Tesla’s (TSLA) investment thesis ultimately depends on which future the market believes the company is building toward. Today, there are three distinct versions of the story, each implying a very different valuation range.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The first version of Tesla is the “current Tesla”—primarily a car manufacturer. It’s profitable and growing, but that business alone doesn’t warrant a $1.5 trillion valuation, leaving limited upside based on traditional auto metrics.

The second version is Tesla two to three years from now—an autonomous software platform, where the vehicle serves as hardware, and Full Self-Driving (FSD) becomes the actual product. This model is scalable, high-margin, and could potentially justify Tesla’s current valuation if FSD adoption accelerates significantly.

And finally, the third version is Tesla three to five years out, running a robotaxi network and deploying Optimus humanoid robots at scale—essentially becoming an “Uber without drivers,” while also selling the device with possibly the largest TAM in modern economic history by automating labor. That is the multi-trillion-dollar scenario.

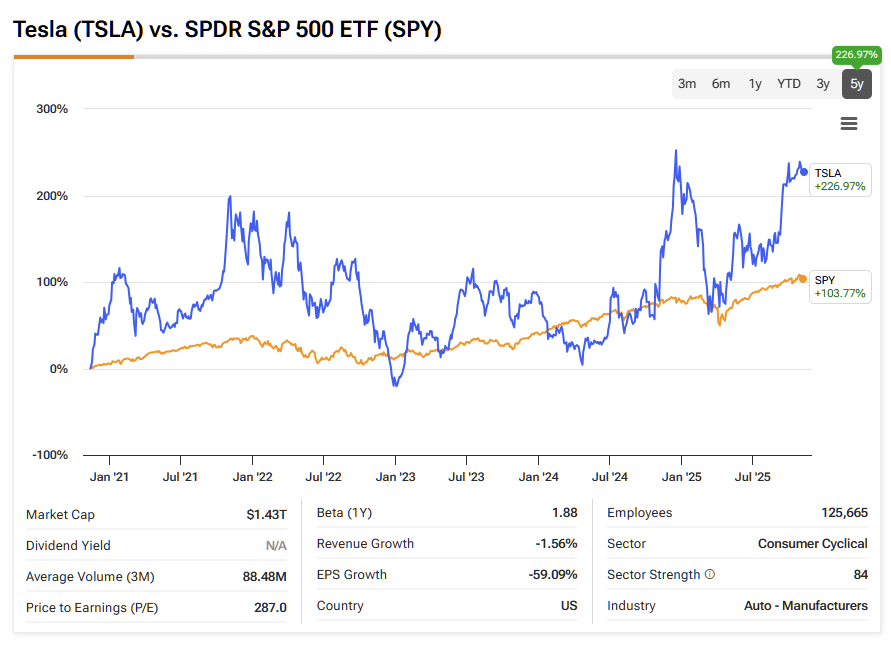

The core debate right now is that the market may already be pricing in these more ambitious outcomes, despite their uncertainty—which is why Tesla trades at nearly 270x earnings. The lack of clear visibility into how quickly Tesla can evolve beyond being “just a car company” is fueling bearish skepticism.

The latest development in TSLA’s story is the approval of Elon Musk’s $1 trillion milestone-based compensation package, designed to ensure he remains fully committed during Tesla’s transition into a more AI-centric company. Critics argue the package is excessive, but the performance requirements imply enormous value creation, and they provide clearer KPIs for investors to track over the next decade. Valuation will remain contentious—but historically, Tesla has outperformed despite skepticism. In this context, I see the compensation package as a net positive, reinforcing long-term alignment. As such, I continue to view Tesla as a Buy.

The Market Just Doubled Down on Musk’s Leadership

The headline speaks for itself. Tesla shareholders approved a $1 trillion compensation package for CEO Elon Musk, with roughly 75% voting in favor at the recent meeting. It is the most extensive compensation package ever awarded in any sector throughout history.

Naturally, there are conditions attached. For Musk to receive the full payout, Tesla must achieve extraordinary performance levels, including an $8 trillion market cap within a decade. The plan is divided into twelve tranches, and each tranche unlocks only when two conditions are met simultaneously. Tesla must reach and sustain a specific market value, and it must also achieve a corresponding number of operational milestones.

The first tranche requires Tesla to reach a $2 trillion market cap, sustained for six months, and to achieve at least one of the twelve operational milestones. One example is delivering $50 billion in adjusted EBITDA on a trailing twelve-month basis. If those requirements are met, approximately 35.3 million Tesla shares will be granted to Musk.

At the other end, the twelfth tranche requires Tesla to reach an $8.5 trillion market cap and fulfill all twelve milestones. Eight of these milestones relate to adjusted EBITDA—including sustaining four hundred billion dollars per year for thirty-six consecutive months—while the remaining four relate to scale and technology deployment, such as delivering twenty million electric vehicles cumulatively, reaching ten million FSD subscribers, deploying one million active robotaxis, and delivering one million Optimus humanoid robots.

A key detail is that there is no individual deadline for any specific tranche. The only time boundary is the overall ten-year duration of the plan. Musk has the whole ten years to meet any of the milestones, including the very first one. Something that skeptics may have overlooked, however, is that the plan is entirely performance-based, meaning that if Musk fails to execute the vision, he will receive nothing.

