Vertiv Holdings Co. (NYSE: VRT) shares jumped 11.5% on April 27, after the global provider of critical digital infrastructure and continuity solutions company delivered a blowout first-quarter results.

The performance was driven by continued strong demand for Vertiv products, better pricing, a 34% surge in orders and a record-high backlog growth of 29% to $4.1 billion.

Q1 Beat

The company reported an adjusted loss of $0.08 per share, which was much better than the street’s estimated loss of $0.17. The company reported earnings of $0.21 per share for the prior-year period.

However, revenues gained 5.3% year-over-year to $1.16 billion and exceeded consensus estimates of $1.14 billion.

Outlook

Despite strong end-market demand and ongoing supply chain and inflationary headwinds, the company did not make any changes to its full-year guidance. However, the company forecasts a strong second half of 2022, leading Vertiv well into 2023.

The company continues to forecast adjusted earnings in the range of $0.67 to $0.77 per share, while the consensus estimate is pegged at $0.67 per share. Revenues are forecast to be in the range of $5.6 billion to 5.8 billion, compared to the consensus estimate of $5.64 billion.

For the second quarter, adjusted earnings are likely to range between $0.07 and $0.13 per share, while revenues are projected to be in the range of $1.31 billion to $1.36 billion.

CEO’s Comments

Vertiv CEO, Rob Johnson, commented, “Based on our first quarter pricing performance, we remain confident in our pricing plan for the remainder of the year. We are on track to deliver strong second half 2022 results and meet our full year commitments with consistently improving profitability going forward into 2023.”

Stock Rating

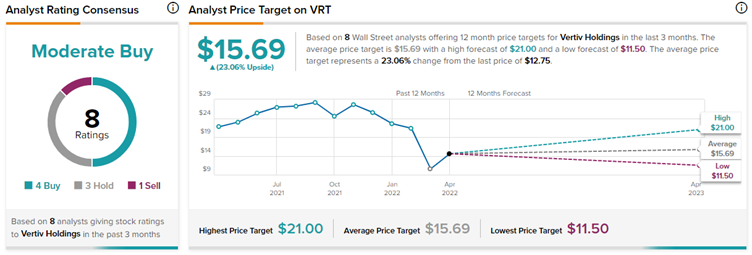

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on four Buys, three Holds and one Sell. The average Vertiv Holdings stock forecast of $15.69 implies 23.06% upside potential to current levels.

Conclusion

Vertiv reported a stellar beat despite a challenging operating environment reflecting strong demand for its offering. The company’s value-creation strategy bodes well for the stock in the long term in sync with the management’s confidence and robust outlook.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Universal Health Stock Dips 11%: Mixed Q1 Results, Cloudy Outlook

Why HSBC Holdings Stock is Down Today

Lennox International Stock Falls Despite Q1 Beat & Improved Outlook