Bumble Inc. (NASDAQ: BMBL) is the owner of three online dating apps, Badoo, Bumble, and Fruitz. Along with dating services, these platforms provide social networking services to millions of users. Headquartered in Austin, TX, the company was founded in 2014.

With an initial public offering (IPO) of 57.5 million shares, Bumble went public in February 2021. The par value of each Bumble share was $0.01, while the offer price was $43 for the public and underwriters.

The company used approximately 84% of its IPO proceeds for redeeming (or purchasing) equity interest from Blackstone-affiliated entities. The remaining proceeds were used for general corporate purposes, repaying debts, and IPO-related expenses.

Since going public, the online dating specialist has witnessed several ups and downs, with a prominent downward trend visible. However, it is bravely facing the hurdles, and its solid fundamentals have won several hearts.

A brief discussion of the company’s journey over the period is provided below.

Share Price & Market Capitalization

After pricing the IPO on February 10, 2021, Bumble started trading on the Nasdaq on February 11, 2021. The day’s opening price was $77, representing a 76.7% premium over the IPO price of $43, and the closing price stood at $70.31 (63.5% above the IPO price). The highest price level touched was $79.60.

After an overwhelming IPO, the company gradually lost its sheen, having declined 59.5% since February 10, 2021.

Shares of Bumble closed at $28.51 on Wednesday. Presently, the company’s market capitalization is $3.7 billion.

Important Milestones

Since its IPO, Bumble has reported results for six quarters. It delivered better-than-expected earnings in two quarters and missed earnings estimates in four.

In the first quarter of 2022 (reported in May 2022), Bumble posted earnings of $0.13 per share, above the consensus loss estimate of $0.04 per share. Revenues of $211.2 million exceeded the consensus estimate of $208.4 million by 1.4%.

In February 2022, Bumble acquired a Europe-based online dating app, Fruitz. The latter has a strong customer base in Spain, France, Canada, Belgium, Switzerland, and the Netherlands. Back then, Bumble’s Founder and CEO, Wolfe Herd, said, “Badoo and Bumble are two of the most popular global dating apps. The acquisition of Fruitz allows us to expand our product offerings in line with our focus on empowering relationships for everyone.”

Growth Drivers, Headwinds & Projections

Bumble is exhibiting continued growth in its subscriber base and average revenue per paying user (ARPPU). Exiting the first quarter, the company’s total paying users stood at three million, up 7.3% year-over-year. Meanwhile, paying users on Bumble App were up 31.2% to 1.78 million.

Also, deep penetration into the United States and international markets (including India, Southeast Asia, and others) is reflective of Bumble’s strength. The company believes that the U.S. market still has solid growth opportunities left for it.

Wolfe believes that “compelling brands, product leadership, and operational excellence” have positioned Bumble “to capture a growing share of the global dating market.”

On the flip side, Bumble is facing weakness in its Badoo App and other businesses (with revenues down 4% year-over-year in the first quarter of 2022). These businesses suffered from the Ukraine-Russia conflict and forex woes.

For 2022, Bumble anticipates revenues between $934 million and $944 million, with Bumble App sales growth within the 34%-36% range. Forex woes and the Ukraine-Russia war are predicted to impact revenues by $28 million and $20 million, respectively.

TipRanks’ Data

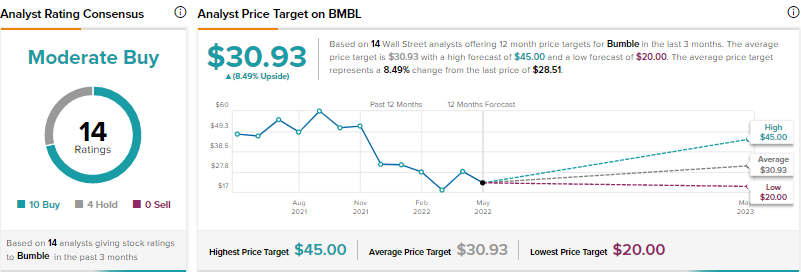

Overall, the Street has a Moderate Buy consensus rating on the stock based on 10 Buys and four Holds. BMBL’s average price forecast of $30.93 suggests 8.49% upside potential from current levels.

Last month, Brent Thill of Jefferies reiterated a Buy rating on BMBL with a price target of $30 (5.23% upside potential).

However, Lauren Schenk of Morgan Stanley reiterated a Hold rating on BMBL while lowering the price target to $28 (1.79% upside potential) from $30. The analyst finds the company’s products interesting and anticipates healthy growth prospects versus downside risks.

As per TipRanks, financial bloggers are 78% Bullish on BMBL, as compared with the sector average of 65%. On the other hand, investors’ sentiment is Negative on BMBL, as 1.4% of portfolios tracked by TipRanks decreased holding in the stock in the past 30 days.

Meanwhile, TipRanks’ Website Traffic tool shows that the footfall on BMBL’s website has increased 56.75% year-over-year in April 2022 and 81.32% year-to-date.

Conclusion

Bumble derives its strength from the rising need for finding love and support, especially in difficult times like the pandemic. The growth prospects are solid for the company and its initiatives to tap the same are impressive. Long-term investors may find the stock attractive at current levels.

Read full Disclosure