Last week, as many as 11 corporate insiders bought shares of Seres Therapeutics (NASDAQ: MCRB) worth $28.82 million. This attracted investors’ attention and shares of the microbiome therapeutics company rose 14.4% on July 8 to close at $4.05.

In an SEC filing, Nutritional Health LTP Fund General Partner LLC, a 10% owner of Seres Therapeutics, disclosed that it lapped up 8,738,243 shares of the company for $3.15 per share on July 5. Nutritional Health now holds $95.15 million worth of MCRB stock.

According to TipRanks, which also provides a comprehensive list of daily insider transactions, various corporate insiders bought MCRB stock worth $1.3 million a day before the above-mentioned transaction. These insiders include Directors, CTO, CEO and EVPs.

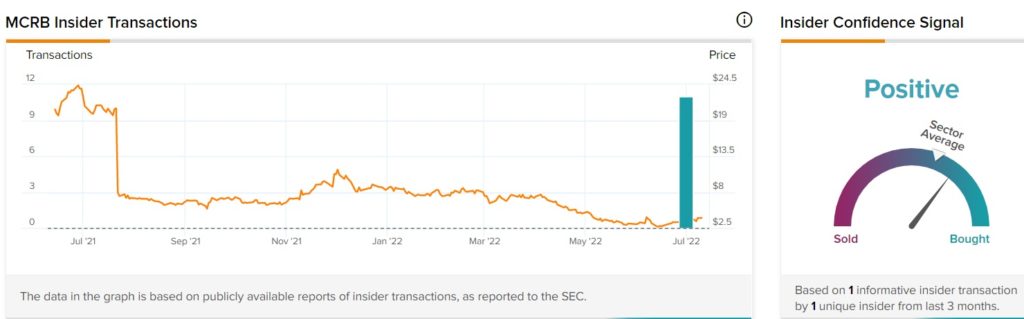

A pictorial representation of the aforementioned transactions is provided below:

Insider Confidence Signal is Positive on MCRB

TipRanks’ Insider Trading Activity tool shows that insiders are currently Positive on MCRB, as corporate insiders have bought MCRB shares worth $27.5 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts of either a Very Positive or Positive insider confidence signal.

MCRB Stock Commands a Strong Buy Consensus Rating

According to TipRanks, the Street is optimistic about MCRB stock and has a Strong Buy consensus rating based on six Buys. MCRB’s average price forecast of $16 implies 321% upside potential to current levels.

TipRanks data shows that financial bloggers are 100% Bullish on MCRB, compared to the sector average of 71%. Meanwhile, retail investors are Very Positive about the stock, as their holdings in MCRB stock have increased by 7.4% in the last 30 days.

Key Takeaways for MCRB Investors

As of now, corporate insiders are seen taking advantage of the company’s weak stock price, which has fallen 54.2% so far this year. The recent insider activities also signal that this could be the right time to gain exposure to the stock that has upside potential of over 300%.

Read full Disclosure