The Compensation Plan as a Blueprint for Tesla’s Next Phase

Based on Tesla’s current trajectory, the most feasible near-term milestone is the cumulative delivery of 20 million EVs. With approximately 8 million vehicles already delivered since 2012, about 12 million remain to be delivered. At the current production pace, this would likely take five to seven years.

The other milestone categories involving FSD adoption, a commercial robotaxi network, and widespread deployment of the Optimus humanoid robot are still in their early stages and difficult to forecast with precision—although these possibilities are already reflected in Tesla’s roughly $1.54 trillion valuation.

Assuming Tesla reaches a $2 trillion market cap and crosses the 20 million EV mark within the next five years, at least one tranche would be unlocked. With 3.32 billion shares currently outstanding, each tranche represents roughly 1.1% dilution. If all twelve tranches were unlocked, the total dilution would approach about 13%, for comparison.

Crucially, unlocking any tranche implies that Tesla has already created enormous value. While the resulting stock-based compensation will lower reported earnings, it does not impact cash flow, and the dilution is incremental. The economic effect would be secondary to the value creation required to trigger the award in the first place. In that sense, the outcome skews bullish rather than bearish.

More broadly, Tesla has always been a narrative-driven stock. The scale and specificity of the performance milestones outlined in Musk’s compensation plan now give investors clearer numerical targets to model when evaluating the long-term transition from an automaker to an AI-centric company. This added structure strengthens the narrative and, in my view, supports sustained positive sentiment and momentum in TSLA shares.

What is the Prediction for Tesla Stock?

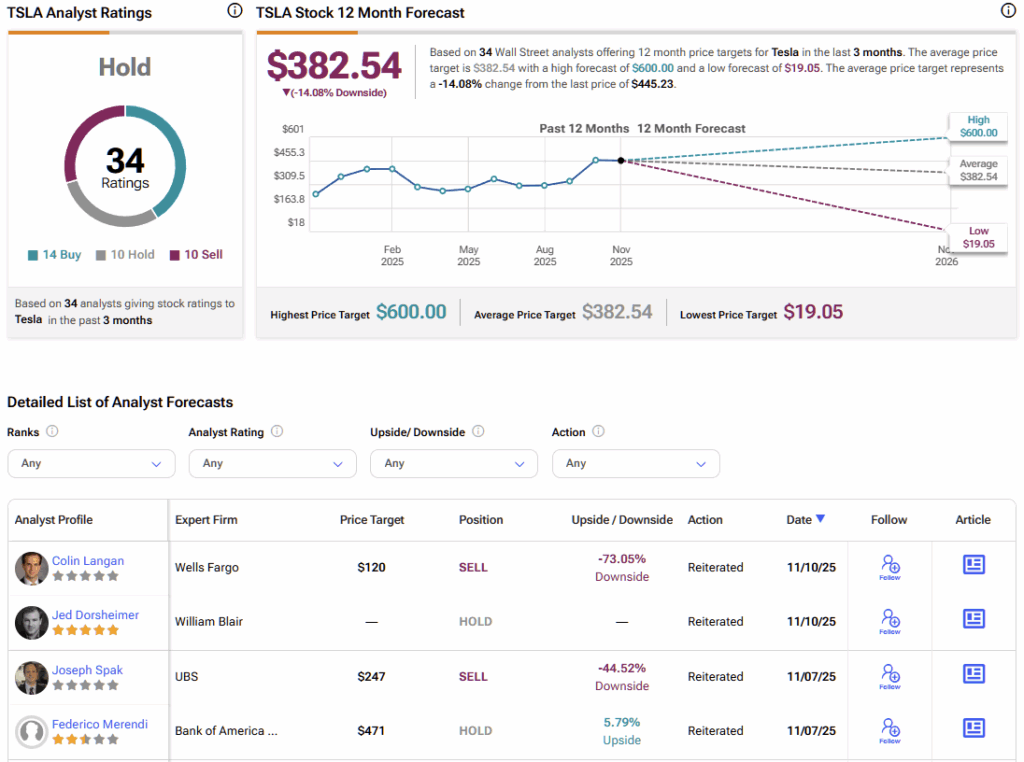

It’s no secret that Wall Street is divided on Tesla, with a fairly even split on market direction. Among the 34 analyst ratings issued over the past three months, 14 are bullish, 10 are neutral, and 10 are bearish. The average price target is currently $382.54, implying a roughly 14% downside relative to the latest share price.

The $1 Trillion Vote That Re-Anchors Tesla’s Vision

I view the approval of Musk’s $1 trillion pay package as broadly bullish for the Tesla investment thesis. Beyond simply ensuring that Musk remains focused on Tesla’s most ambitious initiatives, his role is central to the company’s narrative power. Musk is uniquely able to sell a vision at a premium, and the market has consistently shown a willingness to price that vision in ahead of time.

Concerns around dilution also look overstated. The milestones required to unlock even a single tranche are highly ambitious, meaning that any dilution would only occur alongside significant value creation. Issuing additional stock is not a problem if the tills are ringing. Even if only the first tranche is achieved, Tesla would have already scaled significantly as both an EV manufacturer and a company moving meaningfully toward an AI-driven future.

In that sense, the package reinforces alignment, strengthens the long-term narrative, and supports the momentum behind Tesla’s overarching investment narrative.