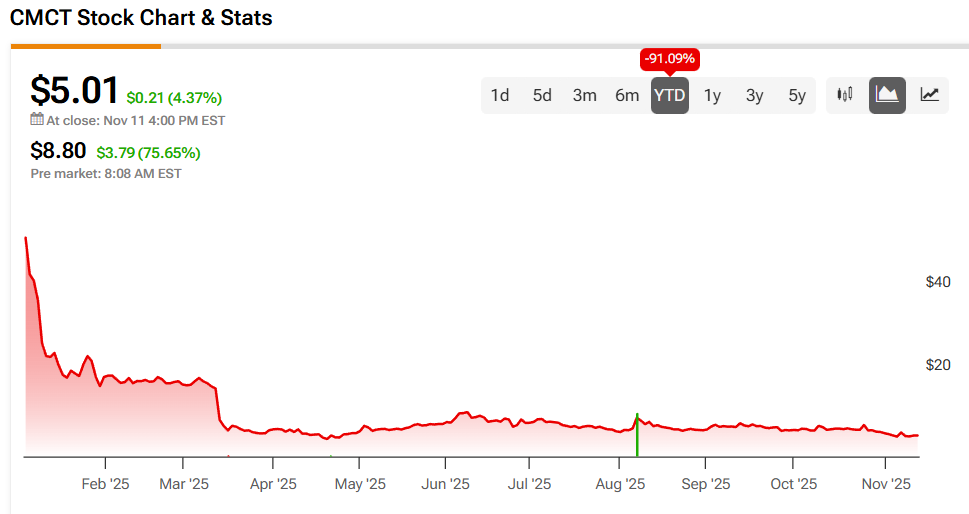

Creative Media Stock Movement Today

Creative Media stock was up 75.65% in pre-market trading on Wednesday, following a 4.37% jump yesterday. Even so, the stock has fallen 91.09% year-to-date and 93% over the past 12 months.

Today’s news came with heavy trading of Creative Media stock. This saw some 18 million shares change hands, compared to a three-month daily average of about 52,000 units.

Is Creative Media Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Creative Media is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates CMCT stock a Neutral (44) with a $4.50 price target. It cites “significant financial challenges and weak technical indicators” as reasons for this stance.