After visiting IBM’s (IBM) quantum lab and speaking with Jay Gambetta, Director of IBM Research, Melius Research reaffirmed its Buy rating on the tech stock. Indeed, although a specific price target wasn’t assigned, four-star analyst Ben Reitzes emphasized that IBM currently operates more quantum computers than any other company and said IBM’s potential in quantum computing could generate billions in high-margin annual revenue by 2029.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Melius Research also pointed to IBM’s “Starling” series of quantum computers, which run on a 200-qubit platform and benefit from improved error correction. The report stated that this could lead to groundbreaking use cases as the technology matures. As a result, IBM is well-positioned in this space, thanks to a strong hardware roadmap and developer support through its Qiskit platform.

Meanwhile, IBM announced that it plans to cut thousands of jobs this quarter as it shifts focus to its more profitable software business. The news comes as Wall Street pays closer attention to IBM’s AI and cloud computing plans. However, the company’s recent slowdown in cloud software growth has led to some worries about its ability to keep up in the fast-growing cloud services market.

Is IBM a Buy, Sell, or Hold?

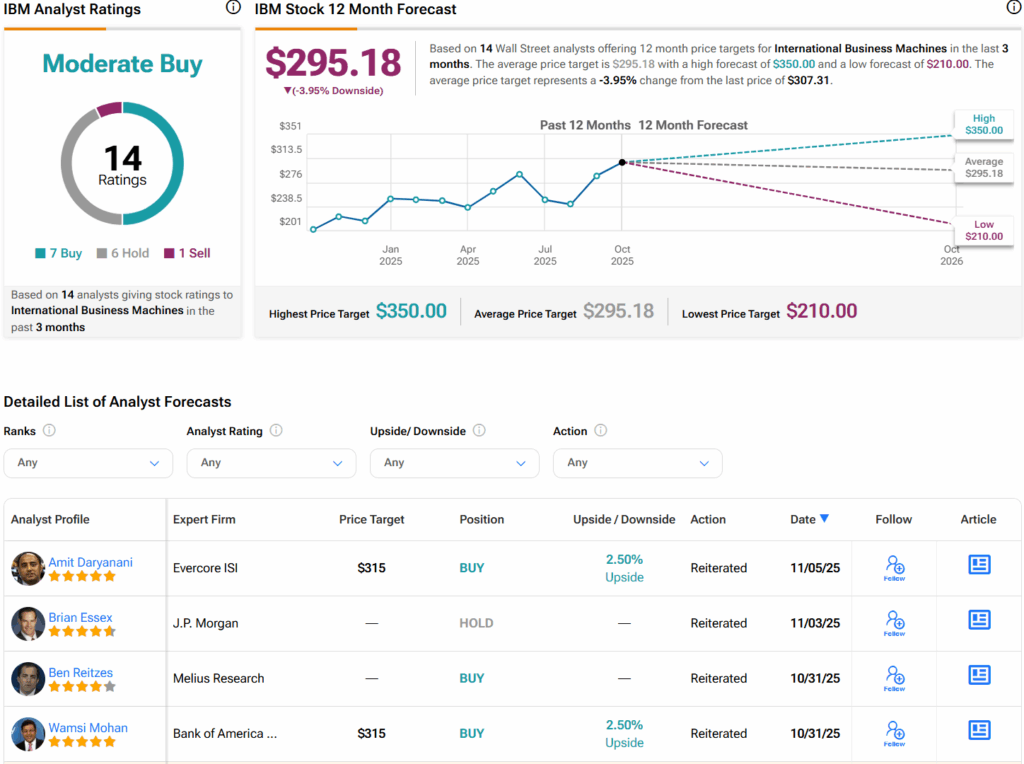

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on seven Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average IBM price target of $295.18 per share implies 4% downside risk.